It’s no secret that attracting and retaining top talent constantly challenges organizations across industries.

A recent study found that 75% of employers report difficulty finding skilled candidates to fill job openings.

This highlights the importance of having a robust talent acquisition strategy that attracts the best talent and effectively screens and selects the right candidates for the job.

But talent management doesn’t stop at hiring. Once an employee is on board, keeping them engaged and motivated is important. Unfortunately, employee engagement levels are often alarmingly low.

So, let’s explore the world of talent management statistics more deeply and uncover the insights that can help organizations thrive in today’s competitive business environment.

Top Talent Management Statistics (Editor’s Picks)

- The global talent management market was valued at USD 1922.96 million in 2022 and is projected to reach USD 2178.26 million by 2028.

- The North American Talent Management Software Market is expected to grow at a CAGR of 10.6% from 2023 to 2030.

- The global market size for talent management software is forecasted to grow from $10.09 billion in 2024 to $25.36 billion by 2032.

- Only 50% of employees clearly understand their work expectations.

- Nearly 40% of organizations focus more on developing internal talent to meet their needs.

- 76% of advertisers, agencies, publishers, platforms, and ad tech companies said inadequate training and development was a key reason for talent scarcity.

- Due to the growing demand for HR and talent management solutions, 60% of global enterprises will invest in cloud-based HCM suites.

- Nearly 85% of businesses use HR and talent management software, and 70% of leaders plan to increase investment in this technology.

- About 54% of companies have implemented a Talent Management Programme (TMP), while 46% of employers do not have one.

Talent Management Market Size

1. The global talent management market was valued at USD 1922.96 million in 2022 and is projected to reach USD 2178.26 million by 2028, growing at a rate of 2.1% annually. (source)

2. In 2022, the BFSI sector held the largest market share in talent management applications. (source)

3. The HR technology market in India reached US$ 1,040 million in 2023 and is projected to reach US$ 2,170 million by 2032, growing at a CAGR of 8.3% from 2024 to 2032. (source)

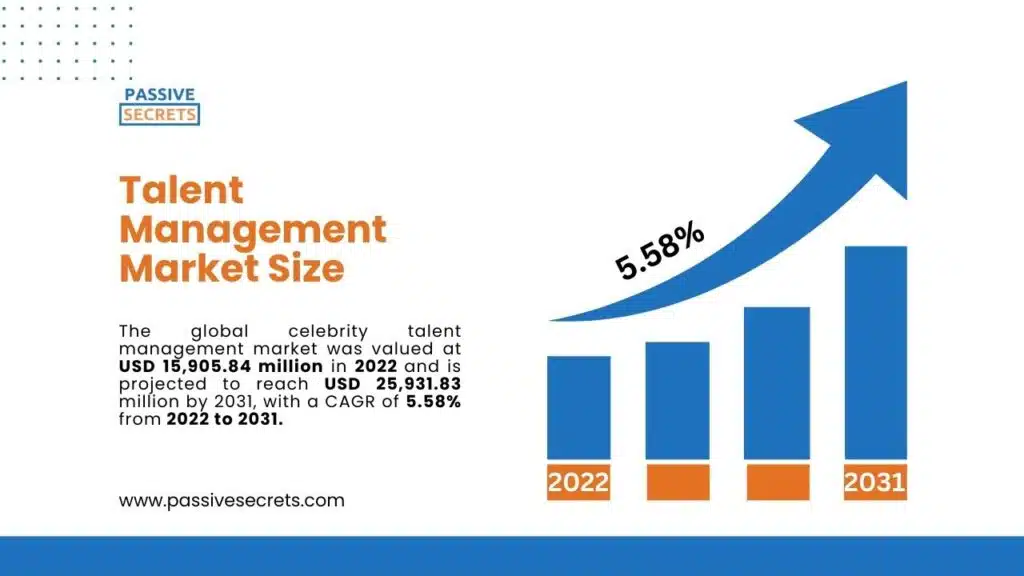

4. The global celebrity talent management market was valued at USD 15,905.84 million in 2022 and is projected to reach USD 25,931.83 million by 2031, with a CAGR of 5.58% from 2022 to 2031. (source)

5. The North American Talent Management Software Market is expected to grow at a CAGR of 10.6% from 2023 to 2030. (source)

Talent Management Software Statistics

6. The global market size for talent management software was USD 9.24 billion in 2022 and is forecasted to reach approximately USD 31.17 billion by 2032. Growing at a CAGR of 12.93% from 2023 to 2032. (source)

7. North America dominated the revenue share of the Talent Management market in 2022. North America is a key market for talent management software, driven by the presence of large firms and strong adoption of new technologies. (source)

8. The United States and Canada primarily contribute to North America’s talent management software market growth. (source)

9. By 2032, the banking, financial, and insurance sectors are expected to surpass the IT and telecom industries in the Talent Management Software market share, which was dominant in 2022. (source)

10. The global market size for talent management software is forecasted to grow from $10.09 billion in 2024 to $25.36 billion by 2032, with a compound annual growth rate (CAGR) of 12.2% during 2024-2032. (source)

11. The increasing adoption of cloud-based platforms and mobile-based personnel management systems is a key driver of growth in the talent management software market. (source)

12. About 75% of HR and talent management software buyers read user reviews before purchasing. (source)

13. Buyers prioritize user experience, training, support services, data privacy, and reporting in HR and talent management software. (source)

14. Among 26 industries surveyed, property management (58%), entertainment/media (57%), distribution/inventory management (56%), and investment services (56%) invested most in HR and talent management software. (source)

15. Most respondents bought HR and talent management software to attract new customers (62%) and strengthen existing customer relationships (61%). 60% aimed to ensure employee and consumer safety. (source)

16. More than half (52%) of respondents cited productivity improvement as the main reason for purchasing new software. Other top reasons are managing competitive pressure (42%) and outgrowing current technology (41%). (source)

17. HR and talent management software buyers prefer content that helps them learn to use the software and understand its benefits. (source)

18. Over 35% of buyers replace their HR and talent management software due to poor integration with other systems. Additionally, 31% switch because of bugs and unreliability or finding a better alternative. (source)

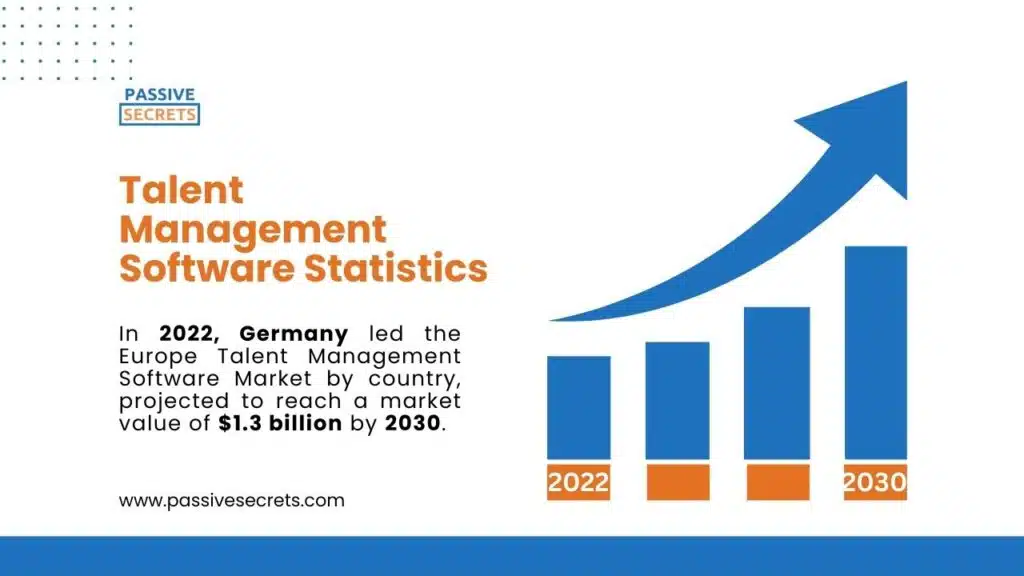

19. The Europe Talent Management Software Market is expected to grow at an 11% CAGR from 2023 to 2030. (source)

20. In 2022, Germany led the Europe Talent Management Software Market by country, projected to reach a market value of $1.3 billion by 2030. (source)

Talent Acquisition

21. The talent acquisition segment held the largest share in the talent management software market in 2023 and is expected to continue growing due to the demand for efficient onboarding, recruiting, and sourcing processes. (source)

22. In 2019, 85% of companies had adopted talent management applications for recruitment. Also, 88% of organizations implemented workforce management applications for time and attendance. (source)

23. In 2019, 92% of medium-sized organizations had already implemented talent management applications for recruitment. (source)

24. A survey on global talent management found that 44% of respondents used assessments during recruitment for professional positions. (source)

25. 63% of HR professionals in the Americas used pre-hire assessments as part of the hiring process. (source)

26. Organizations increasingly offer better pay and benefits to address recruitment difficulties (36%, up from 29% last year). (source)

27. Pay and benefits have emerged as one of the top factors in employer branding to attract candidates. However, nearly 60% of organizations do not consider them among their primary attractors. (source)

28. Flexible working options are advertised for at least some jobs by 69% of organizations. It’s increasingly viewed as an effective method for attracting candidates, with 54% of those facing recruitment challenges opting to offer greater work flexibility. (source)

29. 66% of organizations have implemented hybrid/remote working policies, and 47% advertise jobs as ‘open to location.’ Such flexibility has helped 68% of these organizations attract and retain talent while also boosting productivity by 45% and engagement by 35%. (source)

30. Formal diversity policies are in place at 61% of organizations, although efforts to attract diverse candidates could be more proactive and comprehensive. One-third of organizations have achieved a more diverse workforce than the previous year. (source)

Employee Engagement

31. Around 70% of individuals derive their sense of purpose from their work, underscoring the importance of aligning daily tasks with meaningful outcomes. (source)

32. Only 15% of frontline managers and employees report feeling connected to their purpose while on the job. (source)

33. Australia prioritizes employee wellbeing, with 62% willing to decline a promotion for their wellbeing, compared to 48% globally and 43% in APAC, reflecting a strong work-life balance culture. (source)

34. Only 50% of employees clearly understand their work expectations. (source)

35. About half of workers feel exhausted (51%), drained (45%), or burned out (44%) due to their job, with stress, overwhelm, and anxiety being common experiences, emphasizing the need for organizations to prioritize mental health support. (source)

Talent Development and Upskilling

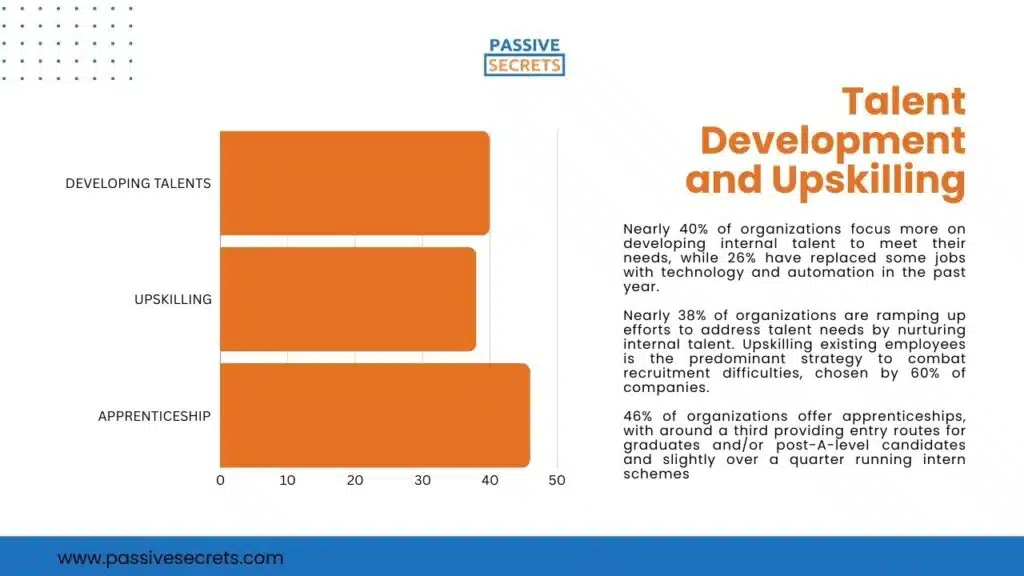

36. Nearly 40% of organizations focus more on developing internal talent to meet their needs, while 26% have replaced some jobs with technology and automation in the past year. (source)

37. Nearly 38% of organizations are ramping up efforts to address talent needs by nurturing internal talent. Upskilling existing employees is the predominant strategy to combat recruitment difficulties, chosen by 60% of companies. (source)

38. 46% of organizations offer apprenticeships, with around a third providing entry routes for graduates and/or post-A-level candidates and slightly over a quarter running intern schemes. (source)

Talent Management Challenges

39. 40% of organizations reported functional gaps in their HR processes related to talent management. (source)

40. In a survey, 76% of advertisers, agencies, publishers, platforms, and ad tech companies said inadequate training and development was a key reason for talent scarcity, and the same percentage cited insufficient prioritization of talent management. (source)

41. Between 2021 and 2022, the proportion of organizations with defined talent strategies decreased from 55% to 38%. (source)

42. In 2023, the biggest challenge for Global Business Services organizations worldwide was career progression and opportunities, with nearly half of respondents highlighting this issue. (source)

43. In a global survey, 48% of advertisers, agencies, publishers, platforms, and ad tech companies believed the industry was facing its worst-ever talent crisis, while 21% disagreed. (source)

44. 67% of respondents in a survey said talent scarcity was a major barrier to growth. (source)

45. 60% of APAC’s advertisers, publishers, platforms, and ad tech companies believed the advertising media industry faced its worst talent crisis. This figure was just over 50% in the U.S. and 44% in Europe, Middle East and Africa. (source)

46. In the same survey, around 75% of respondents acknowledged some talent scarcity, with 85% of ad agencies reporting this issue. (source)

47. The purchasing cycle for HR and talent management software is lengthy, with 65% of respondents taking three to nine months to finalize a purchase and only 18% taking less than three months. (source)

48. One-third (33%) of people managers feel their role isn’t worth the stress and 40% experienced a decline in mental health after taking on a leadership position. (source)

49. Only 13% of HR leaders consider their talent management practices excellent, while 70% rate their organization’s ability to meet talent needs as mediocre. (source)

50. Talent management has been a key priority for only 38% of organizations over the past year, an increase from 30% in 2021, albeit lower than in previous years. (source)

Talent Management Challenge Statistics By Country

51. Overall, 81% of organizations attempted to fill vacancies, and 77% encountered challenges attracting candidates, up from 49% in 2021. (source)

52. Recruiting for senior and skilled roles posed the greatest difficulty at 58%, while 26% struggled with hiring low-skilled candidates. (source)

53. 60% reported it is now harder to retain talent than the previous year, prompting 37% to initiate retention improvement efforts, up from 29% in 2021. (source)

54. 80% of UK employers face challenges finding talent with the necessary skills, marking a 17-year high. (source)

55. Globally, 4 out of 5 employers find it difficult to secure needed talent in 2023, up 2 percentage points from the previous year. And substantially higher than the 2015 figure of 14%. (source)

56. Demographic shifts have worsened talent scarcity, including declining birth rates and increased early retirements. (source)

57. UK employers report talent shortages three percentage points higher than the global average of 77%. (source)

58. 70% of respondents acknowledge heightened competition for skilled talent over the past year, with 60% indicating increased difficulty in talent retention compared to a year ago. (source)

Australia

59. An Australian study of 500 employers and 1,000 workers shows that 89% of employers and 71% of employees doubt their company’s ability to recruit skilled personnel this year. (source)

60. The primary issue hindering employers from attracting top talent is non competitive salaries, identified by 30% of workers. (source)

61. Limited career advancement opportunities are a significant concern, with 30% of employers and 26% of workers worrying about this. (source)

62. Financial and accounting professionals are the most anxious about retention policies (74%), followed by business support (73%) and technology sector employees (67%). (source)

63. One in four executives (24%) believes meeting this year’s business demand will be challenging with the current talent model. (source)

64. Despite 58% seeing AI as delivering over 30% productivity gains, two-thirds are wary of implementing new technology without transforming work processes. (source)

65. Less than 30% of HR leaders in Australia view AI as a tool to enhance human intelligence, missing opportunities beyond automation. Only 16% of employees report job redesigns benefiting from new technologies. (source)

66. In Australia, 62% of businesses struggle to find talent, exceeding the global average of 50%. Additionally, 46% have difficulty retaining employees, higher than the global average of 40%. (source)

The Future of Talent Management

67. The market size for human capital management solutions is expected to increase by USD 13.92 billion, with a CAGR of 9.52% from 2023 to 2028. (source)

68. A new report by KBV Research projects the Global Talent Management Software Market will reach $19.4 billion by 2030, with a CAGR of 11.4% during the forecast period. (source)

69. The Performance Management segment is projected to grow at a CAGR of 12% from 2023 to 2030. (source)

70. The On-premise segment led the Global Talent Management Software Market by Deployment in 2022, expected to reach a market value of $10.0 billion by 2030. (source)

71. Gartner predicts that by 2025, 60% of global enterprises will invest in cloud-based HCM suites due to growing demand for HR and talent management solutions. (source)

72. Around 40% of companies expect to boost their recruitment and talent management budgets in the coming year. A significant rise compared to previous years reflects growing challenges and resourcing expenses. (source)

73. Artificial intelligence (AI) is beginning to transform workplaces globally, with 30% of workers worldwide and 41% in the Asia Pacific region utilizing AI in daily tasks. (source)

Talent Analytics and Metrics

74. 69% of organizations considered cost and user experience as the top factors when selecting a talent management application. (source)

75. In 2019, the global market for assessment services was valued at over $6.5 billion. (source)

76. Nearly 85% of businesses use HR and talent management software, and 70% of leaders plan to increase investment in this technology. (source)

77. In 2019, 45% of organizations reported that Paycor consistently met their needs as a primary talent management vendor. Also, 30% of organizations indicated that Paycor met their needs as a primary workforce management vendor. (source)

78. 24% of organizations stated that Ultimate UltiPro met their needs as a primary HR management system vendor. 46% of enterprises reported that UltiPro also met their payroll needs. (source)

79. In 2019, 58% of organizations reported using employee referral management tools, while 88% had adopted time and attendance workforce management applications. (source)

80. Almost 40% of respondents prefer buying from well-known HR and talent management software providers. (source)

81. Around 85% of surveyed business leaders use HR and talent management software, with the highest adoption rates in Spain, Norway, Finland, France, Italy, Colombia, and Brazil. (source)

82. About 54% of companies have implemented a Talent Management Programme (TMP). 46% of employers do not have a TMP. (source)

83. Regarding long-term planning related to their staff as key business, Among those with a TMP, 34% are focusing on development opportunities for their staff more than a year ahead, and an additional 25% are planning over two years in advance. (source)

84. Apart from formal TMPs, 94% of companies provide training to their staff, with only 6% not offering any training. Of those without training outside a TMP, 3% have a formal strategy elsewhere. (source)

85. The primary reason for having a TMP, cited by 83% of companies with one, is to retain existing staff, believing it crucial to prevent losing top talent. (source)

86. Companies with a TMP are 18% less likely to lose junior managers. (source)

87. Beyond retention, 79% of organizations with a TMP emphasize developing their people as a core organizational value. Their strategies include offering career progression opportunities, structured support for career growth, and linking performance to clear objectives and culture. (source)

88. The third most common reason (72%) for implementing a TMP is to foster business growth by developing new leaders. (source)

89. The private and non-profit sectors are most likely to anticipate increases in recruitment and talent management budgets compared to the public sector. (source)

90. Only 63% of organizations gather data for staffing decisions, but only a minority use a thorough approach. Specifically, 21% collect data for predicting hiring needs, 16% for evaluating talent availability, and 28% for pinpointing retention problems internally. (source)

91. In 2022, around 30% of respondents reported complete alignment between their talent and business strategies, up nearly 10% from 2021. (source)

92. According to a survey, companies that found their talent management highly effective were significantly more likely to outperform competitors compared to others. (source)

93. German managers excel in accountability and accessibility, with 71% of employees feeling their manager is aware of their projects and 60% receiving prompt responses. However, only 32% of employees feel their manager helps set performance goals, and 38% receive support in setting work priorities. (source)

Conclusion

As the talent management statistics show, attracting, developing, and retaining top talent is challenging.

With the workforce rapidly evolving, skills gaps widening, and competition for the best employees fiercer than ever, effective talent management is critical for companies that want to succeed.

Other Related Statistic Articles You Should Know:

- 80+ Employee Benefit Statistics: Insights and Trends

- The Most Important Wealth Management Statistics You Can’t Afford to Ignore

- Enterprise Data Management: Essential Statistics and Emerging Trends

- Top Reputation Management Statistics and Trends to Improve Your Brand

- 36 Helpful Social Worker Burnout Statistics To Know

- 100 Business Process Outsourcing Statistics & Facts

- Top HR Outsourcing Statistics and Trends Every Business Must Know

- The Top Outsourcing Statistics You Shouldn’t Ignore

- 47+ Shocking 4-day Work Week Statistics To Know

- 105+ Supply Chain Statistics & Facts You Can’t Ignore

- 50+ Interesting Employer Branding Statistics And Trends

- Job Seekers Statistics: Unemployment Rates, Preferences, Challenges

- 95 Interesting Job Interview Statistics and Huge Trends To Know

- 60+ Helpful Change Management Statistics & Facts

- 65+ Employee Performance Management Statistics & Trends

- Workforce Management Statistics: Trends, Insights, & Opportunities

- 73 Revealing Workplace Distraction Statistics

- Workplace Romance Statistics: How Common Is Workplace Romance?

- 40+ Top Workplace Conflict Statistics You Should Know

- The State of Workplace Communication: Key Statistics and Trends

- 55 Workplace Collaboration & Teamwork Statistics