Did you know that in the past year alone, over 50% of small businesses sought financing to fuel growth, manage cash flow, or recover from economic setbacks? Business loans provide the capital needed to turn ideas into thriving ventures.

From approval rates and loan amounts to the industries most reliant on financing, these latest business loan statistics offer valuable insights into the state of the lending market. Understanding these statistics is crucial to navigating the complex world of business financing.

Keep reading to explore the latest business loan statistics.

Key Business Loan Statistics (Editor’s Pick)

- In June, loan application growth increased by 1.5% year-over-year, a slower pace compared to the 3.4% year-over-year growth seen in May.

- Almost all banks offer loans up to $1 million to small businesses, while half of them provide loans up to $3 million.

- 15% of UK businesses have been recently rejected for a loan.

- Banks account for 64% of all lending to businesses, including business loans, bankers’ acceptances, non-residential mortgages, and other lending products.

- More than 9 out of 10 banks frequently compete with another bank for small business lending.

- 38% of SMEs sought external finance through loans in the past year, while 37% applied for a bank loan or overdraft facility during the same period.

- 1 in 5 SMEs lack the necessary data structure to secure a loan.

- The primary reason for low loan applications was the availability of sufficient internal funds, which firms felt were enough to support their business plans.

- APAC (Asia-Pacific) is expected to contribute 46% to the global P2P lending onn9 growth by 2028.

- Banks make up about two-thirds of the business lending market.

- Although over 13% of the U.S. population is Black, only 8% of 7(a) loans and 3.6% of 504 loans were granted to Black applicants.

- Around 90% of businesses plan to be cautious with borrowing.

General Business Loan Statistics

1. In June, loan application growth increased by 1.5% year-over-year, a slower pace compared to the 3.4% year-over-year growth seen in May. Similarly, loan approvals also slowed, with a 7.6% year-over-year growth, down from the 15.5% year-over-year growth reported in May. (source)

2. In September 2023, US alternative lenders had the highest SME loan approval rate (nearly 30%), followed by institutional lenders (27.5%). (source)

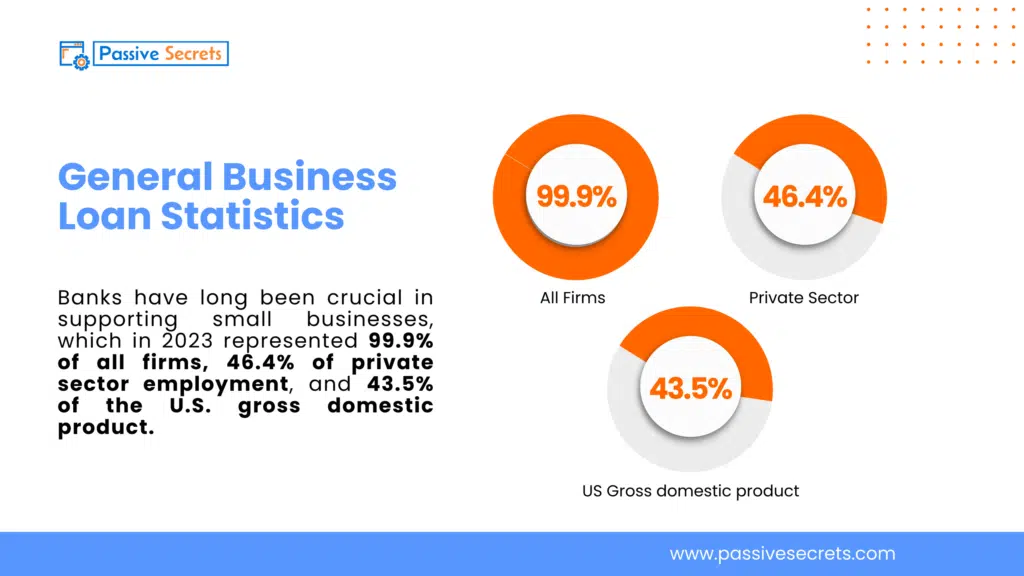

3. Banks have long been crucial in supporting small businesses, which in 2023 represented 99.9% of all firms, 46.4% of private sector employment, and 43.5% of the U.S. gross domestic product. (source)

4. Almost all banks offer loans up to $1 million to small businesses, while half of them provide loans up to $3 million. (source)

5. 3 in 10 banks, including over half of large banks, can approve a small and simple loan within one business day. (source)

6. 3 out of 4 banks can approve a small and simple loan within five business days. Also, 3 out of 4 banks approve their typical loan within 10 business days. (source)

7. A 2019 report on SME lending by the ABA found that over 80% of SME lending applications were approved by banks. (source)

8. About 45% of Australian businesses plan to spend more time comparing loans to find the best value, while 23% will focus more on deciding whether to apply for a loan. (source)

9. 12% of Australian businesses said they abandoned their loan applications after initial inquiries, while 10% plan to consider smaller loans. (source)

10. Asset finance increased for the third consecutive year, rising 26% in real terms in 2023 compared to 2014. (source)

11. In 2014, the five largest banks accounted for 63% of lending, but their share dropped to 41% by 2023. (source)

12. In 2023, the total stock of bank lending was £185 billion, marking a 12% decrease in real terms compared to 2022. (source)

13. Over the past decade, the lending landscape changed significantly, with 60 new banking licenses issued since 2014, 36 of which were aimed at serving small businesses. (source)

14. Small and medium-sized enterprises (SMEs) in the United Kingdom (UK) are businesses with fewer than 250 employees, a turnover of up to £25 million, and/or gross assets not exceeding £12.5 million. (source)

15. 15% of UK businesses have been recently rejected for a loan. (source)

16. 67% of MSMEs saw a decline in demand, mainly due to high costs (38%) and low purchasing power (36%), linked to inflation and slow growth. 12% cited alternatives, and 10% noted changing preferences. (source)

17. In the financial year 2024, 27.4 million MSME loans were sanctioned, totaling Rs 54.2 trillion, reflecting a 19.3% growth in volume and a 5.4% increase in value. (source)

18. Survey results show that borrowing costs remained elevated due to past monetary tightening, but to a lesser extent. Only 4% of firms reported higher interest rates, down from 31% last quarter, though many noted stricter loan conditions. (source)

19. Firms reported a slight decrease in the need for bank loans, with little change in loan availability. (source)

20. In 2024, a net 2% of companies reported reduced demand for bank loans, while a net 1% saw improved loan availability. Consequently, the financing gap for bank loans was negative for a net 2% of firms, a slight rise from the previous quarter. (source)

21. Companies noted a rise in banks’ willingness to lend, though not as significant as the previous quarter. Overall, 6% of firms observed an improvement in lending conditions, a decrease from 9% in the last survey. (source)

22. Banks account for 64% of all lending to businesses, including business loans, bankers’ acceptances, non-residential mortgages, and other lending products. (source)

Average Business Loan Interest Rates

23. Smaller businesses usually face higher borrowing costs than larger ones, though the gap has narrowed in recent years. (source)

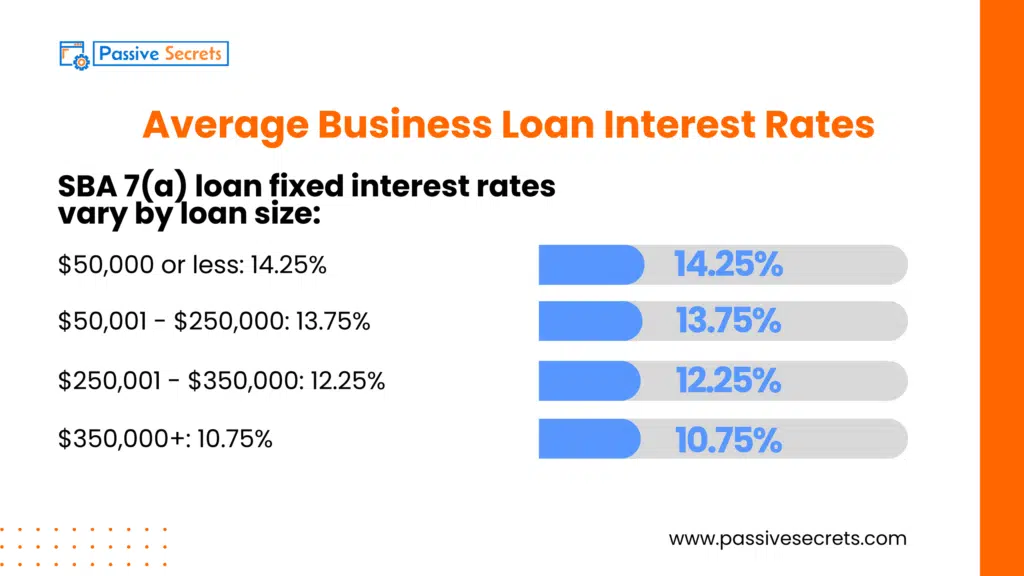

24. SBA 7(a) loan fixed interest rates vary by loan size:

25. The SBA 7(a) loan variable interest rates:

Industry-Specific Business Loan Statistics

26. 32% of Australian SMEs in the hospitality industry reported a demand for finance, while just 9% of SMEs in the retail trade sector indicated the same. (source)

27. In 2023, about 29% of UK SMEs reported growth over the past year, with those in the transport sector experiencing the highest growth rate at 32%. (source)

28. In June, working capital loans grew by 6.8% year-over-year, building on the 4% growth seen in May. This increase was driven by loan growth in the services, wholesale and retail, and construction sectors. (source)

Small Business Loan Statistics

29. Outstanding property loans to very small businesses were 2.6 billion euros in the third quarter of 2017 and rose to 3.4 billion euros by the third quarter of 2019. (source)

30. Between October 2023 and April 2024, a survey of UK SMEs found that 23% either obtained no external finance or secured between £25,000 and £100,000. Less than 0.5% of SMEs received financing over £10 million in 2023. (source)

31. About 1 in 5 small banks and one in three large banks sold a small business loan on the secondary market. (source)

32. More than 9 out of 10 banks frequently compete with another bank for small business lending. (source)

33. At the end of 2023, small banks held nearly 42% of small commercial and industrial, as well as commercial real estate loans to businesses, despite holding only 15% of industry assets. (source)

34. Vice President Kamala Harris announced that the Small Business Administration (SBA) provided a record $56 billion through over 100,000 small business financings in Fiscal Year (FY) 2024, the highest in more than 15 years. (source)

35. The SBA’s 2024 Capital Impact Report revealed that the agency increased its lending to small businesses to a record $56 billion in FY 2024, a 50% rise from FY 2020. Additionally, the SBA provided over 100,000 small business financings last year, the highest number in over 15 years. (source)

36. In FY 2024, the SBA certified over 17,000 small businesses, setting a record for a single year and marking a nearly 40% increase compared to FY 2023. (source)

37. In the three months leading up to August 2021, new lending to small businesses totaled $10 billion, a 26% increase from $7.9 billion during the same period in 2020. (source)

38. Small businesses have a lower survival rate compared to larger ones, with only 59% of micro-businesses and 72% of small businesses still operating after four years. (source)

39. In 2023, small businesses’ use of external finance grew from 41% to 50%, with increased reliance on credit cards (12% to 20%) and overdrafts (11% to 17%) due to cash flow pressures. (source)

40. Smaller businesses raised £6.5 billion in equity finance during the first three quarters of 2023, a 53% decrease compared to the same period in 2022. Despite this drop, the total is similar to 2020, which remains the fourth-highest year on record. (source)

41. In 2024, the UK had around 5.49 million SMEs. Most were micro-enterprises (over 5.23 million) with fewer than 10 employees, followed by about 219,900 small enterprises (10-49 employees) and 37,750 medium-sized businesses. (source)

42. Around 38% of SMEs sought external finance through loans in the past year, while 37% applied for a bank loan or overdraft facility during the same period. (source)

43. A total of 86% of SME businesses stated they did not seek external financing in the 12 months prior to the survey. Additionally, 9% of SMEs reported attempting to access external finance once during the past year. (source)

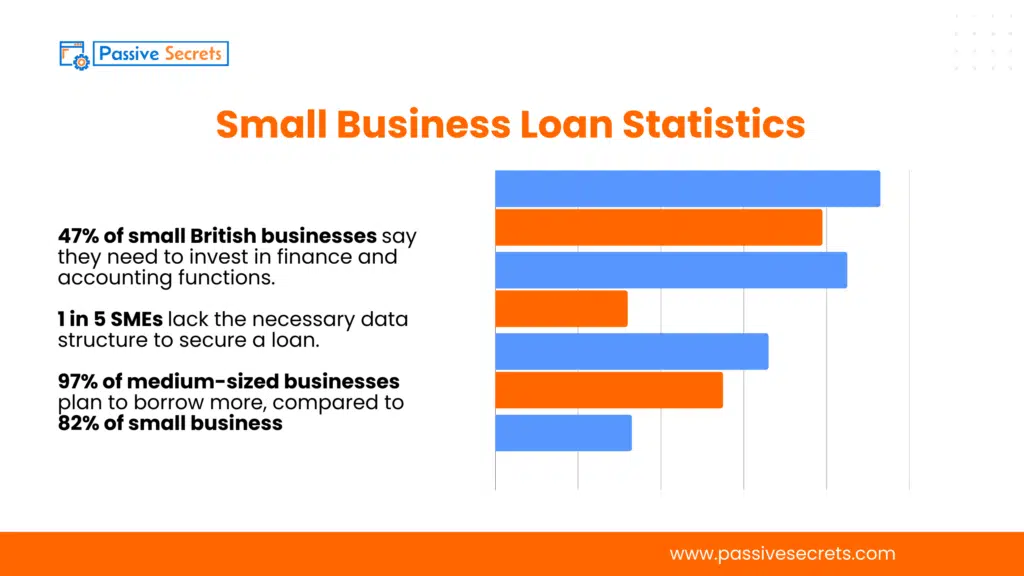

44. 97% of medium-sized businesses plan to borrow more, compared to 82% of small businesses. (source)

45. 47% of small British businesses say they need to invest in finance and accounting functions. (source)

46. 1 in 5 SMEs lack the necessary data structure to secure a loan. (source)

47. The global market for small business loans was valued at $2.46 trillion in 2023 and is projected to grow to $7.22 trillion by 2032, with a compound annual growth rate (CAGR) of 13.0% from 2024 to 2032. (source)

48. In 2023, North America had the largest small business loan market share in terms of revenue, representing nearly two-fifths of the global small business loan market. It is expected to maintain its dominance in revenue throughout the forecast period. (source)

49. In the 2023 fiscal year, over 63,000 loans were granted through the SBA’s 7(a) and 504 loan programs, with the total amount nearing $34 billion. Approximately one-third of those loans were allocated to businesses with female ownership.(source)

50. In the third quarter of 2024, 17% of firms sought bank loans. The primary reason for not applying was the availability of sufficient internal funds, which firms felt were enough to support their business plans. (source)

51. The proportion of firms facing difficulties in securing a bank loan saw a small increase. Among businesses that considered bank loans important, 6% reported encountering obstacles during the loan application process. (source)

52. In 2023, banks approved $1.78 trillion in funding for growing businesses, including $286 billion in credit for small- and medium-sized enterprises (SMEs). (source)

53. Approval rates are high, with 90.8% of SMEs applying for debt financing from financial institutions being approved. Since 2010, more than 87% of small business financing requests in Canada have been approved each year. (source)

54. Approval rates for rural Small and Medium-sized Enterprises are higher than those for urban SMEs. (source)

Regional Business Loan Statistics

55. In 2022, outstanding business loans from SMEs in Luxembourg totaled 8.76 billion euros, down from over 9.3 billion euros the previous year. (source)

56. In 2023, Lithuania had the highest SME loan rejection rate in the EU at 27%, followed by Romania at 19%. Rejection rates can vary with stricter bank policies. (source)

57. In 2022, the average interest rate on new business loans to SMEs in France was 1.87%, up from a low of 1.04% in 2020. Rates did not return to pre-pandemic levels until 2022. (source)

58. Luxembourg, Netherlands, and Malta had the lowest average business loan interest rates in the Eurozone as of July 2024, while Estonia and Latvia had the highest rates, with the euro area average being 5.06%. (source)

59. In Australia, the top three reasons for SME failure were “insufficient leadership and management” (25%), “inadequate marketing/sales” (17%), and “poor financial management” (14%). (source)

60. In a May 2024 survey, 54% of SMEs in Australia expected to be able to meet their loan repayments over the next six months, while 10% believed they would not be able to. (source)

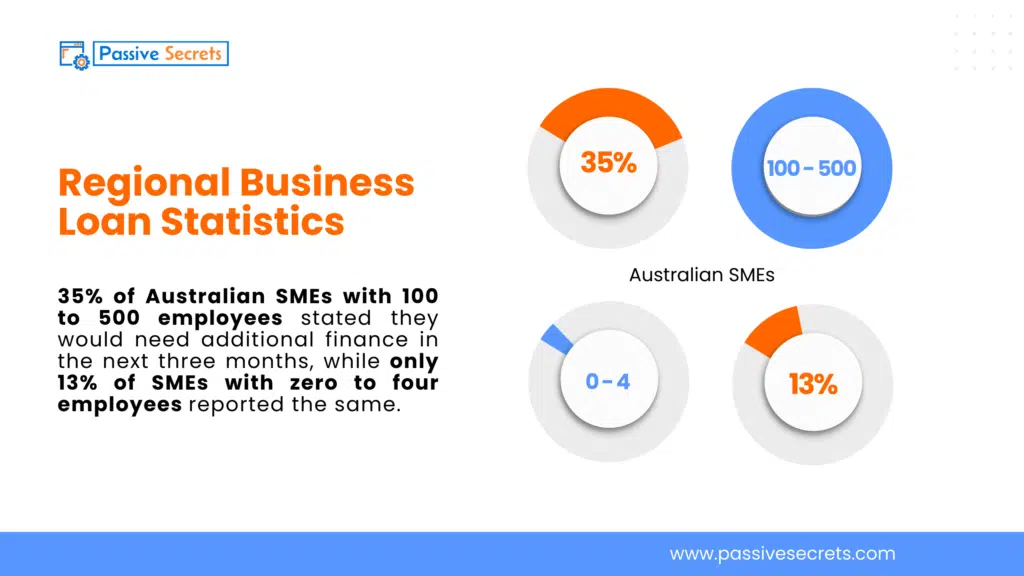

61. 35% of Australian SMEs with 100 to 500 employees stated they would need additional finance in the next three months, while only 13% of SMEs with zero to four employees reported the same. (source)

62. APAC (Asia-Pacific) is expected to contribute 46% to the global P2P lending market growth by 2028. (source)

63. In Nigeria, micro enterprises (MEs) made up 96.9% of the total number of businesses, while SMEs accounted for 3.1%. (source)

64. As of 2020, MSMEs contributed 46.3% to Nigeria’s national GDP, represented 6.21% of gross exports, and employed over 84% of the total workforce. (source)

65. Regarding ownership structure, 96.2% of Nigerian MSMEs are sole proprietorships, while 3.3% are partnerships, faith-based organizations make up 0.1%, and other types account for 0.4%. (source)

66. 35% of Nigerian businesses cited limited access to finance as their top challenge. The government has addressed this with the ₦500 billion debenture stock and the ₦70 billion MSME Development Fund. (source)

67. The alternative lending market in the region is projected to grow significantly, increasing from $4.3 billion in 2023 to $12.3 billion by 2028, with a compound annual growth rate (CAGR) of 21.4%. (source)

68. Alternative lending in the African & Middle East region is projected to grow by 31.3% annually, reaching US$5.7 billion in 2024. (source)

69. In response to protests, the Nigerian President, Bola Tinubu announced that 75,000 Nigerians will receive N1 million each in low-interest business loans starting August 2024. (source)

70. The Asian Pacific alternative lending market is expected to reach $333.1 billion in 2024, growing at an annual rate of 11.3%, and a compound annual growth rate (CAGR) of 8.2% from 2024 to 2028. (source)

71. The alternative lending market in the Asian Pacific Region is projected to grow from US$299.4 billion in 2023 to US$455.8 billion by 2028. (source)

72. Despite the majority of businesses in the region falling into this category, data from the Asian Development Bank shows that financing for SMEs makes up only 22% of all bank loans in developing economies across the Asia-Pacific. (source)

73. In India, despite significant progress in financial inclusion by the government, fewer than 11% of the country’s SMEs have access to formal credit. (source)

74. Malaysian banks are projected to achieve over 6% year-on-year (YoY) loan growth for the entire year of 2024, driven by business loans. (source)

75. According to UOB Kay Hian, based on data from Bank Negara Malaysia (BNM), business loans grew at a faster rate of 6.4% YoY in June. (source)

76. India’s MSME loan portfolio grew by 17.8%, reaching Rs 64.1 trillion by March 2024, compared to the previous year, as per the fourth edition of CRIF High Mark’s How India Lends report. (source)

77. A recent detailed report on How India Lends highlighted a 28.9% increase in loans to self-employed individuals, totaling Rs 35.7 trillion, while loans to MSME entities grew by 6.6%, reaching Rs 28.4 trillion. (source)

78. In fiscal year, 2024, the microfinance loan portfolio grew by 26.8%, reaching Rs 4.4 trillion. The origination volume rose by 6%, with 83.5 million loans sanctioned, totaling Rs 3.8 trillion, reflecting a 19% growth. (source)

79. In the financial year 2023, 47% of business loans provided by fintech companies in India ranged from 10,000 to 50,000 rupees, while 22% exceeded 500,000 rupees. (source)

80. By the end of the second quarter of 2024, consumer spending in India totaled 24.57 trillion rupees, reaching a record high in the fourth quarter of 2023. (source)

81. Digital lending in India, one of the fastest-growing fintech sectors, surged from $9 billion in 2012 to nearly $150 billion in 2020. The market was projected to reach $350 billion by 2023, primarily driven by fintech startups and non-banking financial companies (NBFCs). (source)

82. Outstanding loans to non-financial corporations in the euro area have remained stable since early 2023. In January 2020, adjusted loans were around 4.58 billion euros. Meanwhile, business loan interest rates in the Eurozone rose sharply in 2022 and 2023. (source)

83. Banks make up about two-thirds of the business lending market and roughly a quarter of the total business financing market in Canada. (source)

84. From 2018 to 2022, business loan values in Canada mostly increased, except for a decline in loans to large businesses in the second half of 2020. Large businesses, with loans over 5 billion Canadian dollars, represented the majority, totaling about 839 billion Canadian dollars in late 2020. (source)

Demographic Business Loan Statistics

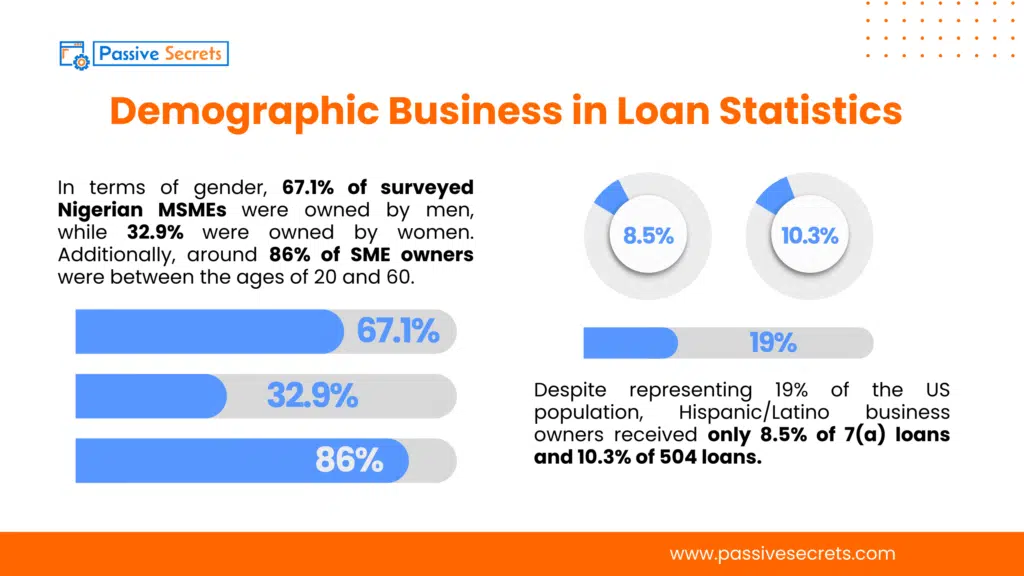

85. In terms of gender, 67.1% of surveyed Nigerian MSMEs were owned by men, while 32.9% were owned by women. Additionally, around 86% of SME owners were between the ages of 20 and 60. (source)

86. Although over 13% of the U.S. population is Black, only 8% of 7(a) loans and 3.6% of 504 loans were granted to Black applicants. (source)

87. Despite representing 19% of the U.S. population, Hispanic/Latino business owners received only 8.5% of 7(a) loans and 10.3% of 504 loans. (source)

Future Outlook For Business Lending

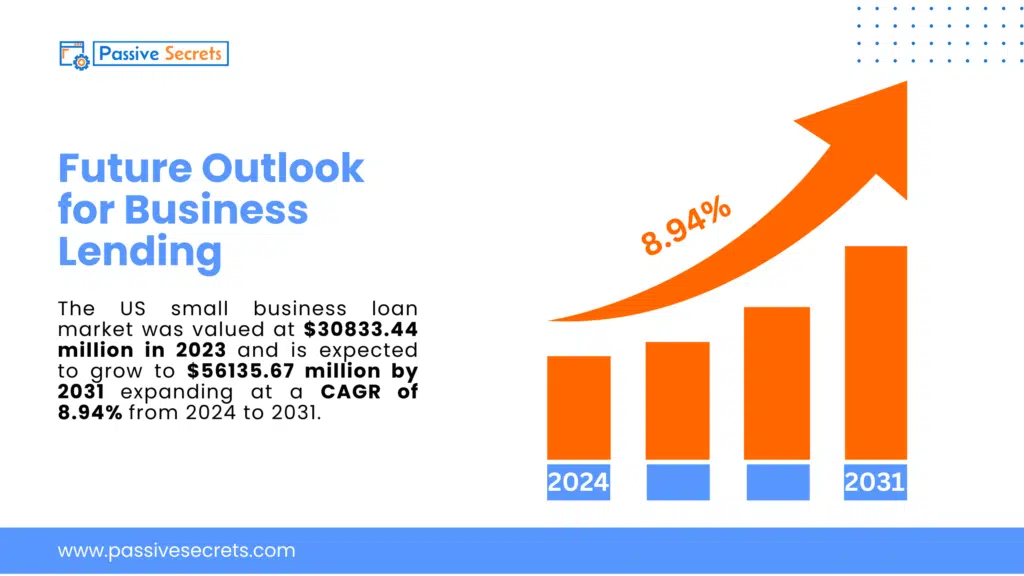

88. The U.S. small business loan market was valued at USD 30,833.44 million in 2023 and is expected to grow to USD 56,135.67 million by 2031, expanding at a CAGR of 8.94% from 2024 to 2031. (source)

89. Around 90% of businesses plan to be cautious with borrowing, while 69% will delay investments such as equipment purchases and hiring. Only 31% plan to continue investing in their business. (source)

FAQs

.

Other Related Statistics You Should Know:

- 101 Billionaire Statistics: Surprising Insights About The World’s Wealthiest

- 70+ AI in Education Statistics That Prove the Future Is Already Here

- Women in Leadership Statistics: Insights into Global Gender Representation

- Soft Skills Statistics: Key Data on Demand, Training, and Impact

- 95+ Fascinating Gift Industry Statistics to Surprise and Delight

- Top Business Coaching Statistics & Trends Every Leader Should Know

- How Much Are People Saving? Key Personal Savings Statistics Explained

- 40+ Useful Procrastination Statistics To Help You

- 90 Amazing Millionaire Statistics & Facts You Dare Not Miss

- 50+ Latest Life Coaching Statistics And Huge Trends

- 30+ Useful Real Estate Photography Statistics and Trends You Need to Know

- Data-Driven Decision-Making Statistics: Trends, Benefits & Challenges

- 54 Incredible Goal-Setting Statistics To Help You

- 45+ Interesting Communication Skills Statistics & Huge Trends

- Body Language Statistics & Fun Facts To Boost Your Communication Skills

- 35 Interesting Public Speaking Fear Statistics & Fun Facts

- 25+ Most Interesting Emotional Intelligence Statistics & Fun Facts