Are you ready to unlock the secrets of Amazon’s advertising powerhouse and boost your sales in 2025?

As the e-commerce giant continues transforming how we shop and sell, its advertising platform is becoming an increasingly crucial channel for businesses to reach their target audiences.

But what’s really working on Amazon Advertising?

Let’s see the latest Amazon advertising statistics and trends to discover the most effective strategies, surprising insights, and emerging opportunities that will take your advertising game to the next level.

From eye-opening spending and revenue figures to the rise of video ads and voice search, we’ll explore the most important Amazon advertising trends shaping the future of e-commerce.

Get ready to optimize your ad campaigns, boost your sales, and stay ahead of the competition.

Key Highlights (Editor’s Pick)

- In 2023, Amazon generated $46.9 billion in global advertising revenue, marking an increase of more than 24% compared to the previous year.

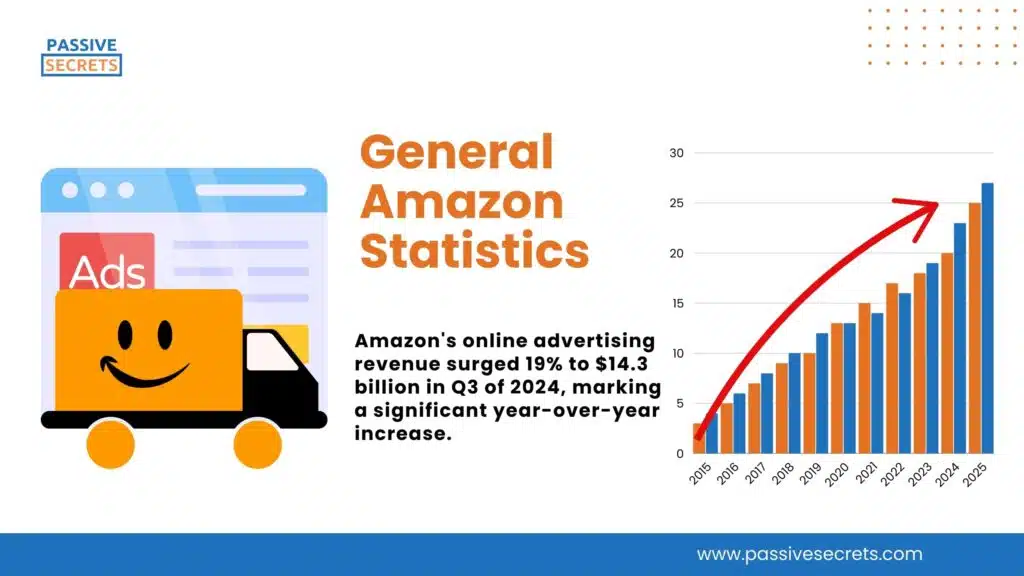

- Amazon’s online advertising revenue surged 19% to $14.3 billion in Q3 of 2024, marking a significant year-over-year increase.

- Amazon’s ad revenue in the U.S. was $12.06 billion in Q3 2023, a 26.3% increase from the previous year. The platform attracted 2.2 billion visits in April 2023.

- Amazon’s ad revenue growth is 5× faster than Google’s ad revenue and is responsible for 11.3% of the total digital ad revenue in the U.S.

- Amazon’s sponsored product ads offer a compelling value proposition. They cost significantly less than Google and Facebook ads, 68% and 44% cheaper, respectively.

- The average cost per mile (CPM) for Amazon Ads is $2.43, with a click-through rate of 0.34% and an average cost of sale (ACOS) of 30.20%.

- Small business products experienced an 18× increase in average daily sales during Prime Day, showcasing the event’s significant impact on sellers’ revenue and brand exposure.

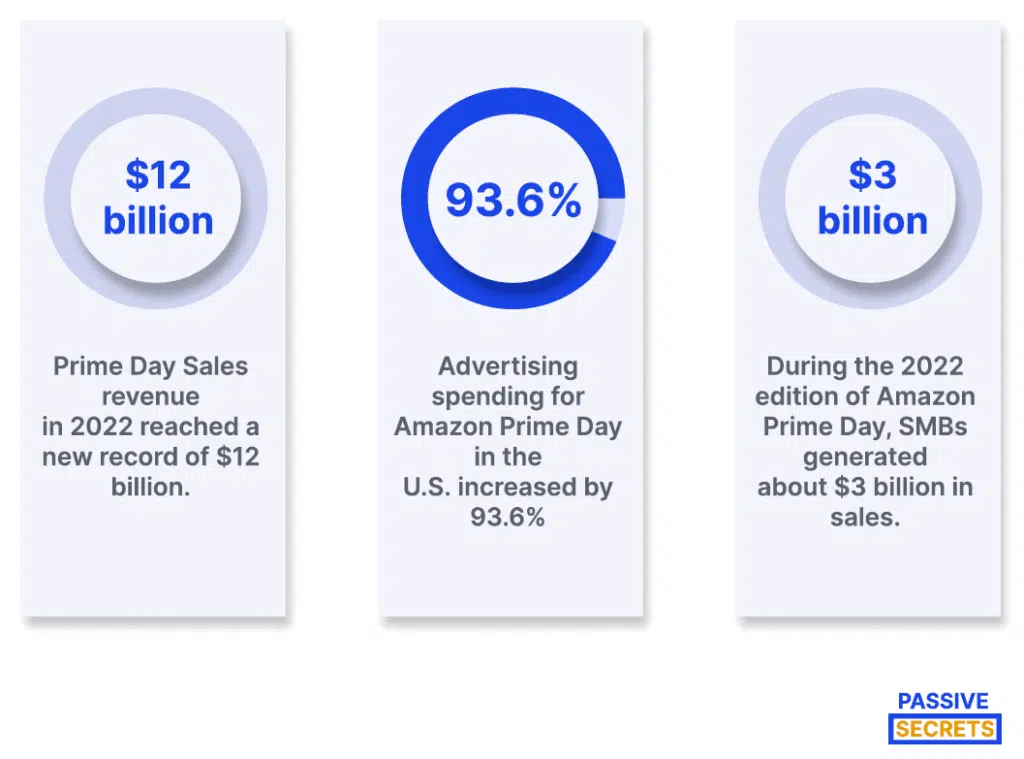

- SMBs generated about $3 billion in sales during Prime Day, and advertising spending for Amazon Prime Day in the U.S. increased by 93.6%.

General Amazon Statistics

1. Amazon accounted for over 37.6% of the U.S. retail eCommerce market in 2023. The e-commerce giant generated over $356 billion in 2022 in its U.S. branch. (source)

2. Amazon’s online advertising revenue surged 19% to $14.3 billion in Q3 of 2024, marking a significant year-over-year increase. (source)

3. Amazon generated $158.88 billion in revenue for the quarter ending September 30, 2024, reflecting an 11.04% increase. (source)

4. In 2023, Amazon’s net sales revenue was valued at $576 billion. (source)

5. Amazon’s ad revenue in the U.S. was worth $12.06 billion in Q3 2023. It was a 26.3% increase from that of the previous year. (source)

6. In April 2023, Amazon’s combined desktop and mobile visits amounted to 2.27 billion. This makes Amazon the most visited eCommerce space in the U.S. (source)

7. Amazon’s ad revenue is said to be growing 5x faster than Google’s ad revenue. (source)

8. Amazon’s brand value increased by 23% from $469 billion in 2023 to $577 billion in 2024. (source)

9. According to CNBC, Amazon is expected to surpass Walmart as the number 1 retailer in the U.S. (source)

10. Amazon sales are so large that it ships over 2.5 billion orders yearly. This is close to the orders FedEx ships, which is 3 billion. (source)

11. The traffic on Amazon is so heavy that the platform makes over $837,000 every minute. (source)

12. Amazon had a $2.7 billion loss in 2022 but made $30.4 billion in 2023. (source)

13. The company’s founder and former CEO, Jeff Bezos, has an estimated net worth of $211 billion. (source)

Latest Amazon Advertising Statistics

14. In 2024, Apple surpassed Amazon as the world’s most valuable brand, with an estimated brand value of $516.6 billion, compared to Amazon’s $308.9 billion. (source)

15. In 2023, Amazon generated $46.9 billion in global advertising revenue, marking an increase of more than 24% compared to the previous year. (source)

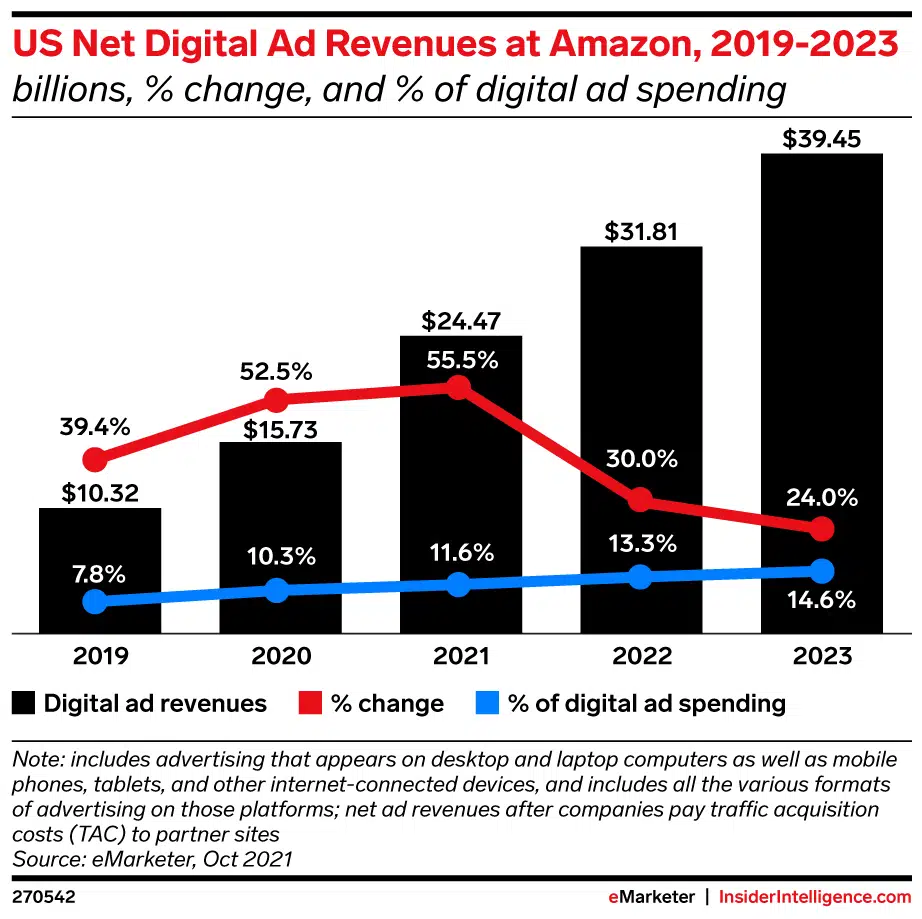

16. Amazon’s net digital advertising revenue in the U.S. was worth about $24.47 billion in 2021. The amount is expected to increase by 2023, reaching about $39.45 billion. (source)

17. A 2022 survey of U.S. retailers found that 20% spent over $100,000 monthly on Amazon ads, 20% spent between $41,000 and $60,000, and 19% spent between $61,000 and $80,000. (source)

18. The cost per mile (CPM) for Amazon Ads is $2.43. (source)

19. Amazon has about 278 million visitors every month. (source)

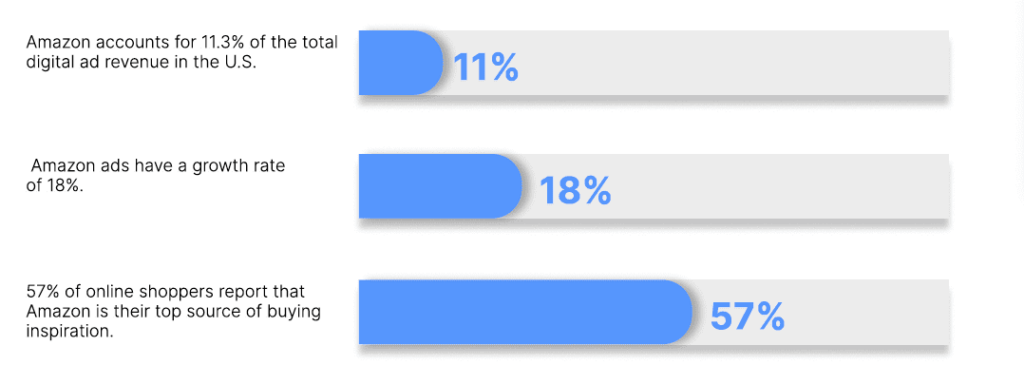

20. Amazon ads have a growth rate of 18%. (source)

21. Amazon accounts for 12.5% of the total digital ad revenue in the U.S. (source)

22. 57% of online shoppers report that Amazon is their top source of buying inspiration. (source)

23. About 31% of U.S. Amazon users agree that sponsored ads on the online platform are very helpful. However, although 11% of surveyed respondents say that the ads “align with their shopping habits,” about 1 in every five respondents say they find the ads very distracting. (source)

24. The U.S. Amazon ads have an average cost per click (CPC) of $0.98. (source)

25. In 2023, Amazon’s marketing expenditure reached approximately $44.4 billion, up from $42.3 billion the year before. (source)

26. Amazon’s advertising average click-through rate is 0.34%. (source)

27. 56% of surveyed retailers cited “driving brand awareness” as their primary goal for advertising on Amazon. Additionally, 61% noted “acquiring new customers” as their primary goal, and 53% said they wanted to “drive sales. “ (source)

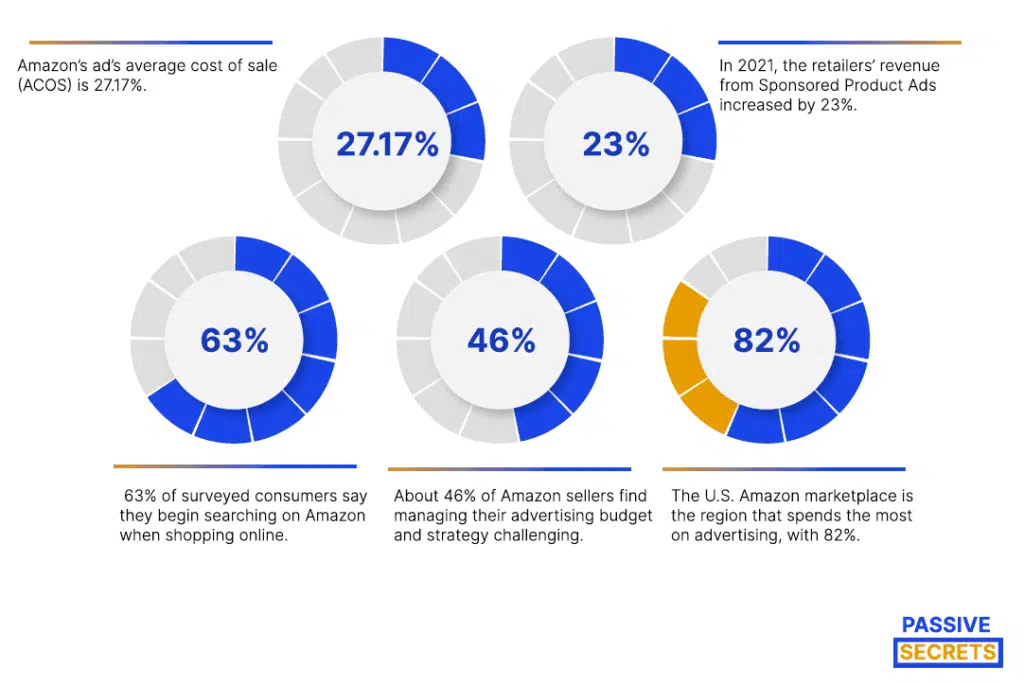

28. Amazon’s ad’s average cost of sale (ACOS) is 30.20%. (source)

29. Amazon’s global advertising cost per click is $0.75 for sponsored product ads. In the U.S., it is $0.87. (source)

30. In 2021, the retailers’ revenue from Sponsored Product Ads increased by 23%. (source)

31. Amazon’s sponsored product ads cost less than Google and Facebook ads, with 68% and 44% less, respectively. (source)

32. In 2021, over 1 million new sellers joined Amazon. (source)

33. The total number of sellers in the North American Amazon Marketplace (which includes the U.S., Canada, and Mexico) was more than 3 million. However, Europe just had 1.4 million sellers. (source)

34. 63% of surveyed consumers say they begin searching on Amazon when shopping online. (source)

35. The average CPC on Amazon in 2023 is $0.99, and the lowest CPC was $0.80 in February. (source)

36. Amazon’s 2021 annual revenue for third-party sellers was worth $103.4 billion. This was a 22% year-on-year (YoY) increase. (source)

37. About 46% of Amazon sellers find managing their advertising budget and strategy challenging. (source)

38. According to 79% of surveyed consumers, Sponsored Products ads in the search results are Amazon’s most appealing ad types. (source)

39. The U.S. Amazon marketplace is the region that spends the most on advertising, with 82%. Additionally, Sponsored Products ads account for most of Amazon’s advertising spending. (source)

40. About 1 in every 5 Amazon sellers find it quite challenging to measure the effectiveness of their marketing strategies. (source)

41. About one-third of Amazon marketers are not confident they are reaching the right audience for their business. (source)

42. In 2023, the online retailer’s global advertising revenue totaled $49 billion. (source)

43. A Clarify Capital study of over 1,000 Americans found that Amazon was the most trusted brand across all generations. (source)

44. In the retail category, Amazon was the most trusted retailer, with 56% of respondents expressing trust, followed by Walmart at 44% and Target at 36%. (source)

45. In 2023, U.S. independent sellers sold over 4.5 billion items, averaging 8,600 items per minute, with annual sales exceeding $250,000 on average. (source)

46. Over 60% of sales on Amazon come from independent sellers, primarily small and medium-sized businesses. (source)

46. U.S.-based sellers exported over 330 million items to customers in more than 130 countries worldwide. (source)

47. Independent sellers employed more than 1.8 million people in the U.S. on Amazon to help run their businesses. (source)

48. Over 100,000 independent sellers have utilized Amazon’s generative AI listing tools. (source)

49. In 2023, over 100,000 new brands launched on Amazon, and all brand owners saw a year-over-year sales growth of more than 22%. (source)

50. California sellers created the most jobs to support their Amazon-related businesses. (source)

51. The top five most popular categories from U.S. sellers in Amazon’s stores are Health & Personal Care, Beauty, Home, Grocery, and Apparel. (source)

52. In 2022, U.S. independent sellers sold over 4.1 billion products on Amazon, with average sales exceeding $230,000. (source)

53. Brand owners experienced a % year-over-year sales growth of over 20% in Amazon’s stores. (source)

54. In 2022, independent sellers on Amazon are estimated to have created 1.5 million jobs in the U.S. (source)

Amazon Prime Day Statistics

55. Brands on Amazon said Black Friday drove the highest sales increase, with one-third citing it as the most influential, followed by Prime Day at 17%. (source)

56. US shoppers spent a record-breaking $14.2 billion online during Amazon’s two-day Prime Day Sales event, an 11% increase from last year. (source)

57. There are over 200 million Amazon Prime members worldwide. Only these members take part in the Amazon Prime Day event. (source)

58. During the 2022 edition of Amazon Prime Day, SMBs generated about $3 billion in sales. (source)

59. Advertising spending for Amazon Prime Day in the U.S. increased by 93.6%. (source)

60. In 2023, prime members shopped more than 375 million items worldwide, saving more than $2.5 billion in deals across the Amazon store. (source)

61. Small business products like True Classic and TUSHY increased their average daily sales by 18 times. (source)

62. The best-selling products across Amazon were Alexa-enabled devices. (source)

63. Amazon Live Prime Day Streams had more than 100 million views in the U.S and India (source)

64. Vendors who partook in Prime Day activities experienced a 10x increase in daily buys with prime orders and saw an 8x increase in daily revenue when compared to before the event. (source)

65. Prime members took advantage of millions of deals across over 35 categories, buying more items in 2024 than ever before during this year’s Prime Day event. (source)

66. Independent sellers, mainly small and medium-sized businesses, contributed to Amazon’s vast selection by selling over 200 million items during the Prime Day event. (source)

67. On average, Buy with Prime boosts the likelihood of an off-Amazon customer making a purchase by 25%. (source)

68. More than half (53%) of Amazon Prime Day shoppers waited for the event to make their purchases. (source)

69. Shoppers also made the most of flexible payment options, with Buy Now, Pay Later accounting for 7.6% of online orders—totaling $1.08 billion in spending, a 16.4% year-over-year increase, according to Adobe. (source)

70. During Prime Day, 35% of shoppers also participated in Walmart’s deals event, 34% joined Target’s Circle Week, and 11% made purchases during Best Buy’s Black Friday in July sale. (source)

Amazon Advertising Trends and Strategies for 2025

Amazon has successfully become one of the top advertising agencies in the United States. It was expected that 14.6% of the market in 2023 accounted for Amazon. The current and future market growth increase lies in consumers’ hands.

Check out the latest Amazon advertising trends that will dominate the market in 2025.

1. AI and machine learning in PPC management

The use of AI and machine learning in PPC management is a key Amazon advertising trend in 2025. Advertisers will increasingly use the power of AI and machine learning to optimize their PPC campaigns, changing how they manage their ad spend, target audiences, and optimize ad creative.

AI-driven bid optimization will become the norm, allowing advertisers to maximize their ROI and reduce manual bidding efforts.

Machine learning algorithms will analyze consumer behavior, sales data, and market trends to predict which products will perform well, enabling advertisers to make data-driven decisions. AI-powered ad targeting will ensure that ads are served to the most relevant audiences, increasing conversion rates and reducing waste.

Additionally, machine learning will help optimize ad creative, such as images, videos, and copy, to resonate with target audiences and boost performance.

AI and machine learning will provide advertisers with real-time reporting and actionable insights to refine their PPC strategies, leading to improved ad performance,

2. Social Media Advertising

Social media marketing is still growing and will not stop anytime soon. For example, it is easier for Amazon sellers to use sites such as Facebook, Instagram, and Twitter.

Also, Statista records that social media advertising spending is projected to reach $255.8 billion in 2028.

If you do not implement social media as part of your Amazon advertising strategy, you will miss out on many opportunities.

Marketers use social media to create brand awareness and boost engagement on their Amazon ads. These ads can help you get your products in front of existing and potential customers.

Social media provides opportunities to advertise your products and create content that drives engagement.

These contents follow trends, draw potential customers in, convert leads, and increase customer lifetime value.

Social media ads can target audiences based on gender, age, demographics, and other data-driven targets.

3. Audio Ads

Over one-third of United States consumers have smart speakers, and 85% use them to play audio in a week. Moreover, the percentage is expected to grow over the next few years.

Audio ads are screen-free adverts; they can connect with your audience regardless of their activity. These ads, which are ten to thirty seconds of audio, frequently play during content breaks.

For example, imagine listening to Alexa play you some songs, and an audio ad about gift cards or electronics comes on during the break. This implies that you can tell your message with premium audio content.

Interactive audio ads allow listeners to respond to an Alexa call-to-action within the ad.

4. Increased Focus on Amazon Marketplace Management

In 2025, Amazon advertisers will focus more on Amazon marketplace management as a key aspect of their advertising strategies. This means they will prioritize optimizing their product listings, inventory management, and customer reviews to improve their visibility, credibility, and sales on the platform.

With Amazon marketplace management, advertisers can increase their chances of winning the Buy Box, drive more organic sales, and create a strong foundation for their paid advertising efforts.

Effective marketplace management will become a crucial differentiator for advertisers seeking to succeed in the increasingly competitive Amazon landscape.

5. Leveraging User-Generated Content

UGC content was popular in 2024 and will continue in 2025. It includes reviews, photos, and videos created by customers, which are perceived as more authentic than traditional ads.

Research shows that 77% of consumers are influenced by UGC when making purchasing decisions, leading to higher engagement rates—ads featuring UGC can achieve four times higher click-through rates and a 50% reduction in cost-per-click.

To encourage UGC, brands should focus on exceptional customer service, engage with customers on social media, and offer incentives for sharing content. Incorporating UGC into advertising strategies can significantly boost visibility and effectiveness.

For instance, using customer reviews in Pay-Per-Click (PPC) ads can enhance appeal and increase click-through rates. Additionally, utilizing Amazon Posts to showcase UGC can drive engagement with potential customers.

6. Ads Targeting

Recent statistics show that 80% of consumers are more likely to make a purchase when brands offer personalized experiences, highlighting the importance of precise ad targeting.

Amazon has significantly upgraded its targeting options for Sponsored brand campaigns, allowing advertisers to reach specific customer segments based on demographics, purchase behaviors, and interests.

Moreover, AI-powered optimization tools will play a crucial role in refining targeting strategies.

These tools analyze large data sets to identify patterns and trends, enabling brands to effectively engage high-value customer groups.

For instance, advertisers can now create custom audiences using insights from the Amazon Marketing Cloud, which enhances their ability to reach potential customers who have shown interest in their products.

Sponsored Display ads further enhance remarketing efforts by targeting users who previously viewed products. Effective ad targeting will maximize visibility and drive sales on Amazon in 2025.

Frequently Asked Questions

![70 Crucial Amazon Advertising Statistics, Trends, and Strategies in 2025 70 Crucial Amazon Advertising Statistics, Trends, and Strategies in 2025 [2025] ᐈ Passive Secrets](https://passivesecrets.com/wp-content/uploads/2024/11/Crucial-Amazon-Advertising-Statistics-Trends-Strategies-in-2025-1-683x1024.jpg.webp)

Other Advertising Statistics To Know In 2025:

- B2B Sales Statistics: Latest Insights and Trends

- 50+ Essential Traditional Marketing Statistics & Trends

- 60+ QR Code Statistics, Usage, Forecasts & Trends

- 90+ Useful Marketing Jobs Statistics & Facts (Latest Report)

- Sales Enablement Statistics: Data You Need to Drive Sales Growth

- In-store vs Online Shopping Statistics And Analysis

- Social Media Addiction Statistics

- Latest In-Game Advertising Statistics

- From Passion to Profit: 120+ Creator Economy Statistics

- 80+ Big Marketing Software Statistics

- 45 Interesting Healthcare Marketing Statistics & Trends

- Print Marketing Statistics: Ad Spending, Market Size, & More

- Key Short-Form Video Statistics and Trends You Should Know

- 49 Interesting Emotional Marketing Statistics

- 90 Amazing Millionaire Statistics

- 70+ Top Law Firm Marketing Statistics & NEW Trends

- Millennials on Social Media Statistics

- 23 Most Interesting First Impression Statistics To Know

- 60+ Interesting Storytelling Statistics, Facts & Huge Trends

- Amazon Book Sales Statistics: Intriguing Numbers and Facts

- 61+ Useful Podcast Advertising Statistics And Trends

- 50+ Useful Call Center Statistics And Trends

- 65+ Must-Know Pay-Per-Click Statistics

- 40+ Interesting Omnichannel Marketing Statistics & Trends

- Multi-Level And Network Marketing Statistics, Facts & Trends

- Virtual Event Statistics & Benchmarks For Marketers & Organizers

- 55 Interesting Direct Mail Marketing Statistics and Trends

- B2B Lead Generation Statistics, Facts, Trends, Benchmarks, & Market Size

- 52 Valuable Trade Show Statistics and Trends

- 100+ Top Digital Marketing Vs. Traditional Marketing Stats

- 110+ Important Social Media Advertising Statistics & Trends

- 50 Interesting Organic Vs. Paid Search Statistics To Know

- 41+ MOST Important Copywriting Statistics To Know

- 80+ Useful Sales Funnel Statistics & Conversion Rates

- 40+ Latest Multi-Channel Marketing Statistics & Huge Trends