The sharing economy has been gaining popularity recently, transforming our perspectives on ownership, access, and exchanging goods and services.

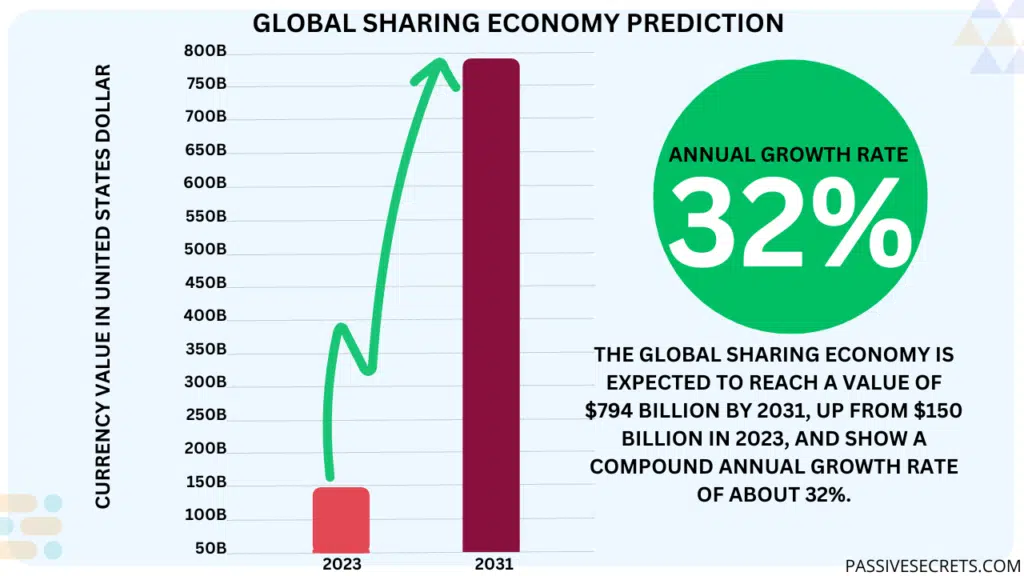

One of the sharing economy’s most striking aspects is its rapid growth. According to recent sharing economy statistics, the global sharing economy market is expected to reach a staggering $794 billion by 2031, up from just $150 billion in 2023.

As the sharing economy continues to evolve and expand, understanding its growth projection and impact on traditional markets is important for businesses and policymakers.

What is the Sharing Economy?

The sharing economy is a way for people to share things like goods and services with each other, often using websites or apps to connect. Rather than owning assets outright, it allows people to rent or borrow underutilized assets like cars, homes, or tools.

Imagine you’re going on a trip and need a place to stay. Rather than booking a hotel room, you can use a home-sharing platform like Airbnb to rent someone’s apartment or house for a few nights. Or maybe you need a ride to the airport, but your car is in the shop. You can use a ride-sharing service like Uber to get a lift from a fellow driver.

The key idea is that it enables peer-to-peer transactions, where individuals directly exchange goods and services. Online platforms that connect providers and users and build trust through peer reviews and ratings make this possible.

Key Sharing Economy Statistics

- The global sharing economy is expected to reach a value of $794 billion by 2031, up from $150 billion in 2023, and show a compound annual growth rate of about 32%.

- The sharing economy market is expected to reach over $1 trillion in revenue by 2031.

- North America dominated the sharing economy market in 2022 and is expected to maintain its dominance through 2032.

- The primary trend driving the growth of the Sharing Economy is the rise of hyperlocal sharing.

- 9,829 companies operate in 133 countries and 25 categories within the sharing economy, including business, finance, food, technology, and real estate.

- Approximately 72% of Americans have used a shared service or app, with 50% purchasing second-hand goods online and 15% using ride-hailing apps.

Sharing Economy Market Size And Growth

1. The global sharing economy is expected to reach $794 billion by 2031, up from $150 billion in 2023. Showing a compound annual growth rate of about 32%. (source)

2. The sharing economy in the United States had approximately 44.8 million adult users in 2016, with estimates suggesting a significant increase to 86.5 million users by 2021. (source)

3. According to New Media Wire, the global Sharing Economy market was valued at $149,939.7 million in 2022 and is expected to grow at a CAGR of 32.01%, reaching USD 793,680.0 million by 2028. (source)

4. From 2023 to 2028, the Sharing Economy market size is projected to grow at a CAGR of 28.96%, expanding by USD 761.76 billion. (source)

5. The individual segment of the Sharing Economy was valued at USD 114.22 billion in 2018, the largest segment at the time. (source)

6. The sharing economy market is expected to reach over $1 trillion in revenue by 2031. (source)

7. Currently, 9,829 companies operate in 133 countries and 25 categories within the sharing economy, including business, finance, food, technology, and real estate. (source)

8. Europe is expected to contribute 19.2% of the sharing economy’s global revenue in 2022, projected to reach $40.2 billion. (source)

9. The US home-sharing economy user base declined to 23.3 million in 2020 due to the COVID-19 pandemic but is projected to recover and reach 68.2 million users by 2023. (source)

Demographics of Sharing Economy Users

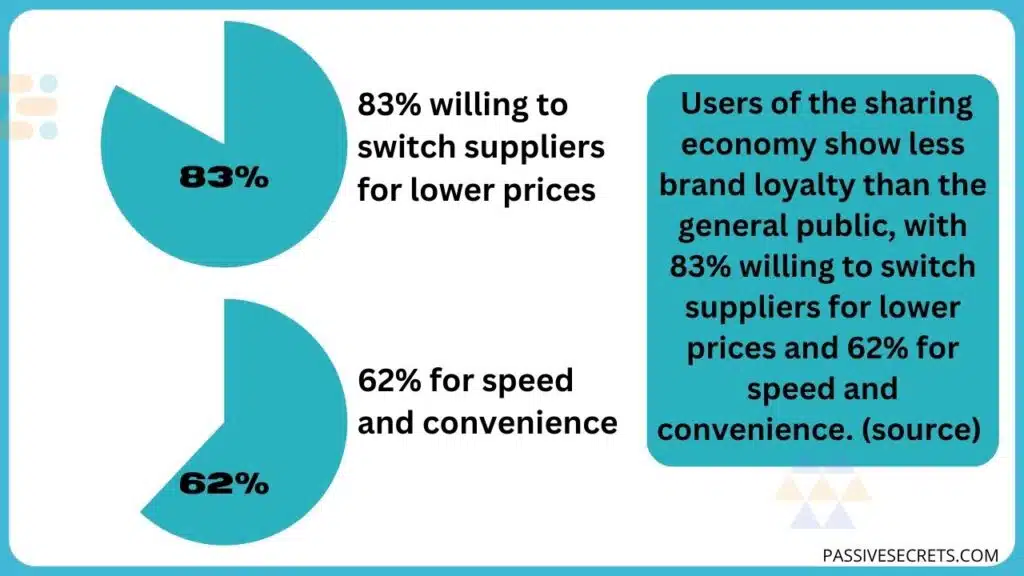

10. Users of the sharing economy show less brand loyalty than the general public, with 83% willing to switch suppliers for lower prices and 62% for speed and convenience. (source)

11. Over 50% of North American millennials (18-34 years old) used sharing economy services for pre-owned goods, compared to 36% of older generations (35+ years old). (source)

12. A survey found that older adults are less likely to view the sharing economy positively. When rating ride-hailing services, 73% of millennials (18-34) gave 4-5 stars, compared to 64% of those aged 35-64 and 52% of those 65 and older. (source)

Sharing Economy Statistics By Sector

13. Uber is valued at 68 billion U.S. dollars, surpassing the individual values of major American automobile firms like Chrysler, Ford, and General Motors. (source)

14. In 2022, entertainment and telecommunications held the largest revenue share in the sharing economy market. (source)

15. In 2023, the Shared Transportation segment had a significant global market share and is expected to grow substantially. (source)

16. Airbnb is the most well-known home-sharing company, with user numbers in the U.S. rising from 30.4 million in 2016 to an estimated 43.2 million in 2018. In September 2017, there were 38,745 properties available in New York and 17,358 in Los Angeles through Airbnb. (source)

17. Uber and Lyft are the largest players in the U.S. ridesharing market. As of May 2018, Uber was familiar to 76% of Americans, and Lyft was familiar to 66% of Americans. (source)

18. In the U.S. coworking office space market as of February 2018, Regus led with over 9.4 million square feet leased, followed by WeWork with around 6.5 million square feet. (source)

19. Coworking offices are less recognized than other sharing services, with only 17% awareness among Americans as of May 2018. (source)

20. Ride-hailing companies like Uber and Lyft employ AI for pricing decisions, discounts, and route optimization. A 2020 Evergage report indicated that 92% of U.S. customers expect personalized experiences. (source)

Benefits of Sharing Economy

21. The sharing economy offers easier entry, flexibility, and freedom. It attracts workers and investors, with 72% of independent workers preferring contract work and 50% of investors participating in peer-to-peer lending. (source)

22. A survey found that the top benefit of using sharing economy services is cost savings, with 54% of respondents recognizing it as a cheaper option. (source)

Sharing Economy Challenges Statistics

23. The lack of clarity regarding the classification and rights of gig economy workers poses a significant challenge to expanding the market. (source)

24. Varying national transport policies and resistance from traditional transport services present substantial hurdles for the growth of the ridesharing market in France. (source)

25. Four major challenges target the sharing economy’s fundamental principles. Firstly, renting may bring considerable disadvantages, leading to new social divisions and increased inequality. (source)

Secondly, despite their appearance, internet platforms are large corporations that diminish the benefits available to gig workers. Thirdly, the long-term sustainability advantages of the sharing economy remain uncertain. Lastly, concerns about security and trust continue to affect the sharing economy.

26. The most common problems encountered by people with the sharing economy services in Sweden include experiencing unpleasant treatment from the other party and encountering delays or no-shows during scheduled meetings, both reported by 26% of respondents. (source)

Sharing Economy Trends and Future Outlook

27. The primary trend driving the growth of the Sharing Economy is the rise of hyperlocal sharing. (source)

28. Sharing economy platforms increasingly use AI to enhance customer experience, with 45% of executives seeing AI as crucial for improving operational efficiency by 2023. (source)

29. Autonomous ridesharing is a significant trend driving growth in the French ridesharing market. (source)

Regional Sharing Economy Statistics

30. North America dominated the sharing economy market in 2022 and is expected to maintain its dominance through 2032. (source)

31. The awareness of sharing services in the United States increased significantly from 47% in 2015 to 83% in May 2018. (source)

32. A survey found that 19% of respondents in the Northeast US consider sharing economy services (like Uber, Lyft, Airbnb, and HomeAway) “very trustworthy”, with varying levels of trust in other regions. (source)

33. APAC is expected to contribute 32% to the global Sharing Economy market growth from 2024 to 2028. (source)

34. In Germany, car-sharing users rose to around 5.5 million in 2024 from approximately 4.47 million in 2023. (source)

35. In 2023, the interest in car sharing in Germany was confirmed by around 8 million people, slightly lower than the 8.3 million in 2022. Germany had 293 car-sharing companies in operation as of 2024. (source)

36. The French ridesharing market is expected to grow at a CAGR of 12.82% from 2022 to 2027, with the market size increasing by USD 2,473.33 million. (source)

37. The e-hailing segment is the fastest-growing segment in the French ridesharing market. Mobile subscriptions connected to smartphones are expected to reach 84.75 million by 2024, contributing to market expansion. (source)

38. The e-hailing segment in the French ridesharing market was valued at USD 1,787.10 million in 2017 and continues to grow. (source)

39. Approximately 72% of Americans have used a shared service or app, with 50% purchasing second-hand goods online and 15% using ride-hailing apps. (source)

40. Younger Americans, especially those under 30, primarily use shared economy platforms for earning income. (source)

41. In the Asia-Pacific region, willingness to share or rent items reaches 78%, while 81% are open to renting from others. (source)

42. In Latin America, 70% are open to sharing or renting, with 73% willing to rent from others. (source)

43. In the Middle East and Africa, 68% of people are open to sharing or renting, and 71% are willing to rent from others. (source)

44. In Europe, 54% of people are willing to share or rent, and 44% are willing to rent from others. (source)

45 Thousand Australians join Airtasker daily to reap the benefits of the sharing economy. With membership tripled since March 2014 to reach 320,000 members. (source)

46. About 16% of Australians use the sharing economy for tasks, and 6.7% use it for earning extra income. (source)

47. Nearly half of Australians (44.8%) know major sharing economy companies like Airbnb, Uber, and Airtasker. (source)

48. PwC reports that 44% of US consumers are familiar with the sharing economy, and 19% have used it for tasks. (source)

49. Airtasker data reveals that the sharing economy is gaining momentum. Airtasker has grown significantly, with over 100,000 new Australian members in the past six months. (source)

50. In Russia in 2020, C2C sales accounted for the largest share of the sharing economy (838 billion Russian rubles), followed by freelance services (183 billion) and carsharing (22.4 billion). (source)

Conclusion

The sharing economy statistics reveal a remarkable shift in how we think about ownership and usage.

Millions of people are embracing this new way of living, from ride-sharing to home-sharing. The numbers show that the sharing economy is growing fast, saving people money and helping the planet.

As we look to the future, one thing is clear: the sharing economy is here to stay, and its potential is vast. The sharing economy statistics paint a promising picture of a sharing future that benefits us all.

Frequently Asked Questions

What is the growth rate of the sharing economy?

The global sharing economy is expected to reach a value of $794 billion by 2031, up from $150 billion in 2023, and show a compound annual growth rate of about 32%.

How big is the sharing economy?

The global Sharing Economy market size was valued at USD 149939.7 million ($149.94 billion) in 2022 and is expected to reach USD 793680.0 million ($793.68 billion) by 2028.

What are the four models of the sharing economy?

The four sharing economy models are franchiser, principal, chaperone, and gardener.

What are the characteristics of a sharing economy?

The top characteristics of a sharing economy are peer-to-peer transactions, temporary access over ownership, underutilized assets, and online platforms.

How do you measure the sharing economy?

Measuring the sharing economy is tricky. It’s like trying to measure a moving target. To understand its size and importance, we use different measures, such as how much money is made, how many people use it, how fast it grows, and how many jobs it creates.

Related Posts:

- Thought-Provoking Gender Inequality Statistics: 160+ Insights Across Regions

- 110+ Shocking Income Inequality Data You Need to Know

- 100+ Animation Statistics: The Ultimate Guide To The Industry’s Trends and Insights

- 80+ Franchise Statistics and Facts You Should Know In 2024

- The Future of Learning: 50+ Top EdTech Statistics For 2024

- The Web3 Statistics Report 2024: Trends, Insights, and Predictions

- Meme Statistics 2024: Facts, Trends, and Figures That Will Blow Your Mind

- 85+ MOST Interesting Anime Statistics and Facts (NEW Report)

- Board Game Statistics: Revenue, Market Size, Demographics & More

- 125+ Interesting Airbnb Statistics by Country (Deep Insights)

- 50+ Interesting Born Into Poverty Stay In Poverty Statistics

- 90+ Interesting Film Industry Statistics (NEW Report)

- 80+ Alarming Technology Addiction Statistics You Must Know

- 65+ Impressive Chess Statistics and Facts To Know in 2024

- Spotify Statistics: Latest Report on The Music Streaming Platform

- 50+ Useful Video Game Addiction Statistics, Facts & Huge Trends

- 50+ Vital Internet Safety Statistics & Facts You Must Know

- Internet Dangers Statistics: A Look At The Internet’s Dark Side

- 50 Interesting Bible Statistics and Facts You Didn’t Know

- 95+ Interesting Dream Statistics and Facts You Can’t Miss

- 75+ Interesting Relationship Statistics & Facts You Should Know

- Dance Statistics: A Deep Dive Into The Rhythm Of Movement

- 40+ Incredible Single Father Statistics You Have to Know

- The Battle of the Sexes: Male Vs. Female Spending Statistics

- 95+ Jaw-Dropping Period Poverty Statistics You Need To Know

- 70 Exciting Love Statistics And Facts (True Love, Intimacy, Marriage, Dating & Relationships)

- 30+ Gentle Parenting Statistics & Facts: Is This Parenting Style Worth It?

- 55+ Useful Black Consumer Spending Statistics (New Report)

- Holiday Spending Statistics: Valentine’s Day, Easter, Thanksgiving, & Christmas