Income inequality remains one of the most pressing socioeconomic challenges of the 21st century.

Why are the richest 1% gaining wealth at record speeds while billions struggle to make ends meet?

What do the statistics really reveal about fairness and progress in the modern world?

From widening wage gaps to unequal wealth distribution across nations, these income inequality statistics reveal startling truths about how resources are shared—or hoarded—within societies.

Get ready to dive into the data that exposes the truth behind income inequality—and discover why these numbers matter more than ever.

Key Income Inequality Statistics & Trends (Editor’s Pick)

- The top 20% of households in the UK by income received 37% of the country’s total disposable income, excluding housing costs.

- The richest 10% hold over 50% of Thailand’s national income, while the bottom 50% earn around 10%.

- The United States Monthly Earnings reached an all-time high of $4,865 in October 2024, surpassing the previous month’s figure of $4,847

- In the EU, Sweden had the highest wealth inequality, with the top 10% owning 74.4% of the wealth, while Belgium had the lowest inequality, with the top 10% owning 43.5%.

- South Africa had the world’s highest income inequality (Gini score: 63), followed by Namibia.

- Median incomes for US family households rose 3.6% in 2023, while nonfamily households saw a 5.0% increase.

- Single-mother households had the lowest median income at $59,470

- Nonfamily households headed by men saw a 5.9% median income increase

- Median earnings for men rose 2.6%, while women’s median earnings decreased 2.0%. For full-time, year-round workers, men’s median earnings increased by 3.0% and women’s by 1.5%.

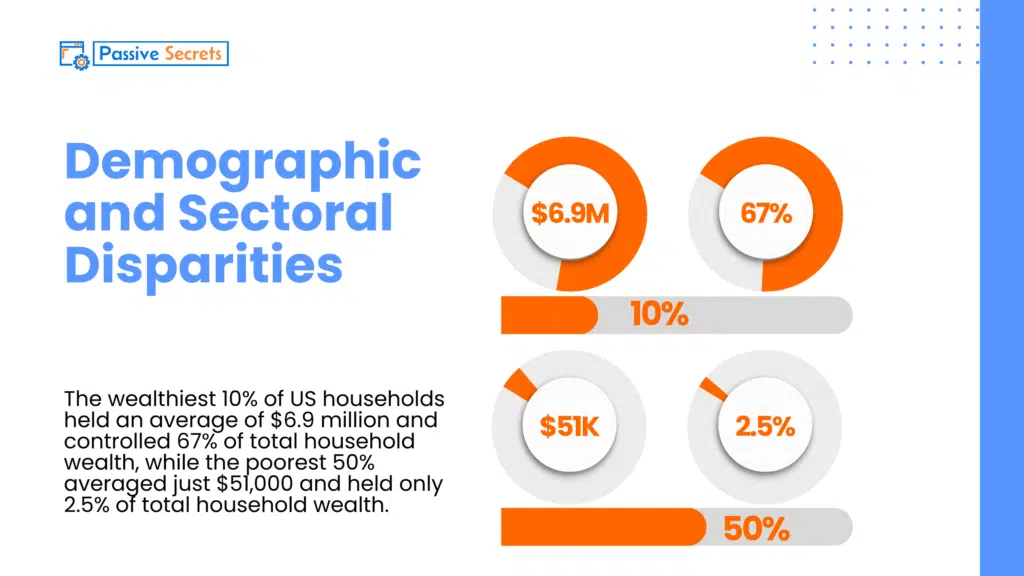

- The wealthiest 10% of US households held an average of $6.9 million and controlled 67% of total household wealth, while the poorest 50% averaged just $51,000 and held only 2.5% of total household wealth.

- The mean weekly earnings for full-time employees in Australia was $1,885.6, a $62 increase.

- In Australia’s public sector, women earned an average of $1,592 per week, while men earned $2,034 per week.

- Women earned 1¢ less than men with the same job/qualifications. The overall gap: women earned $0.83 for every $1 earned by men.

- US Bachelor’s degree holders earned a mean of $86,970, while high school graduates earned $46,720.

- Canada’s income inequality increased in Q2 2024, with a 47.0 percentage point gap between the top 40% and bottom 40% of households.

- Canada’s least wealthy saw a 1.4% net worth decline due to mortgage debt rising faster than real estate values. Meanwhile, the top 20% of the wealthiest saw a 2.3% net worth increase.

- In the US, the top 1% of earners make about 40 times more than the bottom 90%.

Global and Regional Income Inequality Statistics & Trends

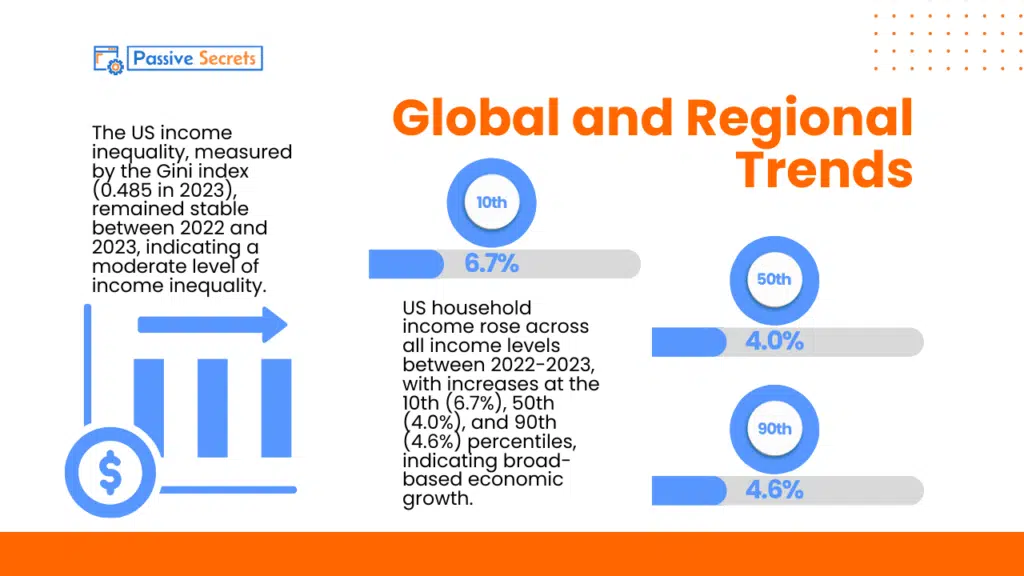

1. The US income inequality, measured by the Gini index (0.485 in 2023), remained stable between 2022 and 2023, indicating a moderate level of income inequality. (source)

2. US household income rose across all income levels between 2022-2023, with increases at the 10th (6.7%), 50th (4.0%), and 90th (4.6%) percentiles, indicating broad-based economic growth. (source)

3. In the UK, the income inequality Gini coefficient was 35% before housing costs and rose to 39% when housing costs were factored in for the 2022-23 period. (source)

4. The top 20% of households in the UK by income received 37% of the country’s total disposable income, excluding housing costs. (source)

5. In 2022/23, 18% of the Northern Ireland population (349,000 people) experienced relative poverty, exceeding the 14% (271,000 people) in absolute poverty across all subgroups. (source)

6. Northern Ireland’s income inequality increased in 2022/23, with Gini Index scores of 28% (Before Housing Costs) and 30% (After Housing Costs), indicating a widening gap between low and high-income households. (source)

7. South and Southeast Asian countries in the region vary in income inequality:

8. Thailand has one of the highest income inequality levels globally. The richest 10% hold over 50% of national income, while the bottom 50% earn around 10%. Income distribution had been improving for the bottom 50% after 2001, but this trend reversed after 2019. (source)

9. A significant income gap existed in Australia (2019-20), with the highest 20% earning five times the lowest 20%. The highest 5% earned eight times the lowest 20%. (source)

10. A significant income gap exists in Australia, with the highest 20% earning $4,306/week ($305,000/year before tax), while the lowest 20% earn $794/week ($43,000/year before tax), and the highest 5% earn eight times the income of the lowest 20%. (source)

11. Australia has the fourth-highest average household wealth globally, at $1.177 million per household in 2022, despite a $92,000 decline from 2021 due to inflation and higher interest rates. This high wealth ranking is attributed to Australia’s reliance on private savings through home ownership and superannuation, rather than a generous public pension system. (source)

12. In 2023, Portugal, Canada, and the US had the highest house price-to-income ratios, exceeding 130, while the OECD average was 117.5. (source)

13. In 2022, Australia’s GDP comprised 63.3% services, 27.48% industry, and 2.68% agriculture. The inflation rate that year was 2.82%. (source)

14. The United States Monthly Earnings reached an all-time high of $4,865 in October 2024, surpassing the previous month’s figure of $4,847. This data, which is updated monthly, has been available since March 2006 and averages $3,448. Interestingly, the record low was $2,743 in March 2006. (source)

15. In 2023, the EU’s median disposable income was €19,955 per inhabitant. Luxembourg had the highest at €34,777, while Slovakia and Hungary had the lowest at €10,670 and €10,960, respectively. (source)

16. In 2023, EU social transfers (including pensions) averaged €5,538 per inhabitant, with Luxembourg, Austria, and France having the largest transfers. Excluding pensions, Austria and Belgium had the highest social transfers, at €3,028 and €2,761 per inhabitant, respectively. (source)

17. In 2023, 9 EU regions had 30-44.9% of their population at risk of poverty, mainly in Spain, Italy, and Romania. Conversely, 26 regions, mostly in central, western, and southern Europe, had poverty rates below 10%. (source)

18. Bulgaria, Lithuania, and Latvia had the highest income disparities in the EU. In contrast, Slovakia, Slovenia, Belgium, and Czechia had the most even income distributions, with Gini coefficients below 25. (source)

19. Among the EU’s “Big Four” economies, Germany had the highest wealth inequality score (77.2), followed by the UK (70.2), France (70.3), Spain (68.3), and Italy (67.8). However, Belgium (59.6), Malta (60.9), Slovenia (64.4), and Slovakia had the lowest wealth inequality scores. (source)

20. Sweden had the highest wealth inequality, with the top 10% owning 74.4% of the wealth, while Belgium had the lowest inequality, with the top 10% owning 43.5%. (source)

21. Among the EU’s “Big Four”, Germany had the highest wealth inequality, with the top 10% owning 63% of the wealth, followed by France (54.9%), Spain (53.8%), Italy (53.5%), and the UK (53.3%). (source)

22. On average, 22% of low-income country wage workers earn less than half the median hourly wage, decreasing to 17% in lower-middle-income, 11% in upper-middle-income, and 3% in high-income countries. (source)

23. Median wages vary significantly across country income groups: $201 in low-income, $630 in middle-income, and $3,333 in high-income countries (in PPP terms). (source)

24. In 2022, Zimbabwe had the world’s lowest average monthly salary (in PPP terms), followed by Rwanda and Gambia. 18 of the 20 countries with the lowest salaries were in Africa, while Luxembourg had the highest average salary. (source)

25. In 2023, South Africa had the world’s highest income inequality (Gini score: 63), followed by Namibia. All 20 most unequal countries were in Africa or Latin America. (source)

26. Globally, 52% of employed people are key workers, dropping to 40% if agricultural workers are excluded. Key workers make up a larger share of the workforce in lower-income countries, particularly in agriculture. (source)

27. The share of low-paid key workers varies globally, from 50% in Kenya to 5% in Portugal, reflecting differences in labour institutions, minimum wage policies, and enforcement. (source)

28. In 2022, Latin America and MENA had the worst wealth distribution, with the top 10% holding 76% of wealth. Europe and Oceania fared slightly better, while East and South Asia had the most equitable distribution, though still with significant inequality. (source)

29. The richest 1% hold around 40% of global personal wealth. Their share dropped during the 2008/2009 financial crisis but has since stabilized. North America is home to nearly a third of the world’s billionaires. (source)

30. US median weekly earnings rose 4.2% to $1,165 in Q3 2024, outpacing the 2.6% increase in the Consumer Price Index (CPI-U) over the same period. (source)

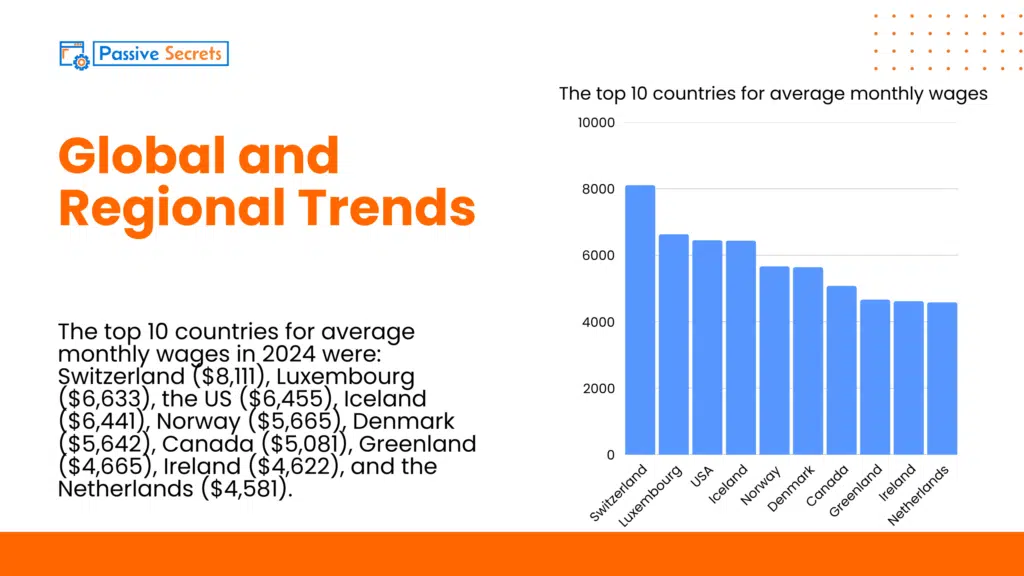

31. The top 10 countries for average monthly wages in 2024 were: Switzerland ($8,111), Luxembourg ($6,633), the US ($6,455), Iceland ($6,441), Norway ($5,665), Denmark ($5,642), Canada ($5,081), Greenland ($4,665), Ireland ($4,622), and the Netherlands ($4,581). (source)

32. In the UK, median annual earnings for full-time workers rose to around £37,430 in 2024, up from £34,963 the previous year. (source)

33. In the Asia-Pacific region, the wealthiest 10% hold over half of the total income. Countries with the greatest income inequality include the Maldives, India, Thailand, and Iran. Since 2000, there’s been a concerning decline in income share for the bottom 50%, with wealth concentrated at the top. (source)

34. In sub-Saharan Africa, the richest 10% hold 56% of the total income, mirroring extreme inequality in Latin America and India. South Africa has the highest income inequality, with unprecedented wealth concentration. (source)

35. In Europe (2021), the top 10% of earners took home around half of the national income in Turkey, Russia, and Armenia, while in Slovakia, Iceland, and the Netherlands, they earned 26-29%. On average, Europe’s top 10% took home over a third, while the bottom half earned less than a fifth. (source)

36. In 2023, Bulgaria had the EU’s highest Gini Index score (37.2), indicating the highest inequality, while Slovakia had the lowest score (21.6), suggesting it’s the most egalitarian society in Europe. (source)

37. The income gap between the EU’s top 20% and bottom 20% has narrowed since 2015, with the ratio decreasing from 5.22 in 2015 to 4.74 in 2022. (source)

38. As of 2024, Bernard Arnault, founder of Louis Vuitton Moët Hennessy (LVMH), was the richest person in Europe, followed by Amancio Ortega, founder of Zara, and Klaus-Michael Kühne, founder of Kuehne + Nagel, among other notable European billionaires. (source)

39. The combined wealth of Nigeria’s five richest men ($29.9 billion) could eradicate national poverty, yet 5 million face hunger, and over 112 million live in poverty, highlighting the country’s stark wealth disparity. (source)

Demographic and Sectoral Disparities of Income Inequality

40. In 2023, the median US household income rose to $80,610, marking a 4% increase from the previous year’s estimate of $77,540. (source) KEY

41. Median incomes for US family households rose 3.6% in 2023, while nonfamily households saw a 5.0% increase compared to 2022. (source)

42. In 2023, married couples earned the highest median income of US family households at $119,400. Single-father households saw a 7% median income increase to $81,890, up from $76,550 in 2022. In contrast, single-mother households had the lowest median income at $59,470, showing no significant change from 2022. (source)

43. In 2023, nonfamily households headed by women had a median income of $42,140, remaining relatively stable since 2022. In contrast, nonfamily households headed by men saw a 5.9% median income increase, rising from $53,990 in 2022 to $57,200 in 2023. (source)

44. US median household income rose for Whites and non-Hispanic Whites between 2022-2023, while other groups saw no significant change. Asian households had the highest median income ($112,800) in 2023, followed by non-Hispanic Whites ($89,050), Hispanics ($65,540), and Blacks ($56,490). (source)

45. In 2023, US Asian households’ median income was 1.27 times higher than non-Hispanic Whites, narrowing the gap from 2022. Conversely, Hispanic households’ median income gap widened, with their income being 0.74 times that of non-Hispanic Whites. The income gap for Black households remained relatively stable. (source)

46. US median household income increased for most age groups from 2022-2023, with the largest gain (7.3%) among householders aged 55-64. The highest median income in 2023 was among householders aged 45-54 ($110,700), while those aged 65+ had the lowest ($54,710). (source)

47. In the US, median household income rose 4.5% for native-born households in 2023, while foreign-born households saw no significant change. Naturalized citizens had the highest median income ($86,060), followed by native-born individuals ($81,700), and noncitizens had the lowest ($61,440). (source)

48. US median household income increased in all regions except the West between 2022-2023. The Midwest saw the largest gain (6.6%). The West had the highest median income ($88,290), followed by the Northeast ($86,250), Midwest ($81,020), and South ($73,280). (source)

49. In the US, median household income rose in 2023 for most education groups aged 25+, except those without a high school diploma. Income increased by 4.3% for high school graduates and 3.1% for those with some college or a bachelor’s degree. Higher education correlated with higher income, with bachelor’s degree holders having the highest median income ($126,800). (source)

50. Between 2022 and 2023, the number of male and female workers in the US increased by 1.0% and 1.6%, respectively. Median earnings for men rose 2.6%, while women’s median earnings decreased 2.0%. For full-time, year-round workers, men’s median earnings increased by 3.0% and women’s by 1.5%. The percentage of full-time, year-round workers decreased slightly for both men and women. (source)

51. The wealthiest 10% of US households held an average of $6.9 million and controlled 67% of total household wealth, while the poorest 50% averaged just $51,000 and held only 2.5% of total household wealth. (source)

52. On average, US Black families held about 23 cents and Hispanic families held about 19 cents in wealth for every dollar held by white families, highlighting significant racial and ethnic wealth disparities. (source)

53. In the US, families headed by someone with higher levels of education held significantly more wealth. For every dollar held by families with a four-year college degree, families with some college education had 30 cents, those with a high school diploma had 22 cents, and those with less than a high school diploma had just 9 cents. (source)

54. In Australia, the wealthiest 20% hold a disproportionate amount of investments, owning 82% of all investment properties (averaging $266,000) and 78% of all shares and financial investments (averaging $563,000). (source)

55. As of August 2023, the mean weekly earnings for full-time employees in Australia was $1,885.6, a $62 increase. (source)

56. In Australia, as of 2023, the mining industry paid around $2,400 per week, while the accommodation and food services industry paid around $650 per week. (source)

57. In Australia’s private sector, a significant pay gap existed in 2023, with females earning an average of $1,065.9 per week, while males earned $1,588.4 per week. (source)

58. In Australia’s public sector, as of November 2023, women earned an average of $1,592 per week, while men earned $2,034 per week. (source)

59. Between 1975 and 2023, Australian male full-time employees consistently earned more than their female counterparts. As of August 2023, males earned $1,991.2 per week, $257 more than females, who earned $1,734.2 per week. (source)

60. In Australia, the wealthiest 10% owned 44% of all net wealth in 2023, with 66% of real estate wealth held by this group, while the lowest 60% held just 5%. (source)

61. Australia’s wealth disparity is stark, with the top 1% holding 9.9% of national income, while the bottom 50% hold just 17.2%. (source)

62. In Europe, wealth inequality is stark, with the wealthiest 10% owning 67% of the wealth, while the bottom 50% of adults possess just 1.2%. (source)

63. Women comprise 40% of the global workforce, but only 1/3 hold senior roles, and less than 30% work in STEM fields. (source)

64. The global gender pay gap narrowed slightly. Women earned 1¢ less than men with the same job/qualifications. The overall gap: women earned $0.83 for every $1 earned by men. (source)

65. In 2023, East Asia/Pacific had the highest share of female top managers (34%), followed by Latin America/Caribbean (20%). The Middle East/North Africa had the lowest (6%), with a global average of 19%. (source)

66. In 2023, US Bachelor’s degree holders earned a mean of $86,970, while high school graduates earned $46,720, showing higher education led to higher earnings. (source)

67. In 2024, UK men’s average full-time hourly wage was £19.36, while women’s was £17.89. (source)

68. In India, April-June 2024, average daily wages were ₹537 for male urban casual laborers and ₹364 for females. (source)

69. Germany’s average monthly wages were €4,702 for men and €4,000 for women. (source)

70. From 2019 to 2022, average bonuses for graduate consultants rose: signing bonus remained $5,000, performance bonus increased from $15,000 to $22,000, and base salary increased from $85,000 to $100,000. (source)

71. As of 2022, only 4 major industries had more than 50% female workers. Healthcare had the highest share (~2/3), while oil/gas/mining and infrastructure had less than 20% female workers. (source)

72. In Q3 2024, women’s median weekly earnings ($1,054) were 83.4% of men’s ($1,264). Earnings ratios varied by ethnicity: Black women (94.7%), Hispanic women (85.6%), White women (82.7%), and Asian women (74.3%) relative to their male counterparts. (source)

73. In Q3 2024, median weekly earnings varied by ethnicity:

Earnings gaps were larger among men, but smaller among women. Asian men and women outearned their White counterparts. (source)

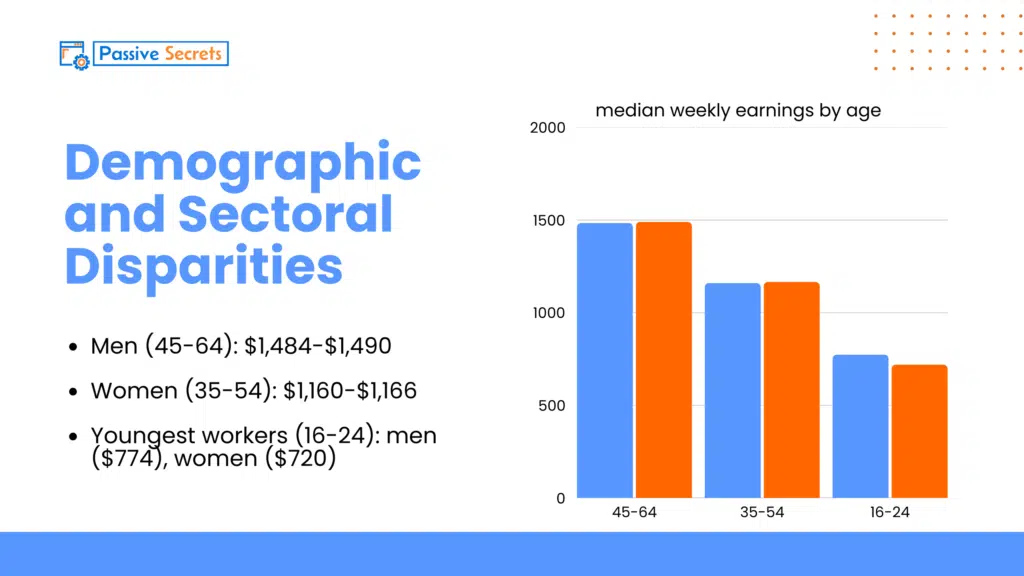

74. In Q3 2024, median weekly earnings varied by age:

The earnings gaps narrowed among younger workers but widened among older workers. (source)

75. In Q3 2024, median weekly earnings were highest for management, professional, and related occupations, at $1,884 for men and $1,392 for women. In contrast, service occupations had the lowest earnings, at $830 for men and $720 for women. (source)

76. Full-time workers aged 25+ with higher education levels earned more: $734/week (no high school diploma), $946/week (high school graduates), $1,697/week (bachelor’s degree), and $5,054+/week ($3,582+/week for women) for advanced degree holders. (source)

77. Iceland ranked as the most gender-equal country in 2024, with a score of 0.94, followed closely by other Nordic nations, which prioritize high female employment rates and shared parental leave. (source)

78. In 2023, women in the US earned 82.7% of what men earned in the same positions, a decrease from the previous year. (source)

79. In 2023, the median weekly earnings for Asian American men in the US was $1,635. (source)

80. In Q4 2022, women aged 16-24 in the US earned about 92.9% of what men in the same age group earned. (source)

81. In 2023, Rhode Island had the highest female-to-male earnings ratio at 89.05%, while Louisiana had the lowest at 71.03%. (source)

82. In 2023, the Gini index for Asian households in the US was 0.48, indicating moderate income inequality. (source)

83. In the UK, the 2024 hourly earnings gap between men and women was 13.1% for all workers, 7% for full-time workers, and -3% for part-time workers. (source)

84. In 2024, the UK men’s average full-time salary was £40,035, while the women’s was £34,000, which is a £6,000 difference. (source)

85. In 2024, UK men’s average full-time hourly wage was £19.36, while women’s was £17.89. (source)

86. Canada’s income inequality increased in Q2 2024, with a 47.0 percentage point gap between the top 40% and bottom 40% of households. However, the lowest-income households (bottom 20%) saw above-average growth in disposable income, driven by strong wage growth (+14.3%). (source)

87. In Q2 2024, Canada’s top 20% wealthiest households held 67.7% of the country’s total net worth, averaging $3.4 million per household. The bottom 40% held 2.8%, averaging $69,595. (source)

88. Canadian households under 35 years old reduced their mortgage debt since 2022 due to affordability concerns, while older households increased theirs, with those 55-64 and 65+ years old seeing 6.5% and 6.4% increases, respectively. (source)

89. In Q2 2024, Canada’s debt-to-income ratio declined across all age groups, driven by income gains exceeding debt growth. Those aged 35-44 had the highest ratio (260.4%), while those under 35 saw the largest decline (-8.9 percentage points). (source)

Drivers and Impacts of Income Inequality

90. The US workforce grew by 2.2 million (1.3%) between 2022-2023, but the number of full-time, year-round workers remained relatively stable. (source)

91. In 2023, 70.1% of US workers were employed full-time, year-round, a slight decrease from 2022. Median earnings for all workers remained stable, but full-time, year-round workers saw a 1.6% decrease in median earnings. (source)

92. Millennials and Gen Zers have significantly less wealth than previous generations at the same age, with only $1.33 and $1.32 in wealth for every $1 held by Gen Xers and baby boomers, respectively, at comparable ages. (source)

93. In Australia, COVID-19 income supports boosted average household incomes by $76/week in 2020-21, reducing income inequality, but their removal in 2021-22 led to a $19/week decline and restored pre-pandemic inequality levels, disproportionately affecting the lowest-income households. (source)

94. The wealth inequality in Australia has significantly increased over the past two decades (2003-2022), with the wealthiest 20% and 5% experiencing substantial growth (82% and 86%, respectively), far outpacing the middle 20% (61%) and lowest 20% (20%). (source)

95. In Australia, the income gap between high, middle, and low-income households is partly due to the composition of their incomes. The highest 20% rely heavily on wages and investments, while the lowest 20% rely on social security payments and wages. In contrast, middle-income households rely mainly on wages, with smaller contributions from investments and social security payments. (source)

96. Between 2020-21 and 2021-22, average Australian household after-tax incomes fell by $19/week due to the removal of COVID-19 income supports and rising inflation. The lowest 20% were disproportionately affected, experiencing a 3.5% decline in income, compared to 0.5% for the middle 20% and 0.1% for the highest 20%. (source)

97. Australia’s inflation rate was 4.1% in Q4 2023, down from 7.8% in Q4 2022. (source)

98. In the US, chronically homeless individuals were the most likely to be unsheltered in 2022, at 61.5%, while homeless people in families were the least likely, at 10.8%. (source)

99. In 2022, 72% of Australians earned $1,000 or more per week, whereas only 13% of those receiving Salvation Army assistance reached this income level, and 38% of respondents earned less than $500 per week. (source)

100. In Australia, 23% of survey respondents in 2023 reported severe food insecurity, up from 21% in 2022. (source)

101. In Australia’s 2023 survey, the Northern Territory reported the highest food security rate at 67%, while New South Wales/Australian Capital Territory and Western Australia had the lowest rates, both at 63%. (source)

102. Between 1987 and 2023, the US poverty rate fluctuated, reaching 11.1% in 2023. Black Americans consistently had the highest poverty rate, peaking at 48% in 1982, and remaining high at 17.8% in 2022. (source)

103. 142,000 US workers without a high school diploma earned minimum wage or less in 2023. (source)

104. In Q2 2024, Canadian households increased their average net savings. High-income households saw the largest increase (+$2,166), while lower-income households reduced debt. Middle-income households struggled with spending outpacing income growth. (source)

105. In Q2 2024, Canada’s least wealthy saw a 1.4% net worth decline due to mortgage debt rising faster than real estate values. Meanwhile, the top 20% wealthiest saw a 2.3% net worth increase, driven by strong financial asset growth. (source)

106. Nigeria’s richest man’s annual wealth earnings could lift 2 million people out of poverty. Women in rural Nigeria comprise 60-79% of the labor force, but are five times less likely to own land and often lack education. (source)

107. In India, 88.4% of billionaire wealth is held by upper castes, with no representation from Scheduled Tribes. Upper castes also own nearly 55% of national wealth, highlighting the deep-seated economic inequalities rooted in India’s caste system. (source)

108. India’s income and wealth inequality has risen sharply since the 1980s, with the top 1% now controlling over 40% of total wealth and earning 22.6% of pre-tax income, up from 12.5% and 7.3% respectively in 1980. (source)

109. In the US, the top 1% of earners make about 40 times more than the bottom 90%, and around 33 million workers earn less than $10/hour, leaving a family of four below the poverty line. (source)

Policy Responses and Statistical Outcomes of Income Inequality

110. Around 4.34 million Australians have a Pensioner Concession Card, with over a million residing in Victoria, and approximately 2.6 million received an age pension payment. (source)

111. Australia’s social housing capital expenditure reached approximately AU$3.53 billion in 2023, continuing a steady upward trend since 2021. (source)

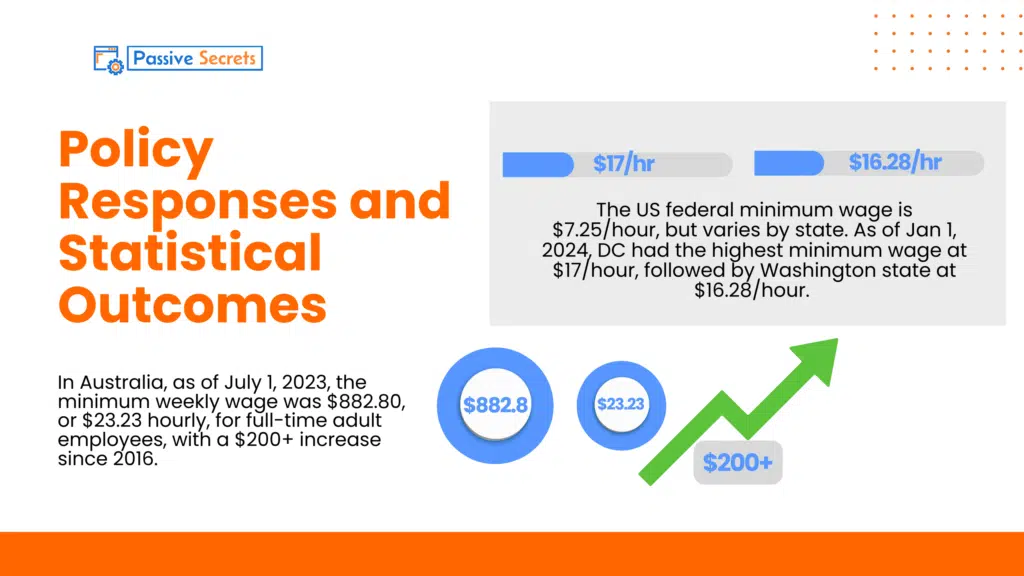

112. In Australia, as of July 1, 2023, the minimum weekly wage was $882.80, or $23.23 hourly, for full-time adult employees, with a $200+ increase since 2016. (source)

113. The US federal minimum wage is $7.25/hour, but varies by state. As of Jan 1, 2024, DC had the highest minimum wage at $17/hour, followed by Washington state at $16.28/hour. (source)

FAQs

Other Related Interesting Statistics You Would Like:

- Gen Z and Social Media: Key Statistics, Trends, and Insights

- Who Spends Smarter? Gen Z and Millennial Money Habits Compared

- 40+ Useful Procrastination Statistics To Help You

- How Much Are People Really Saving? Key Personal Savings Statistics Explained

- Millennials on Social Media: Top Platforms, Usage Trends, and Insights

- 50 Interesting Sharing Economy Statistics You Need to Know

- Thought-Provoking Gender Inequality Statistics: 160+ Insights Across Regions

- The Battle of the Sexes: Male Vs. Female Spending Statistics

- 55+ Useful Black Consumer Spending Statistics (NEW Report)

- 170 Insightful Holiday Spending Statistics You Should Know

- 80+ Franchise Statistics and Facts You Should Know

- 50+ Interesting Born Into Poverty Stay In Poverty Statistics