Outsourcing has changed how businesses operate, allowing companies to streamline processes, reduce costs, and boost efficiency. But just how prevalent is outsourcing in today’s economy?

Businesses outsource tasks to cut costs and improve productivity. Organizations across various industries, from tech giants to small startups, leverage external expertise to stay competitive.

This article will explore the fascinating world of outsourcing statistics, exploring the latest trends, numbers, and insights that will surprise you.

As a business owner, entrepreneur, or simply curious about the future of work, you will discover the interesting impact of outsourcing on the global business world.

Top Outsourcing Statistics & Facts (Editor’s Pick)

- 74% of companies say they use external support for their internal audit due to skill gaps.

- 92% of large companies (G2000) outsource their IT services.

- 93% of companies that outsourced reported being satisfied with the outcome.

- The U.S. IT Outsourcing market will reach $197.30 billion in 2024.

- The payroll outsourcing services market is expected to grow by $5.99 billion, at a 4.79% annual rate, from 2023 to 2028.

- The global legal process outsourcing market was worth $19.9 billion in 2023 and is projected to grow to $147.8 billion by 2032.

- Small businesses sought new outsourced providers in marketing (27%), followed by IT services (22%), and design (21%).

- China is the global leading country for manufacturing outsourcing and IT outsourcing.

- 50+% of EU companies outsourced some cybersecurity tasks.

- Organizations increased outsourcing of OT cybersecurity training by 5% and vulnerability management by 3%.

- 56% of C-suite leaders cite a lack of financial resources as the reason they don’t outsource.

General Outsourcing Statistics

1. About 72% of the C-suite leaders say they have outsourced in the past. And almost 50% of them outsourced finance, accounting, and IT tasks. (source)

2. Over 40% of companies not currently outsourcing plan to consider it in the next year. (source)

3. 61% of companies opt for outsourcing financial tasks and other business processes. (source)

4. In 2024, 46% of UK companies outsourced marketing, with 50% of B2B and 41% of B2C companies relying on external partners. (source)

5. In 2024, 84% of companies in Poland outsourced data security to external providers, up from the previous year. (source)

6. Between 2021 and 2024, most US facility managers in cleaning/janitorial services rejected outsourcing, while a smaller group considered it but ultimately decided to keep services in-house. (source)

7. 74% of companies say they use external support for their internal audit due to skill gaps. (source)

8. 80% of HR services will be delivered through a hybrid model, combining in-house and outsourced solutions. (source)

9. 83% of small businesses planned to keep or increase outsourcing spending in 2023. (source)

10. 92% of large companies (G2000) outsource their IT services. (source)

11. Nearly half (48%) of UK companies outsourced work in 2023, a significant increase from 41% since the COVID-19 pandemic. (source)

12. 28% of marketers in UK companies outsource digital marketing tasks, with 10% specifically outsourcing social media marketing. (source)

Outsourcing Benefits Statistics

13. A 2024 UK survey of 3,000+ marketers found that 50% outsourced marketing due to skill gaps, while 14% did so to cut costs. (source)

14. 93% of companies that outsourced reported being satisfied with the outcome. (source)

15. 71% of organizations prefer outsourcing accounting because it allows for greater flexibility and adaptability. (source)

16. 78% of CFOs report that outsourcing has freed up their teams to focus on strategic, value-added activities. (source)

Outsourcing Market Statistics

17. The U.S. Outsourced Sales Services Market is expected to experience significant growth, expanding from $1.2 billion in 2024 to $1.97 billion by 2031. This represents a compound annual growth rate (CAGR) of 6.95% over the forecast period of 2024-2031. (source)

18. The global business process outsourcing market was valued at $280.64 billion in 2023 and is expected to grow at a 9.6% CAGR from 2024 to 2030. (source)

The customer services segment dominated the market, while IT and telecommunication had the largest revenue share. Onshore outsourcing held the largest revenue share and is expected to grow the fastest.

North America accounted for over 36% of the revenue share and is expected to retain its dominance, driven by demand from tech giants. The Asia Pacific region, led by China’s 11.8% CAGR, and the UK, growing at 10% CAGR, are also significant markets.

19. The global IT Outsourcing market is projected to reach $541.10 billion in 2024, growing at an annual rate of 8.48% to hit $812.70 billion by 2029, with the average spend per employee reaching $152.00 in 2024. (source)

20. However, the U.S. IT Outsourcing market will reach $197.30 billion in 2024, growing at 8.03% CAGR to $290.30 billion by 2029, with the average spend per employee at $1,140. (source)

21. The global Procurement Outsourcing industry was worth $2.90 billion in 2022. The revenue is expected to grow to $10.52 billion by 2032 with a CAGR of 13.8% from 2023 to 2032. (source)

22. Canada’s IT Outsourcing market revenue is expected to rise by $6 billion (51.02%) from 2024 to 2029, reaching a record $17.71 billion in 2029, extending a nine-year growth streak. (source)

23. The data entry outsourcing services market is expected to grow by $202.3 billion, at a rate of 6.18% per year, from 2023 to 2028. (source)

24. The Data Analytics Outsourcing Market is projected to surge from $8.11 billion in 2024 to $60.02 billion by 2029, growing at an impressive 34.33% annual rate. (source)

25. The global document outsourcing market is expected to grow by $17.8 billion, at a 5.46% annual rate, from 2023 to 2028, as organizations aim to reduce costs, streamline operations, and improve customer communication by outsourcing document management services. (source)

26. Europe is estimated to contribute 37% to the growth of the global document outsourcing market from 2023 to 2028. (source)

27. The global data center outsourcing market was worth $173.22 billion in 2023 and is expected to grow at a 5.10% annual rate, reaching $271.04 billion by 2032. The market is driven by factors such as shrinking IT budgets, limited IT expertise, and increasing operational costs in enterprises. (source)

28. The global Public Sector Outsourcing Market is expected to grow from $280.64 billion in 2023 to $522.7 billion by 2030, at a 9.4% annual growth rate, from 2024 to 2030. This market involves government agencies and public institutions contracting private sector providers to perform specific functions and services across various industries like healthcare, education, and transportation. (source)

The public sector outsourcing market grows due to two main drivers: cost reduction (up to 20% savings) and demand for better service delivery, as governments seek efficiency and citizens expect high-quality services.

29. The CRM outsourcing market is expected to grow by $27.7 billion, at a 5.82% annual rate, from 2023 to 2028. This rise is due to the need for large-scale client management, the importance of data-driven insights, and the benefits of flexibility and cost savings, making it an attractive option for businesses to enhance customer engagement. (source)

30. The Desktop Outsourcing Market was worth $61.76 billion in 2023 and is expected to reach $67.36 billion in 2024, growing at a 10.25% annual rate to $122.28 billion by 2030. The need for external services such as desktop infrastructure support, software management, and technical support drives the market. (source)

31. The payroll outsourcing services market is expected to grow by $5.99 billion, at a 4.79% annual rate, from 2023 to 2028. During this period, North America is projected to contribute 55% to the growth of the global market. (source)

32. The Service Desk Outsourcing Market is expected to grow from $88.55 billion in 2023 to $130.66 billion by 2030, at a 5.09% annual growth rate from 2024 to 2030. (source)

33. The medical billing outsourcing market was valued at $13.24 billion in 2023 and is forecasted to grow at a CAGR of 12.5%, reaching $39.67 billion by 2033. (source)

34. The Game Outsourcing Services Market is growing from $1.17 billion in 2023 to $1.26 billion in 2024 and is expected to reach $1.91 billion by 2030, at a 7.30% annual growth rate. The market is driven by the demand for external vendors to provide specialized game development services like art creation, animation, programming, and quality assurance. (source)

35. The global legal process outsourcing market was worth $19.9 billion in 2023 and is projected to grow to $147.8 billion by 2032, at a remarkable 24.18% annual growth rate from 2024 to 2032. (source)

36. The global Contact and Call Centre Outsourcing market is valued at $105.18 billion in 2024 and is expected to grow at an 8% annual rate from 2024 to 2031. (source)

37. The US engineering services outsourcing market is expected to grow by $187.62 billion, at a remarkable 32.14% annual growth rate, from 2023 to 2028. (source)

38. The human resource outsourcing (HRO) market is expected to grow by $13.3 billion, at a 5.28% annual growth rate, from 2023 to 2028, with North America driving 42% of the global market’s growth during this period. (source)

39. The recruitment process outsourcing market is expected to grow by $11.41 billion, at an impressive 18.68% annual growth rate, from 2023 to 2028. (source)

40. The knowledge process outsourcing market is expected to grow by $141.26 billion, at a rapid 19.51% annual growth rate, from 2023 to 2028. This is primarily driven by digital transformation in industries like banking and financial services, which are leading the expansion. (source)

41. The US Business Process Outsourcing Services market has grown at a 1.7% annual rate over the past five years, reaching $73.0 billion in revenue in 2024. (source)

42. The Global Telecom Outsourcing Market is projected to grow from $22.01 billion in 2024 to $28.99 billion by 2030, at a 4.7% annual growth rate from 2024 to 2030. (source)

43. The global marketing technology outsourcing market will grow from $44.04 billion in 2024 to $86.20 billion by 2030, at a 10.2% annual growth rate. (source)

The digital marketing and IT & Telecom segments led with 32% and 20% shares, respectively. North America accounted for 38% of the market. From 2024 to 2030, the US market will grow at an 8.1% CAGR, while Europe’s will be at a 9.7% CAGR.

44. The Offshore Software Development Market is expected to grow from $122 Billion in 2024 to $283 Billion by 2031, at a 10.13% annual growth rate. (source)

45. The Laboratory Outsourcing Market is expected to grow from $38.54 Billion in 2023 to $69.24 Billion by 2030, at an annual growth rate of 8.23% from 2024 to 2030. (source)

46. The global laboratory products and services outsourcing market is expected to grow from $38.56 billion in 2023 at an annual growth rate of 8.21% from 2024 to 2030. (source)

47. The Healthcare Contract Research Outsourcing (CRO) Market was worth $44.4 Billion in 2022 and is expected to grow from $51.2 Billion in 2023 to $162.4 Billion by 2032, at a 15.50% CAGR. (source)

48. The global logistics outsourcing market grew from $1.32 trillion in 2024 to $1.38 trillion in 2025 and is expected to reach $2.09 trillion by 2034, expanding at a 4.70% CAGR from 2024 to 2034. (source)

49. The US Logistics Outsourcing Market is expected to grow from $256.5 billion in 2024 to $378.5 billion by 2033, at a CAGR of 4.4%. (source)

50. The global Logistics Business Outsourcing market is expected to grow from $1.45 billion in 2024 to $2.18 billion by 2031, expanding at a compound annual growth rate (CAGR) of 6%. (source)

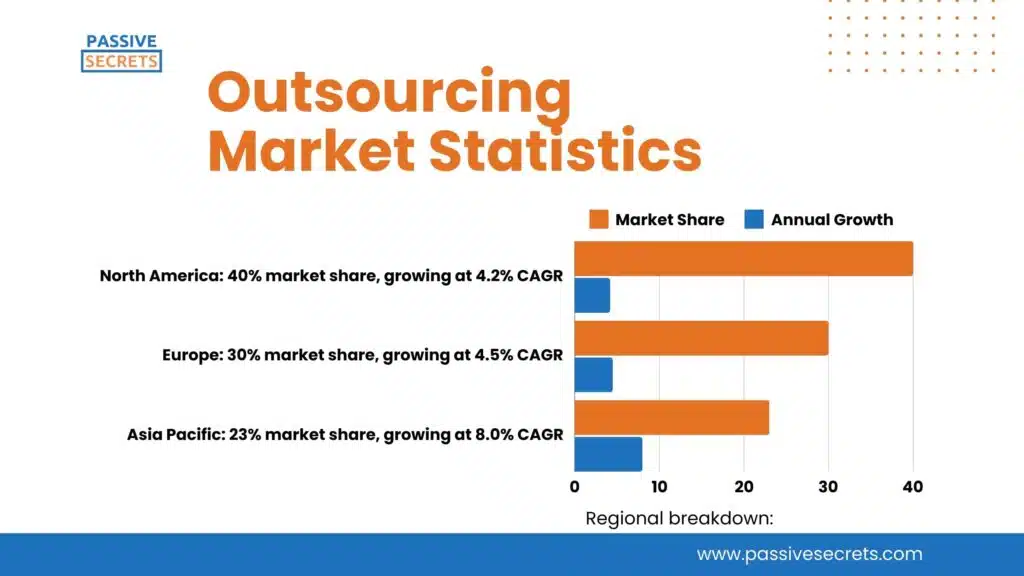

Regional breakdown:

51. The global Accounts Receivable Outsourcing Service market will grow from $4.5 billion in 2024 to $6.5 billion by 2030, at a 6.2% CAGR. (source)

52. The customer experience outsourcing services market is expected to grow from $79.4 billion in 2023 to $205.1 billion by 2032, expanding at an 11.1% CAGR from 2024 to 2032. (source)

53. The global internal audit outsourcing market is expected to grow from $14.2 billion in 2023 to $26.8 billion by 2032, expanding at a 7.5% CAGR from 2024 to 2032. (source)

54. The global help desk outsourcing market was worth $9 billion in 2023 and is expected to reach $17.4 billion by 2032, growing at a 7.29% CAGR from 2024 to 2032. This growth is driven by factors such as expanding enterprises, demand for cost-efficient customer support, and the need for efficient customer services. (source)

55. The global outsourced sales service market is expected to grow from $2.734 billion in 2023 to $3.96 billion by 2032, expanding at a 4.2% CAGR during the forecast period. (source)

56. The U.S. Outsourced Sales Services Market is expected to grow from $1.209 billion in 2024 to $1.971 billion by 2031, expanding at a 6.95% CAGR. The expected growth is driven by the need for effective sales strategies to generate new business opportunities and build sales pipelines. (source)

57. The Global Software Outsourcing Market is expected to grow from $585.5 billion in 2024 to $897.9 billion by 2031, expanding at a 5.49% CAGR. There is an increased demand for third-party vendors and service providers to create, maintain, and support software systems and projects. (source)

58 The global healthcare BPO market is expected to grow from $293.25 billion in 2023 to $713.20 billion by 2031, expanding at an 11.75% CAGR from 2024 to 2031. (source)

59. The global healthcare IT outsourcing market is expected to grow from $31.4 billion in 2021 to $78.3 billion by 2031, expanding at a 5.9% CAGR. (source)

60. The global healthcare BPO market will grow from $395.3 billion in 2024 to $626.6 billion by 2029, at a 9.7% CAGR, fueled by the need to reduce healthcare costs and outsourcing trends in pharmaceuticals and biopharmaceuticals. (source)

61. The global accounts payable outsourcing services market will grow from $5.14 billion in 2024 to $12.25 billion by 2031 at a 13.2% CAGR, driven by a skilled labor shortage in finance and accounting. (source)

North America led the market with a 40% share ($2.06 billion) and 11.4% CAGR, followed by Europe (30% share, $1.54 billion) and Asia Pacific (23% share, $1.18 billion, growing at 15.2% CAGR).

62. The global hospital outsourcing market was valued at $381.7 billion in 2024 and is expected to grow at a 10.3% CAGR from 2025 to 2030. (source)

In 2024, clinical services led the market with a 21.5% share, while private hospitals accounted for 72.8% of the market. North America dominated the global hospital outsourcing market, capturing a 69.9% revenue share.

63. The global outsourcing beauty market is expected to grow from $22.5 billion in 2023 to $40.8 billion by 2032, at a 6.8% CAGR, driven by increasing demand for beauty products, innovation, and cost-effective outsourcing services. The market includes services like manufacturing, packaging, R&D, quality assurance, and more. (source)

64. The global medical affairs outsourcing market is projected to grow from $2.31 billion in 2024 to $5.21 billion by 2031, at a 12.3% CAGR. (source)

65. The global medical device outsourcing market was valued at $128.8 billion in 2023 and is expected to grow at a 12.8% CAGR from 2024 to 2030. The contract manufacturing segment led the market in terms of service, accounting for 54.4% of global revenue in 2023. (source)

The cardiology segment held the largest share (21%) in terms of application, while general and plastic surgery device outsourcing will see the fastest growth (14.3% CAGR).

66. Class II medical devices dominated the global medical device outsourcing market (81.34% share) and will register the fastest CAGR (14%). And Asia Pacific held the largest revenue share (41.3%) in 2023. (source)

67 The Intellectual Property Outsourcing Services Market is projected to grow to $65.19 billion by 2029, at a 12% CAGR from 2022 to 2029. (source)

68. The customer care BPO market is expected to grow from $24.29 billion in 2023 to $43.33 billion by 2031, at a CAGR of 7.5% during the forecast period. (source)

69. The global Engineering Services Outsourcing Market was worth $2.3 trillion in 2023 and is projected to reach $10.73 trillion by 2032, growing at an annual rate of 18.7% from 2024 to 2032. (source)

70. The global Outsourcing Transcription Services market is expected to expand from $226.57 billion in 2024 to $310.53 billion in 2030, growing at a rate of 5.4% per year from 2024 to 2030. (source)

71. The global pharmaceutical R&D outsourcing market was worth $81.23 billion in 2023 and is projected to reach $187.80 billion by 2032, growing at a CAGR of 9.76% from 2024 to 2032. (source)

72. The global source-to-pay (S2P) outsourcing market was valued at $31.1 billion in 2023 and is expected to reach $81.5 billion by 2032, growing at a CAGR of 10.97% from 2024 to 2032. S2P outsourcing involves companies delegating their procurement and purchasing tasks to third-party service providers. (source)

73. The global finance and accounting outsourcing market was valued at $60.31 billion in 2023 and is projected to reach $110.74 billion by 2030, growing at a CAGR of 9.1% from 2024 to 2030. (source)

74. The offshore software development market was valued at $122 billion in 2024 and is expected to reach $283 billion by 2031, growing at a CAGR of 10.13% from 2024 to 2031. This market involves outsourcing software development to remote teams in different countries. (source)

75. The global sales and marketing BPO market was valued at $28.65 billion in 2022 and is expected to grow at a 9.4% CAGR from 2023 to 2030, driven by the rising adoption of cloud computing, which has significantly contributed to the industry’s expansion. (source)

76. The global sales and marketing BPO market is projected to reach $49.2 billion by 2028, growing at a CAGR of 9.5% from 2022 to 2028. (source)

77. The global Human Resource Outsourcing Market grew from $18.65 billion in 2023 to $19.97 billion in 2024 and is expected to continue growing at a CAGR of 7.59% to reach $31.14 billion by 2030. (source)

78. India’s IT outsourcing market is projected to reach $11.04 billion in 2024 and grow at a CAGR of 13.52% to reach $20.81 billion by 2029. (source)

79. The global Application Outsourcing market is expected to grow steadily, increasing by $5.9 billion (4.99%) from 2024 to 2029, reaching a record high of $124.07 billion in 2029. This marks the ninth consecutive year of growth, continuing the segment’s upward trend. (source)

Global Outsourcing Statistics

80. Firms are increasingly outsourcing accounting services, with global spending up 40% and interest rising 20% over the past five years. (source)

81. Poland surpassed Ukraine in 2021 as a leading destination for software development outsourcing, earning the top spot as a nearshore and offshore hub. Additionally, Poland ranks third worldwide for software development services. (source)

82. In 2023, small businesses sought new outsourced providers in marketing (27%), followed by IT services (22%), and design (21%). (source)

83. In 2022, China’s service outsourcing industry saw 1.02 million new hires, maintaining a stable trend since 2016. The industry’s total workforce reached 14.98 million in 2022. (source)

84. China’s IT Services market is expected to reach $78.03 billion by 2024, with IT Outsourcing leading at $29.03 billion. The market will grow at a CAGR of 6.8% from 2024 to 2029, reaching $108.40 billion by 2029. (source)

85. China is the leading global country for manufacturing and IT outsourcing. (source)

86. There was a 19% increase in Google searches for “accountancy outsourcing” in 2023. (source)

Industry-Specific Outsourcing Statistics

IT Outsourcing Statistics

87. Companies are considering outsourcing top tech roles, with 34% likely to outsource CTO, 30% CISO, and 30% CIO positions within the next year. (source)

88. In 2024, 50+% of EU companies outsourced some cybersecurity tasks, while 65% of Luxembourg organizations relied on external firms for cybersecurity. (source)

89. Internal Audit departments faced a 15% increase in capability shortfalls and skill misalignment between 2021 and 2024. Leaders responded by leveraging internal resources (18% rise) and external resources (26% annual increase) to address these gaps. (source)

90. In 2024, organizations increased outsourcing of OT cybersecurity training by 5% and vulnerability management by 3% but decreased outsourcing of other services like managed detection and response and data privacy services, compared to 2023. (source)

Pharmaceutical Outsourcing Statistics

91. The global pharmaceutical market’s in-house spending share is expected to decline from 66.3% in 2014 to 51% in 2023, indicating a shift towards outsourcing services. (source)

92. 87% of biopharmaceutical manufacturers outsource analytical testing and bioassays, making it the top category for outsourcing among such companies as of 2022. (source)

93. 35% of biopharma executives prefer the full-service outsourcing model for clinical development work, making it the most popular choice among surveyed companies worldwide. (source)

94.. 34% of biopharma executives currently use the full-service outsourcing model for clinical development, with small and mid-sized companies (40%) using it more frequently than large companies (35%). (source)

95. 73% of biopharma executives say it’s extremely likely or very likely that their company will outsource patient recruitment in the next 2 years. (source)

96. In 2024, 75% of biopharma executives say their company will likely outsource patient recruitment for clinical trials within 2 years, showing a growing trend in outsourcing drug development. (source)

Outsourcing Challenges and Concerns

97. 56% of C-suite leaders cite a lack of financial resources as the reason they don’t outsource. However, 63% say they didn’t outsource because there was no current need to outsource or they were concerned about the quality of work. (source)

98. 89% of companies said “experience in our industry” was a major factor to consider when deciding who to hire as their outsourcing provider. Also, 84% considered “data privacy/security practices,” and 76% considered “cost savings.” (source)

99. 81% of executives cite cybersecurity as a major external concern, and 96% rely on outsourcing providers to enhance data and analytics capabilities, underscoring the crucial role of outsourcing in addressing emerging security threats. (source)

100. Half of executives cite talent acquisition as a major internal challenge in achieving their organization’s strategic objectives. (source)

Conclusion

Outsourcing continues to be a critical strategy for businesses seeking to improve efficiency, reduce costs, and access specialized talent. The statistics highlighted in this article demonstrate its widespread adoption across industries, with companies leveraging outsourcing for functions like IT, customer service, and marketing.

As businesses adapt to an increasingly globalized and digital economy, outsourcing remains a valuable tool for scalability and competitive advantage. Companies can make informed decisions to optimize their operations and drive long-term growth by understanding these trends.

FAQs

Other Related Statistics You Should Know:

- 80+ Employee Benefit Statistics: Insights and Trends

- The Most Important Wealth Management Statistics You Can’t Afford to Ignore

- Enterprise Data Management: Essential Statistics and Emerging Trends

- 93 Talent Management Statistics to Help You

- Top Reputation Management Statistics and Trends to Improve Your Brand

- 36 Helpful Social Worker Burnout Statistics To Know

- 100 Business Process Outsourcing Statistics & Facts

- Top HR Outsourcing Statistics and Trends Every Business Must Know

- 47+ Shocking 4-day Work Week Statistics To Know

- 105+ Supply Chain Statistics & Facts You Can’t Ignore

- 50+ Interesting Employer Branding Statistics And Trends

- Job Seekers Statistics: Unemployment Rates, Preferences, Challenges

- 95 Interesting Job Interview Statistics and Huge Trends To Know

- 60+ Helpful Change Management Statistics & Facts

- 65+ Employee Performance Management Statistics & Trends

- Workforce Management Statistics: Trends, Insights, & Opportunities

- 73 Revealing Workplace Distraction Statistics

- Workplace Romance Statistics: How Common Is Workplace Romance?

- 40+ Top Workplace Conflict Statistics You Should Know

- The State of Workplace Communication: Key Statistics and Trends

- 55 Workplace Collaboration & Teamwork Statistics