The world of billionaires is as fascinating as it is exclusive. With just over 3,000 individuals controlling trillions of dollars, billionaires represent the pinnacle of financial success and influence.

But what do the numbers really tell us about these ultra-wealthy individuals? Which industries produce the most billionaires? How is their wealth distributed across the globe? And what role do inheritance and self-made success play in their stories?

From the youngest billionaires redefining innovation to the world’s wealthiest cities, these billionaire statistics offer a unique lens through which to understand global wealth distribution, economic trends, and societal impact.

In this article, we’ll dive deep into the most compelling data and trends, revealing how billionaires are shaping the global — and how their influence might evolve in the coming years.

Key Billionaire Statistics (Editor’s Pick)

- According to Forbes, the number of billionaires has reached a record high of 2,781 in 2024, with a combined wealth of $14.2 trillion.

- Elon Musk, CEO of Tesla and SpaceX, is the world’s richest person, worth $330.1 billion.

- Billionaires comprise only 0.8% of the ultra-wealthy population and hold 24% of all ultra-wealth.

- Tech billionaires’ wealth grew the fastest, tripling from $788.9 billion in 2015 to $2.4 trillion in 2024.

- Finance and investments is the top industry for billionaires, with 372 individuals, despite a slight decrease from 393 last year.

- Tech billionaires have the highest average wealth at $70.6 billion.

- In 2024, 268 new billionaires emerged, with 60% of them being self-made entrepreneurs.

- In 2024, 1,877 billionaires were self-made, while 805 inherited their wealth.

- The number of female billionaires grew 81% from 190 in 2015 to 344 in 2024.

- The average wealth of male billionaires rose 45% to $5.3 billion, while female billionaires’ average wealth increased 40% to $4.8 billion.

- Female billionaires’ portfolios are: 39% liquid assets, followed by privately owned investments and public holdings.

- Self-made female billionaires have a median net worth of $1.8 billion and an average age of 64.

- Francoise Bettencourt Meyers is the world’s wealthiest woman, with a net worth of $99.5 billion.

- The US leads with a record 813 billionaires, worth $5.7 trillion, followed by China with 473 billionaires

- The collective wealth of the top 400 wealthiest individuals in America has reached a record-breaking $5.4 trillion.

- The number of billionaires in Europe is projected to increase from 397 in 2014 to 573 by 2024.

- The EU is home to 15% of the world’s billionaires and 16% of global billionaire wealth.

- Africa’s top 20 billionaires have a combined net worth of $82.4 billion.

- 60% of American adults aspire to become billionaires, while 40% hold a negative view.

Global Distribution of Billionaires: General Billionaire Statistics

1. According to Forbes, the number of billionaires has reached a record high of 2,781 in 2024, with a combined wealth of $14.2 trillion, a $2 trillion increase from 2023. (source)

2. The top 20 billionaires added $700 billion in wealth since 2023. (source)

3. In 2022, North America had over 1,000 billionaires, the highest number globally, closely trailed by Europe and Asia, with a significant gap separating them from the rest of the world. (source)

4. Since 2020, the richest 1% captured 63% ($26 trillion) of new global wealth, while the remaining 99% shared 37% ($16 trillion). Billionaires’ fortunes grew by $2.7 billion daily. (source)

5. Billionaire wealth skyrocketed in 2022, driven by soaring food and energy profits. In 2022, 95 corporations in these sectors more than doubled their profits, earning $306 billion in windfall profits, with 84% ($257 billion) going to wealthy shareholders. (source)

6. According to Forbes, Elon Musk, CEO of Tesla and SpaceX, is the world’s richest person, worth $330.1 billion, having surpassed Bernard Arnault in May 2024. (source)

7. Billionaires’ wealth has grown 121% to $14 trillion over the past 10 years, outpacing global equity markets. (source)

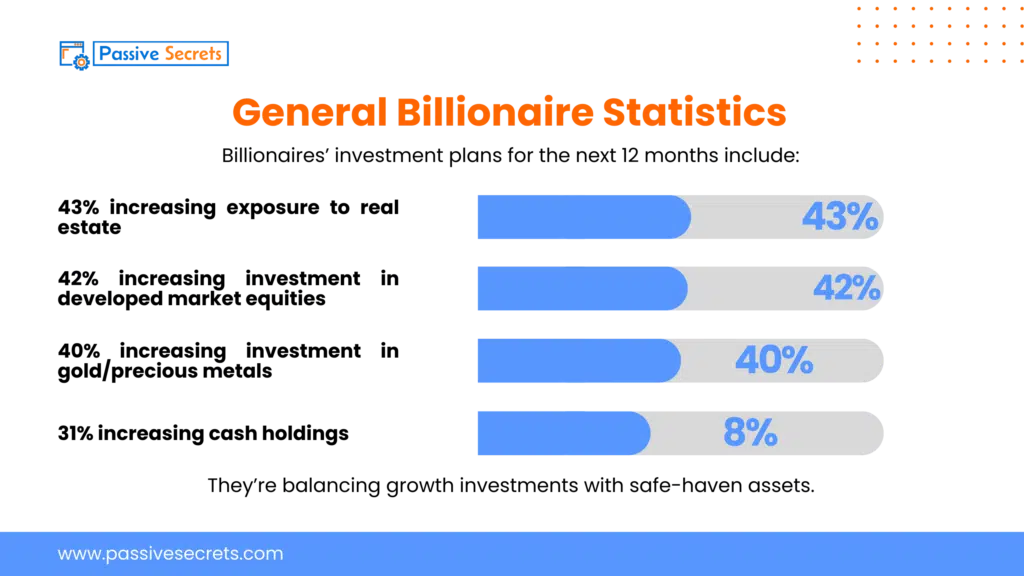

8. Billionaires’ investment plans for the next 12 months include:

They’re balancing growth investments with safe-haven assets. (source)

9. Billionaires’ alternative asset investment plans include:

10. The global ultra-high net worth population grew 7.6% to 426,330 individuals in 2023. (source)

11. The global ultra-wealthy population is forecast to reach 587,650 by 2028, adding $19 trillion in new wealth. North America’s share will rise to 39%, while Asia’s will increase slightly to 27%, and Europe’s will decline to 25%. (source)

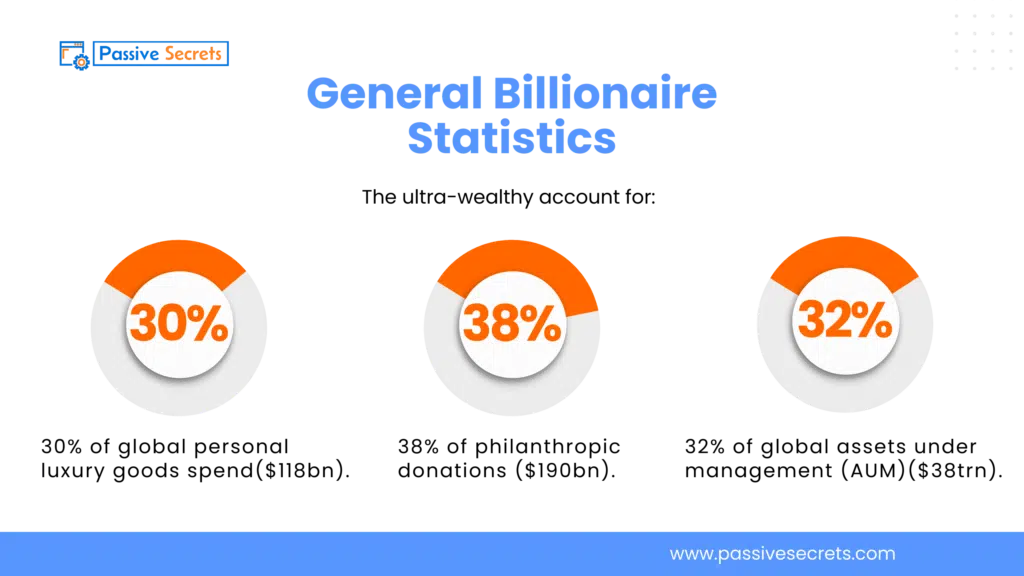

12. The ultra-wealthy account for:

13. The ultra-wealthy population with a net worth of $100m-$1bn makes up about 20% of the population and holds similar wealth to those worth $30m-$100m. (source)

14. Billionaires, comprising just 0.8% of the ultra-wealthy population, hold 24% of all ultra wealth. (source)

15. According to Altrata, the global billionaire population grew 4% in 2023 to reach 3,323 individuals, surpassing the previous year’s decline and setting a new record high. (source)

16. 18 billionaires hold fortunes over $50bn, accounting for 0.5% of all billionaires but 16% of total billionaire wealth, a fourfold increase since 2014, with a combined net worth of $2trn and an average fortune of over $100bn. (source)

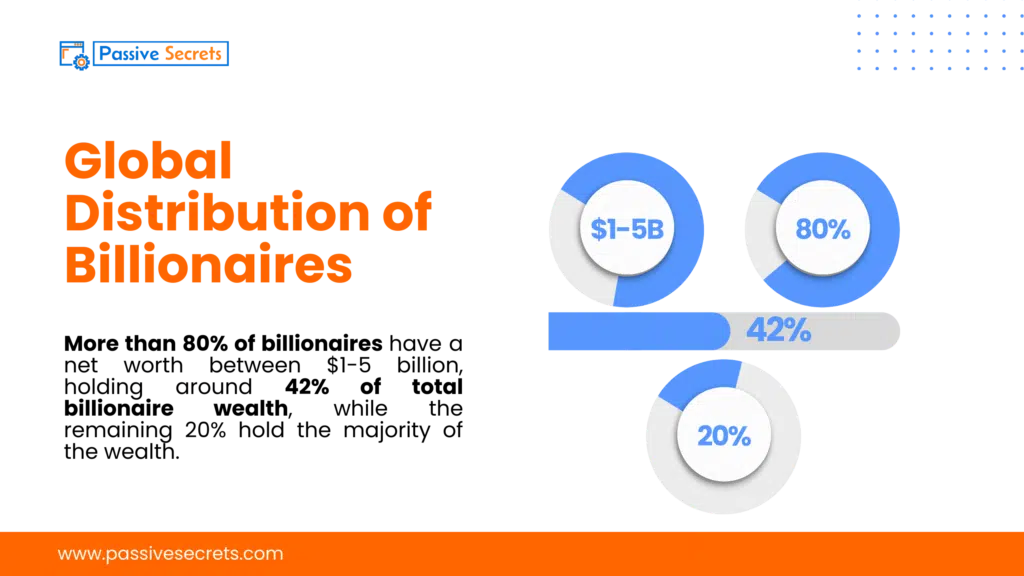

17. More than 80% of billionaires have a net worth between $1-5 billion, holding around 42% of total billionaire wealth, while the remaining 20% hold the majority of the wealth. (source)

18. Just 6% of billionaires, or 194 individuals, have a net worth of over $10 billion, yet they control 41% of global billionaire wealth, with a combined net worth of nearly $5 trillion. (source)

19. Billionaires globally typically pay extremely low personal tax rates, ranging from 0% to 0.5%. Taxing the world’s 2,700 billionaires at a rate of 2% annually could generate enough revenue for countries to address global crises such as income inequality and climate change. (source)

Top Industries Producing Billionaires

20. Tech billionaires’ wealth grew the fastest, tripling from $788.9 billion in 2015 to $2.4 trillion in 2024. (source)

21. The wealth of industrial billionaires surged from $480.4 billion to $1.3 trillion, driven by nations’ investments to boost competitiveness. (source)

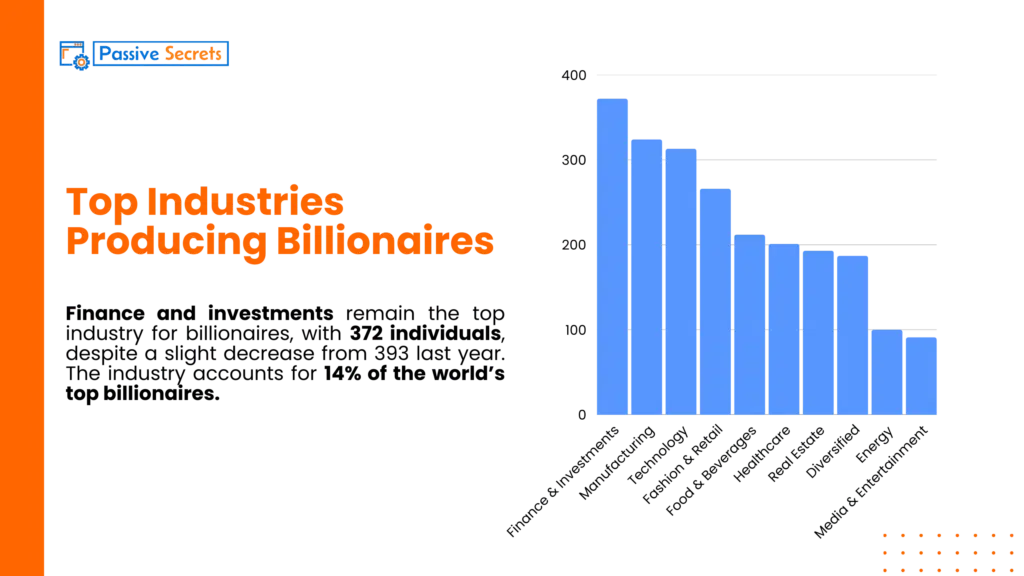

22. Finance and investments remain the top industry for billionaires, with 372 individuals, despite a slight decrease from 393 last year. The industry accounts for 14% of the world’s top billionaires. (source)

The top 10 biggest industries for billionaires according to Forbes:

| Industries | Number of Billionaires |

| Finance and investments | 372 |

| Manufacturing | 324 |

| Technology | 313 |

| Fashion and Retail | 266 |

| Food and Beverages | 212 |

| Healthcare | 201 |

| Real Estate | 193 |

| Diversified | 187 |

| Energy | 100 |

| Media and Entertainment | 91 |

23. Billionaires in the materials sector saw their wealth surge from $718.1 billion to $1.8 trillion. (source)

24. Despite a strong start, real estate billionaires’ wealth growth has lagged since 2017, rising from $534 billion in 2015 to $692.3 billion in 2024, impacted by factors like China’s property correction and higher interest rates. (source)

25. Tech billionaires have the highest average wealth at $70.6 billion, although they make up a relatively small group. (source)

26. As of January 2024, Elon Musk topped the list of richest tech industry individuals, with a net worth of $217 billion, followed by Jeff Bezos ($180 billion) and Bill Gates ($142 billion). (source)

Demographics of Billionaires

27. Heirs and philanthropic causes of baby boomer billionaires are expected to inherit approximately $6.3 trillion over the next 15 years. (source)

28. In 2024, 268 new billionaires emerged, with 60% being self-made entrepreneurs, reversing last year’s trend where most new billionaires were inheritors. (source)

29. The number of children of billionaires has increased from 4,136 in 2015 to 6,441 in 2024, adding complexity to billionaires’ families. (source)

30. Among surveyed UBS billionaire clients, 46% had a giving strategy 10 years ago, increasing to 56% today. (source)

31. In 2024, 1,877 billionaires were self-made, while 805 inherited their wealth. (source)

32. The number of multigenerational billionaires grew from 582 in 2015 to 805 in 2024, with 542 in the 2nd generation, 163 in the 3rd, and 100 in the 4th. (source)

33. Multigenerational billionaires make up 36.9% in the Americas, 35.9% in EMEA, and 27.2% in APAC. (source)

34. As of April 2024, Mark Mateschitz, heir to Red Bull, was the richest billionaire under 34, with a net worth of nearly $40 billion, followed by three Irish billionaires. (source)

35. As of Dec 7, 2024, the average annual salary for a billionaire in the US is reportedly $134,333, according to ZipRecruiter. (source)

36. By 2045, Millennials and Gen Z are expected to inherit approximately $84 trillion. (source)

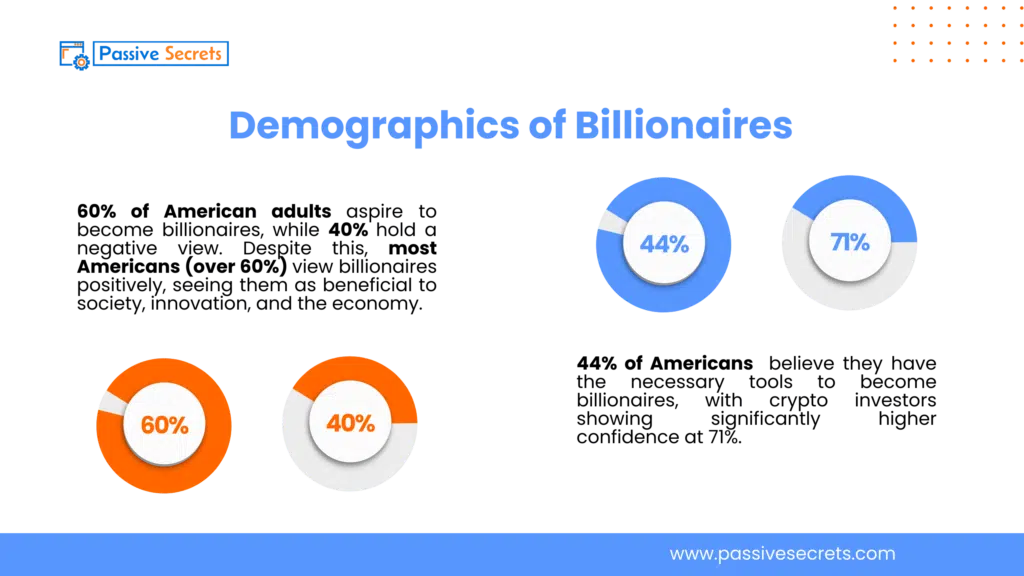

37. 60% of American adults aspire to become billionaires, while 40% hold a negative view. Despite this, most Americans (over 60%) view billionaires positively, seeing them as beneficial to society, innovation, and the economy. (source)

38. Two-thirds of Americans see economic inequality as a serious issue, with 46% believing billionaires hinder achieving the American Dream, especially among younger (Gen Z, Millennials) and diverse (LGBTQ, Asian) Americans. (source)

39. 44% of Americans believe they have the necessary tools to become billionaires, with crypto investors showing significantly higher confidence at 71%. (source)

40. 70% of Americans believe billionaires have a responsibility to improve society, but feel they’re not doing enough. (source)

The Rise of Female Billionaires: Gender Statistics to Watch

41. The number of female billionaires grew 81% from 190 in 2015 to 344 in 2024, driven mainly by self-made women, while the number of male billionaires rose 49% to 2,338. (source)

42. Female billionaires’ wealth surged 153% to $1.7 trillion, outpacing the 117% growth of male billionaires’ wealth to $12.3 trillion. (source)

43. The average wealth of male billionaires rose 45% to $5.3 billion, while female billionaires’ average wealth increased 40% to $4.8 billion. (source)

44. In 2023, there were 431 female billionaires, making up 13% of the total. (source)

45. While many inherited their wealth, the number of self-made female billionaires is growing. Philanthropy is their top interest, and many focus on non-profit or finance sectors. (source)

46. Female billionaires are more likely to own luxury property and valuable art, with 1.5 times more high-end real estate and 1.3 times more valuable art than their male counterparts, who instead favor private jets, yachts, and luxury cars. (source)

47. 13% of female billionaires are under 50, compared to 9% of males. Most billionaires, male and female, are between 50-70 years old. (source)

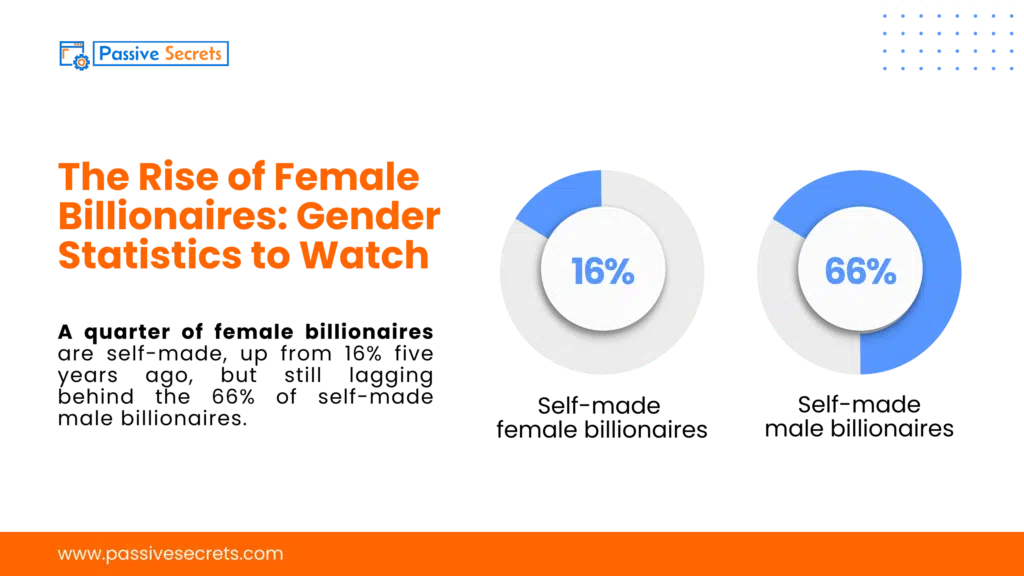

48. 75% of female billionaires inherited wealth, compared to 33% of males. 38% of female billionaires inherited their wealth solely, versus 5% of males. (source)

49. A quarter of female billionaires are self-made, up from 16% five years ago, but still lagging behind the 66% of self-made male billionaires. (source)

50. Female billionaires’ portfolios are: 39% liquid assets, followed by privately owned investments and public holdings. (source)

They hold a larger proportion of liquid assets and private investments, often tied to family businesses and a smaller proportion of public holdings (22%) compared to male billionaires.

51. Female billionaires are 1.5 times more likely to own luxury real estate (>$10M), while male billionaires are 4 times more likely to own valuable car collections (>$1M). (source)

52. In 2023, 104 female billionaires (24% of the total 431) were self-made, having created their own fortunes. (source)

53. Self-made female billionaires have a median net worth of $1.8 billion and an average age of 64. Only 10% are under 50, and a quarter are over 70, compared to over half of female billionaires who inherited their wealth. (source)

54. Among self-made female billionaires, the top industries are banking/finance and technology. This reflects the same industries that dominate among self-made male billionaires. (source)

55. As of June 2024, Francoise Bettencourt Meyers was the world’s wealthiest woman, with a net worth of $99.5 billion, followed by Alice Walton with over $70 billion. (source)

56. As of May 2024, Diane Hendricks, founder of ABC Supply, was the wealthiest self-made female billionaire in the US, with a net worth of $20.9 billion, followed by Judy Love and her family at $11.6 billion. (source)

57. The U.S. is the country with the most female billionaires, with a total of 101 female billionaires. (source)

| Rank | Country | Total Female Billionaires | Richest Female Billionaire |

| 1 | USA | 101 | Alice Walton: $72.3 billion |

| 2 | China | 39 | Zheng Shuliang: $9.4 billion |

| 3 | Germany | 32 | Susanne Klatten: $26.1 billion |

| 4 | Italy | 19 | Massimiliana Landini Aleotti: $7.5 billion |

| 5 | India | 14 | Savitri Jindal: $33.4 billion |

Billionaire Statistics By Region

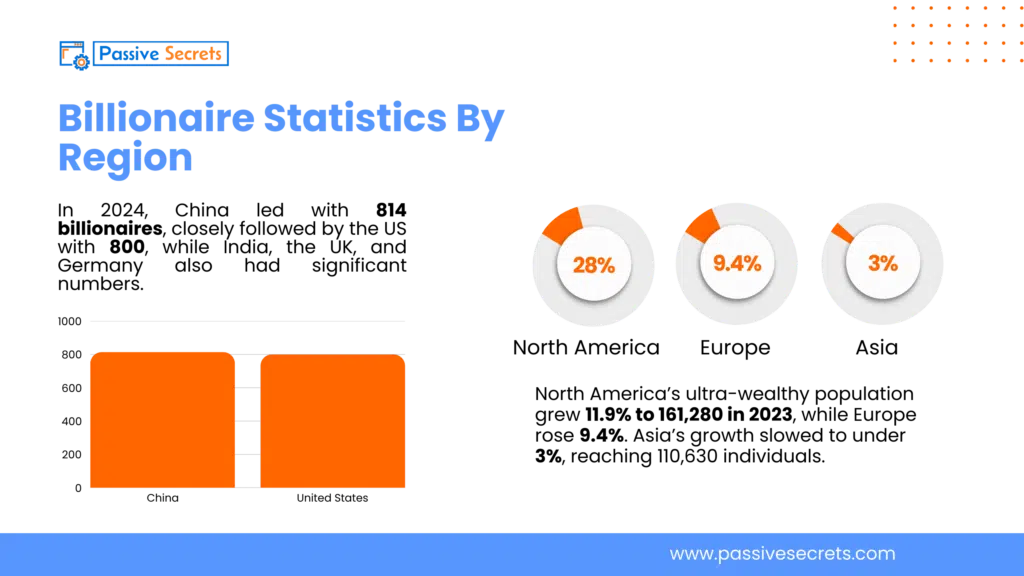

58. In 2024, China led with 814 billionaires, closely followed by the US with 800, while India, the UK, and Germany also had significant numbers. (source)

59. The US leads with a record 813 billionaires, worth $5.7 trillion, followed by China with 473 billionaires, worth $1.7 trillion, and India with a record 200 billionaires. (source)

60. Chinese billionaire wealth more than doubled from $887.3 billion in 2015 to $2.1 trillion in 2020, but has since declined to $1.8 trillion, while the number of billionaires remains steady. (source)

61. North American billionaires’ wealth has surged, growing from $2.5 trillion in 2015 to $3.8 trillion in 2020, and then jumping 58.5% to $6.1 trillion by 2024, driven by industrials and tech billionaires. (source)

62. Wealth accumulation in Western Europe slowed slightly after 2020 due to higher interest rates. Despite this, wealth grew from $1.5 trillion in 2015 to $2.1 trillion in 2020, and further increased to $2.7 trillion by 2024, driven by tech billionaires. (source)

63. US billionaires saw significant gains in 2024, with their wealth rising 27.6% to $5.8 trillion, accounting for over 40% of global billionaire wealth. (source)

64. The number of US billionaires increased 11.2% to 835, with 101 new billionaires emerging, while 20 individuals’ wealth dropped below $1 billion. (source)

65. Central and South America’s billionaires had a successful year, with Brazil seeing 19 new billionaires, bringing the total to 60, and wealth increasing 37.7% to $154.9 billion. Overall, the region’s billionaires grew their wealth by 20.8% to $411.4 billion, with the number of billionaires rising from 74 to 92. (source)

66. The Americas region saw a significant increase in billionaires, growing from 867 to 973, with their collective wealth rising 26.9% to $6.5 trillion. (source)

67. Billionaires from Mainland China and Hong Kong SAR saw their collective wealth decline 16.8% to $1.8 trillion, with the number of billionaires dropping from 588 to 501, as 138 individuals fell below the billionaire threshold and 53 new billionaires emerged. (source)

68. Indian billionaires’ wealth increased 42.1% to $905.6 billion, with their number growing from 153 to 185. (source)

69. In contrast, the APAC region’s billionaire wealth growth slowed, rising 1.8% to $3.8 trillion, with the number of billionaires decreasing from 1,019 to 981. (source)

70. Western Europe’s total billionaire wealth increased 16.0% to $2.7 trillion, driven in part by a 23.8% rise in Swiss billionaires, with the number of Western European billionaires growing from 456 to 495. (source)

71. UAE billionaires’ wealth increased 39.5% to $138.7 billion, with the number of billionaires growing to 18. (source)

72. EMEA’s billionaire wealth grew 17.0% to $3.7 trillion, with the number of billionaires increasing by 70 to 728. (source)

73. In China, the number of multigenerational billionaires decreased from 35 in 2015 to 33 in 2024. (source)

74. India’s billionaire count surged 123% to 185 and their total wealth nearly tripled, rising 263% to $905.6 billion, over the past decade. (source)

75. The US led with a 13% increase in ultra-high-net-worth individuals to 147,950. Germany also saw similar growth. (source)

76. China’s UHNW population fell 1% due to economic slowdown and real estate decline, while Japan and India experienced robust growth. (source)

77. India will dominate the list of fastest-growing ultra-high-net-worth cities, with Bengaluru, Hyderabad, and Delhi expected to grow 14-16% annually over the next five years. (source)

78. North America’s ultra-wealthy population grew 11.9% to 161,280 in 2023, while Europe rose 9.4%. Asia’s growth slowed to under 3%, reaching 110,630 individuals. (source)

79. By 2028, 42% of the ultra-wealthy will reside in the top 50 UHNW cities, up from 38% in 2015, with New York, Hong Kong, Los Angeles, and Tokyo remaining the top 4 cities. (source)

80. North America solidified its lead as the world’s top billionaire region, with a 9.9% increase to 1,111 billionaires. Asia’s billionaire population and wealth declined, while Europe’s population grew 5% to 980 billionaires, securing its position as the second-largest billionaire region. (source)

81. The US is the country with the highest billionaire population. (source)

According to a recent report on the billionaire census, the top billionaire countries in terms of population are:

| Rank | Country | Combined Billionaire Wealth | Billionaire Population* |

| 1 | U.S.A | $4,893bn | 1,050 |

| 2 | China | $1,168bn | 304 |

| 3 | Germany | $614bn | 170 |

| 4 | India | $395bn | 131 |

| 5 | UK | $296bn | 122 |

| 6 | Russia | $469bn | 118 |

| 7 | Switzerland | $371bn | 116 |

| 8 | Hong Kong | $262bn | 107 |

| 9 | Italy | $212bn | 74 |

| 10 | France | $284bn | 72 |

| 11 | Saudi Arabia | $195bn | 68 |

| 12 | Canada | $134bn | 61 |

| 13 | Singapore | $108bn | 58 |

| 14 | Brazil | $204bn | 55 |

| 15 | UAE | $205bn | 48 |

*The population as of 2023

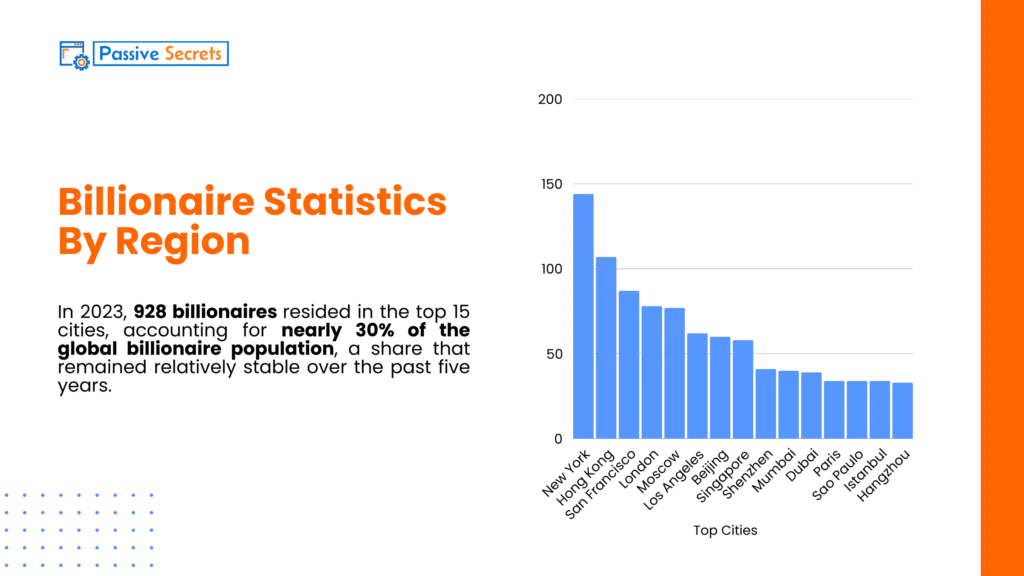

82. New York is the top city with the most billionaires in the world. Hong Kong comes in second place. (source)

83. In 2023, 928 billionaires resided in the top 15 cities, accounting for nearly 30% of the global billionaire population, a share that has remained relatively stable over the past five years. The top 15 billionaire cities in the world are:

| Rank | City | Billionaire Population* |

| 1 | New York | 144 |

| 2 | Hong Kong | 107 |

| 3 | San Francisco | 87 |

| 4 | London | 78 |

| 5 | Moscow | 77 |

| 6 | Los Angeles | 62 |

| 7 | Beijing | 60 |

| 8 | Singapore | 58 |

| 9 | Shenzhen | 41 |

| 10 | Mumbai | 40 |

| 11 | Dubai | 39 |

| 12 | Paris | 34 |

| 13 | Sao Paulo | 34 |

| 14 | Istanbul | 34 |

| 15 | Hangzhou | 33 |

*the population is as of 2023

84. In June 2024, Elon Musk was assessed to be the wealthiest individual in the United States, with a net worth approximating 195 billion dollars. (source)

85. The collective wealth of the top 400 wealthiest individuals in America has reached a record-breaking $5.4 trillion. This reflects an increase of almost $1 trillion compared to the previous year. (source)

86. According to Americans for Tax Fairness, about 800 billionaires in the nation possess 3.8% of U.S. wealth, whereas the bottom half of American families hold merely 2.5%. (source)

87. As of August 2024, the top five wealthiest billionaires in the United States have a total net worth of $856 billion. According to the source, the top five billionaires are Elon Musk, Jeff Bezos, Mark Zuckerberg, Larry Ellison, and Warren Buffett. (source)

88. The number of billionaires in Europe is projected to increase from 397 in 2014 to 573 by 2024. (source)

89. Implementing a wealth tax on EU multi-millionaires and billionaires could generate approximately €286.5 billion annually, covering 40% of the EU’s recovery fund. (source)

90. The EU’s 5 richest billionaires increased their wealth by 75.9% from March 2020 to November 2023, from €244.2 billion to €429.43 billion. This gain of €185 billion is equivalent to 57% of the EU’s education budget and translates to an hourly gain of €5.7 million. (source)

91. According to Oxfam, the EU is home to 15% of the world’s billionaires and 16% of global billionaire wealth, despite accounting for less than 6% of the global population. (source)

92. A progressive wealth tax on EU multi-millionaires and billionaires could generate €286.5 billion annually. The proposed tax rates are:

This revenue could cover 40% of the EU’s recovery and resilience facility. (source)

93. In 2023, Germany had the highest number of billionaires in Europe, with more than twice as many as Italy and France combined. (source)

94. In 2022, Germany had the most billionaires in Europe, with 173, and the third-highest globally. The UK followed with 114 billionaires, and Russia with 112. The US topped the list, followed by China. (source)

95. Australia had 37 billionaires in 2019, down from the previous year, but was expected to increase to 41 billionaires by 2024. (source)

96. By 2026, Australia is projected to have almost 18,000 multi-millionaires, reflecting the country’s growing economy and increasing wealth inequality. (source)

97. The collective wealth of Australia’s 50 richest individuals increased by $9 billion to $222 billion, up from $213 billion in 2023. (source)

98. Australia’s wealthiest 200 individuals now control a combined $625 billion, marking an 11% increase from the previous year. (source)

99. The number of millionaires, ultra-high-net-worth individuals, and billionaires in Switzerland is projected to increase from 2014 to 2024. (source)

100. Africa’s private wealth totalled $2.5 trillion in 2023, with 21 billionaires, led by Nigerian Aliko Dangote, founder of Dangote Cement. (source)

101. Africa’s top 20 billionaires have a combined net worth of $82.4 billion, a $900 million increase from the previous year (2023). (source)

FAQs

Other Related Statistics That Will Interest You:

- 89 Business Loan Statistics Every Entrepreneur Should Know

- 70+ AI in Education Statistics That Prove the Future Is Already Here

- Women in Leadership Statistics: Insights into Global Gender Representation

- Soft Skills Statistics: Key Data on Demand, Training, and Impact

- 95+ Fascinating Gift Industry Statistics to Surprise and Delight

- Top Business Coaching Statistics & Trends Every Leader Should Know

- How Much Are People Saving? Key Personal Savings Statistics Explained

- 40+ Useful Procrastination Statistics To Help You

- 90 Amazing Millionaire Statistics & Facts You Dare Not Miss

- 50+ Latest Life Coaching Statistics And Huge Trends

- 30+ Useful Real Estate Photography Statistics and Trends You Need to Know

- Data-Driven Decision-Making Statistics: Trends, Benefits & Challenges

- 54 Incredible Goal-Setting Statistics To Help You

- 45+ Interesting Communication Skills Statistics & Huge Trends

- Body Language Statistics & Fun Facts To Boost Your Communication Skills

- 35 Interesting Public Speaking Fear Statistics & Fun Facts

- 25+ Most Interesting Emotional Intelligence Statistics & Fun Facts