What separates the good from the great in wealth management? The answer lies in understanding the numbers.

Behind every investment strategy, market trend, and financial decision are statistics that shape outcomes and fuel success.

Did you know that global high-net-worth individuals now control over $80 trillion in assets—and their preferences for wealth management are shifting faster than ever?

For wealth managers, this data is a goldmine of opportunity. For clients, it’s a roadmap to smarter, more secure financial choices.

Now the question is, “Are you leveraging the power of wealth management statistics to stay ahead?” Let’s uncover the insights that matter most.

Key Wealth Management Statistics (Editor’s Pick)

- The top three US wealth management firms by AUM are Creative Planning ($175.27 billion), Pathstone ($48.5 billion, and Moneta Group ($37.5 billion).

- Bank of America Private Bank ranked first in client satisfaction worldwide with a 96.67% score.

- 46% of US HNWIs plan to switch or add new wealth management providers within the next 2 years.

- Wealth management advisors are 56% more likely to be employed by private companies than by public companies.

- China’s investable personal assets grew from 160 trillion yuan in 2019 to a projected 287 trillion yuan by 2025.

- The global wealth pyramid is led by 14 individuals worth nearly $2 trillion, followed by tiers of 12 people ($50-100 billion), 2,600 people ($1-50 billion), and 58 million people ($1M-$1 billion).

- Global net wealth reached $477 trillion in 2023, growing 4.3% from the previous year.

- Wealthy Africans own at least 10% of the $2 trillion ($2000 billion) held by the world’s ultra-high-net-worth individuals.

- The primary financial goal for wealth management clients was wealth protection.

- US baby boomers held 51.8% of the country’s total wealth, while millennials owned around 9.4%.

- There are over 116,025 wealth management advisors currently employed in the United States.

- The average age of a wealth management advisor in the US is 44 years old.

- 72% of asset and wealth managers believe disruptive tech will shift customer preferences towards tech-enabled solutions.

- Over 90% of asset managers are utilizing disruptive technologies such as AI, big data, and blockchain.

- The global wealth management software market was valued at $5.51 billion in 2024 and is projected to grow at a 14% CAGR from 2025 to 2030.

- 80% of asset and wealth managers see AI driving revenue growth, with “tech-as-a-service” potentially adding 12% to revenues by 2028.

- 71% of asset and wealth managers believe cloud technology will shape the industry’s future over the next 2-3 years.

- 65% of wealth managers believe that AI can improve productivity.

- 84% of executives expect AI to revolutionize the wealth management industry within the next five years.

- 36% of wealth managers see sustainable investing as a top opportunity for the next two years.

- Wealth managers’ main concerns are volatile markets (40%), higher inflation (28%), and low investment returns (28%).

- 59% of asset and wealth managers are adopting or considering big data analytics for investment operations.

General Wealth Management Statistics

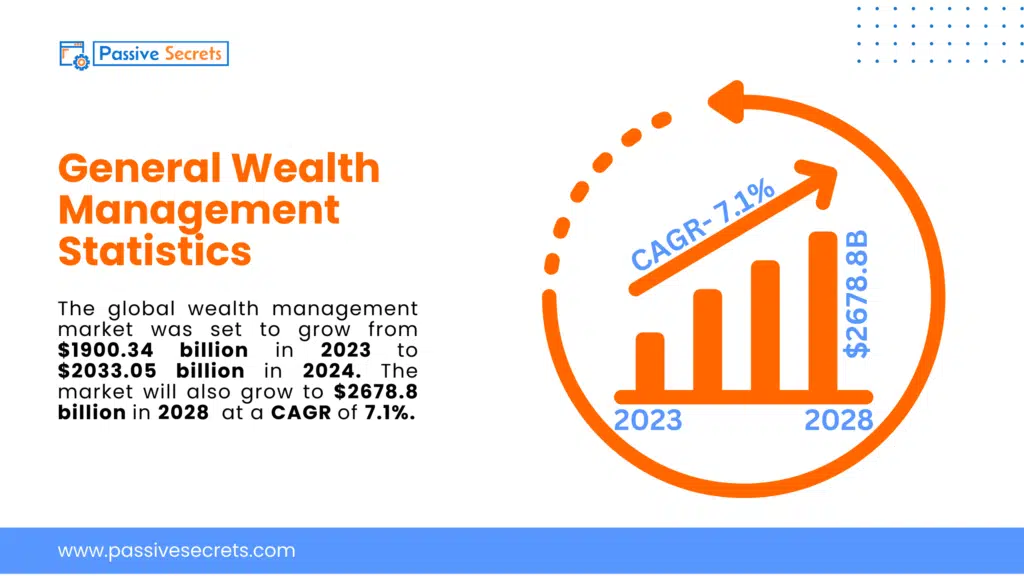

1. The global wealth management market was set to grow from $1900.34 billion in 2023 to $2033.05 billion in 2024 at a CAGR of 7.0%. The market will also grow to $2678.8 billion in 2028 at a CAGR of 7.1%. (source)

2. In 2023, CAPTRUST, based in Raleigh, was the leading Registered Investment Advisor (RIA) firm in the US, managing around $852 billion in assets, followed by Edelman Financial Engines with $270 billion. (source)

3. Wealth management clients showed high satisfaction (over 70%) with actively managed funds, but low satisfaction (under 30%) with digital asset services. (source)

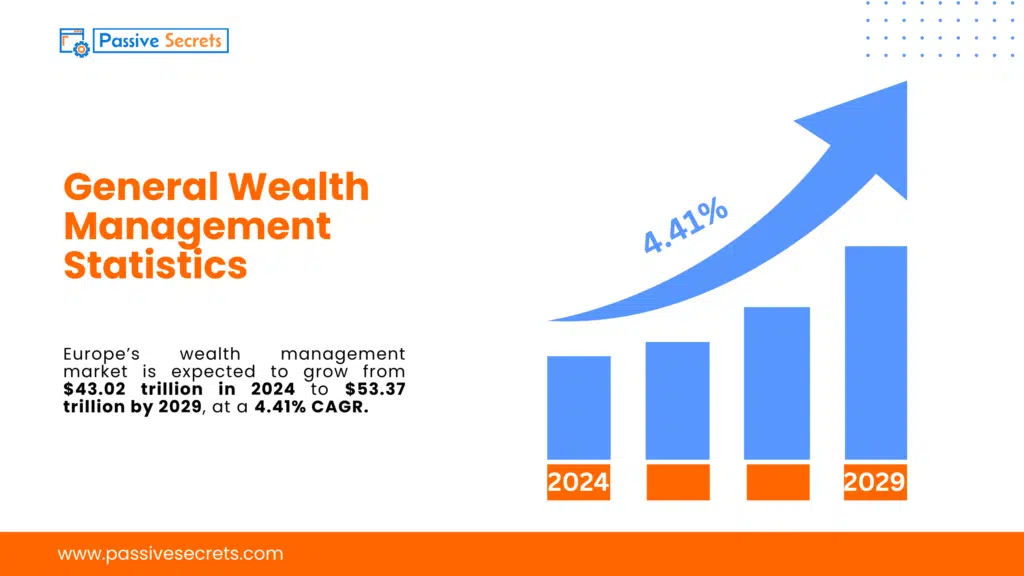

4. Europe’s wealth management market is expected to grow from $43.02 trillion in 2024 to $53.37 trillion by 2029, at a 4.41% CAGR. (source)

5. The global asset and wealth management market is projected to grow from $3.2 trillion in 2023 to $6.5 trillion by 2032, at a CAGR of 8.1%. (source)

6. Latin America’s wealth management market is expected to grow from $1.18 trillion in 2024 to $1.32 trillion by 2029, at a 2.34% CAGR. (source)

7. In 2023, the top three wealth management firms in the US by total assets under management (AUM) were Creative Planning with $175.27 billion, Pathstone with roughly $48.5 billion, and Moneta Group with $37.5 billion. (source)

8. The US had the largest wealth management market in 2024 with $64.4 trillion in AUM, expected to reach $87.35 trillion by 2028. The UK and France followed, with $9.4 trillion and $8.6 trillion in AUM, respectively. (source)

9. The US wealth management market’s AUM is expected to rise by $22.5 trillion (+35.94%) from 2024 to 2028, reaching a record $85.14 trillion. (source)

10. The US wealth management market’s AUM saw positive growth from 2019-2024, except for a nearly $1 trillion drop in 2018, and is expected to continue increasing annually through 2028. (source)

11. In 2024, Bank of America Private Bank ranked first in client satisfaction worldwide with a 96.67% score, narrowly ahead of Morgan Stanley’s Private Wealth Management and UBS Wealth Management. (source)

12. As of 2024, Merrill Wealth Management’s Global Corporate team led the US with $110 billion in AUM, followed by Morgan Stanley’s Malone Neuhaus Group with $51.5 billion. (source)

13. The number of US financial advisors grew from 302,000 in 2017 to 322,000 in 2024 and is expected to remain stable at around 322,800 until 2028. (source)

14. In 2023, 20% of wealth management clients valued legal services most, while 17% prioritized tax preparation. (source)

15. In 2018, 30% of wealth management clients preferred one-stop-shop solutions, increasing to 47% by 2023, who sought holistic advice for their financial needs. (source)

16. Edelman Financial Engines is the largest registered investment advisor in the US, serving around 1.3 million clients, followed by Mariner Wealth Advisors with around 80,000 clients. (source)

17. 46% of US HNWIs plan to switch or add new wealth management providers within the next 2 years. (source)

18. 52% of wealth management consumers prioritize saving and planning, while 45% focus on investment and portfolio management, indicating a growing demand for advisory services. (source)

19. Wealth management advisors are 56% more likely to be employed by private companies than by public companies. (source)

20. The top wealth management centers, ranked by competitiveness, are Switzerland, followed closely by Singapore, then the US, Hong Kong, UAE, and the UK. (source)

21. The global wealth management market is expected to reach $162.30 trillion in 2024, led by financial advisory services at $159.50 trillion, and grow 2.27% annually from 2024 to 2029. It is expected to reach $181.60 trillion by 2029. (source)

Global Wealth Overview Statistics

22. The total wealth of Europe’s adult population reached its peak in 2021 at approximately $108.1 trillion. However, wealth fluctuated between 2010 and 2022, with the lowest point occurring in 2016 at around $77.56 trillion. Currently, the total wealth stands at about $104.4 trillion. (source)

23. China’s investable personal assets grew from 160 trillion yuan in 2019 to a projected 287 trillion yuan by 2025. (source)

24. The US household financial assets grew from $34.46 trillion in 2000 to $118.34 trillion in 2023. (source)

25. China had over 194 million online wealth management users by the end of 2021. This growth is due to the country’s thriving FinTech industry. (source)

26. Global AUM is projected to reach $171 trillion by 2028, growing at a 5.9% CAGR, with alternatives growing faster at 6.7% CAGR. (source)

27. Wealthy individuals’ alternative asset holdings are expected to rise from $4 trillion (24%) to $12 trillion (33%) by 2030. (source)

28. As of 2024, BlackRock led global fund managers with over $10.4 trillion in assets, followed by Vanguard Group in second, and Charles Schwab third with $7.32 trillion. (source)

29. India is expected to become a $5 trillion economy by 2027-28, with three individuals joining the ultra-high-net-worth (UHNW) club daily, boasting over $30 million in net worth. (source)

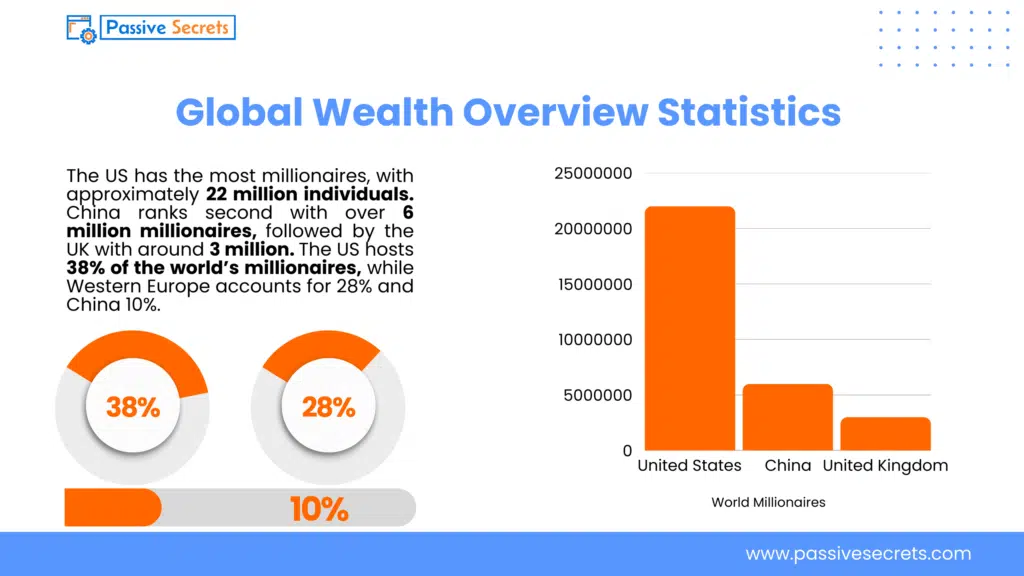

30. The US has the most millionaires, with approximately 22 million individuals. China ranks second with over 6 million millionaires, followed by the UK with around 3 million. The US hosts 38% of the world’s millionaires, while Western Europe accounts for 28% and China 10%. (source)

31. The world’s wealth pyramid is topped by 14 individuals with a collective wealth of nearly $2 trillion. The second-highest tier consists of 12 people with $50-100 billion. The next tier has around 2,600 individuals with $1-50 billion. Below these tiers are a broad band of approximately 58 million people with $1 million to $1 billion. (source)

32. Approximately $83 trillion is expected to be transferred within the next 20-25 years. Notably, people over 75 years old currently hold nearly 20% of the world’s total wealth. (source)

33. An estimated $9 trillion in wealth will be transferred between spouses within the same generation. Of the total $83.5 trillion expected to be transferred, over 10% is likely to come from women passing wealth to the next generation. (source)

34. In 2022, the total value of assets held by financial institutions in the euro area declined to approximately $102.93 trillion, a decrease from $105.27 trillion in the previous year, following a steady decline from 2012 to 2021. (source)

35. Global revenue from alternative investment products is projected to rise until 2028, reaching $343 billion (57% of total revenue), up from 32% in 2005. (source)

36. Switzerland remains the largest booking center with $2.2 trillion in international assets, narrowly ahead of the UK. Total international managed assets reached $10.1 trillion in 2023, up 2.9% from the previous year. The market share shifts saw the UK, US, Hong Kong, and Luxembourg gain, while Switzerland and Panama & Caribbean lost share. (source)

37. Global net wealth reached $477 trillion in 2023, growing 4.3% from the previous year. This includes financial wealth, liabilities, and real assets. (source)

38. Financial wealth grew 7% in 2023 to $275 trillion, driven by a 15.8% surge in global equities to $72.5 trillion, following a strong rebound in corporate earnings and a decline in global inflation. (source)

39. The US is the fastest-growing booking center for Western wealth, with cross-border wealth inflows increasing 5.6% in 2023 and expected to grow 6.9% annually through 2028. (source)

40. Wealthy Africans own at least 10% of the $2 trillion ($2000 billion) held by the world’s ultra-high-net-worth individuals. (source)

Demographic Breakdown in Wealth Management

41. In 2023, clients worldwide chose wealth managers based on service-related factors. The top three reasons were investment performance (46%), fee structure, and availability of investment products. (source)

42. In 2023, the primary financial goal for wealth management clients was wealth protection, with over 40% of investors seeking this service. This goal surpassed ensuring adequate income, which was the top goal in 2021. (source)

43. Baby boomers were the least satisfied with their wealth management firms’ investment product services, particularly with digital assets, where less than 15% were satisfied. (source)

44. In 2022, ultra-high-net-worth individuals favored alternative investments, while high-net-worth individuals prioritized equities, with fixed-income securities also being popular among both groups. (source)

45. In 2023, US ultra-high-net-worth individuals held about 80% of their assets in alternative and equity securities, while listed equities made up around half of high-net-worth individuals’ portfolios. (source)

46. As of 2023, the highest-paid financial advisors in the US worked in securities and investments, earning an average of $164,210/year, followed by those in investment pools and funds, averaging $128,510/year. (source)

47. In Q1 2024, US baby boomers held 51.8% of the country’s total wealth, while millennials owned around 9.4%, despite the two generations having an equal population share. (source)

48. In Q1 2024, the top 10% of US earners held approximately 65% of the country’s total wealth, while the bottom 50% held just 2.5%. (source)

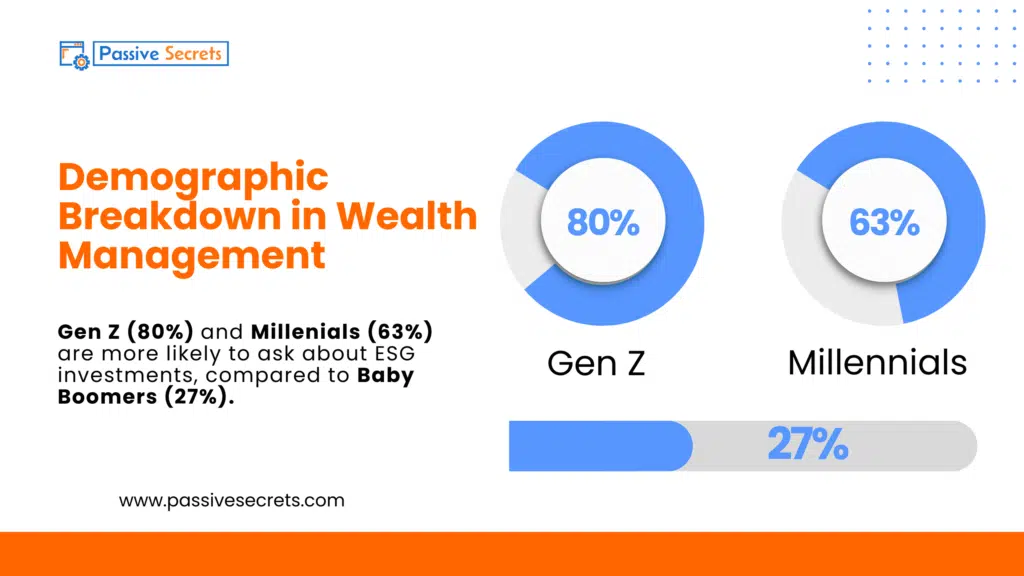

49. Gen Z (80%) and Millennials (63%) are more likely to ask about ESG investments, compared to Baby Boomers (27%). (source)

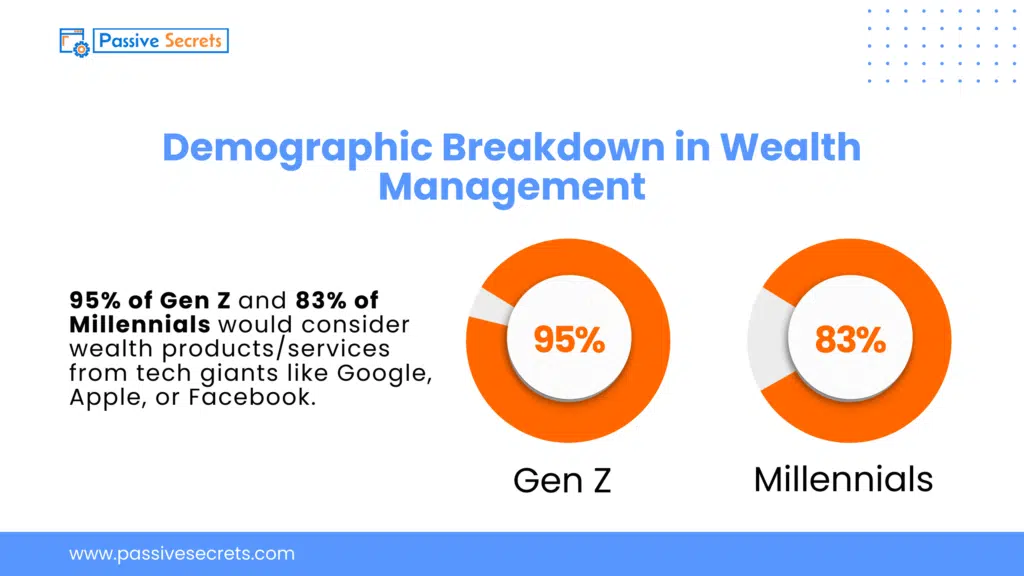

50. 95% of Gen Z and 83% of Millennials would consider wealth products/services from tech giants like Google, Apple, or Facebook. (source)

51. There are over 116,025 wealth management advisors currently employed in the United States. (source)

52. The US wealth management industry comprises 30.9% female advisors and 69.1% male advisors. (source)

53. The average age of a wealth management advisor in the US is 44 years old. (source)

54. The ethnic breakdown of US wealth management advisors is predominantly White (72.2%), followed by Hispanic or Latino (9.4%), Asian (8.3%), and Black or African American (5.6%). (source)

55. In the wealth management industry, women earn 84 cents for every dollar earned by men, with a median income of $76,363 for women compared to $90,621 for men. (source)

56. The average salary for wealth management advisors in the US is $91,605, with a typical range of $49,000 to $168,000 per year. The average hourly rate is $44.04. (source)

Wealth Management Technology Statistics

57. In 2023, fintech solutions like robo-advisors and neobanks were expected to see the largest growth in usage for wealth management. Fintech’s share of wealth management was 9% in 2023, projected to rise to 18% by 2026. (source)

58. Wealth management clients prefer direct communication with their advisors, especially through virtual tools. However, for creating and maintaining a financial plan, clients prefer in-person meetings. (source)

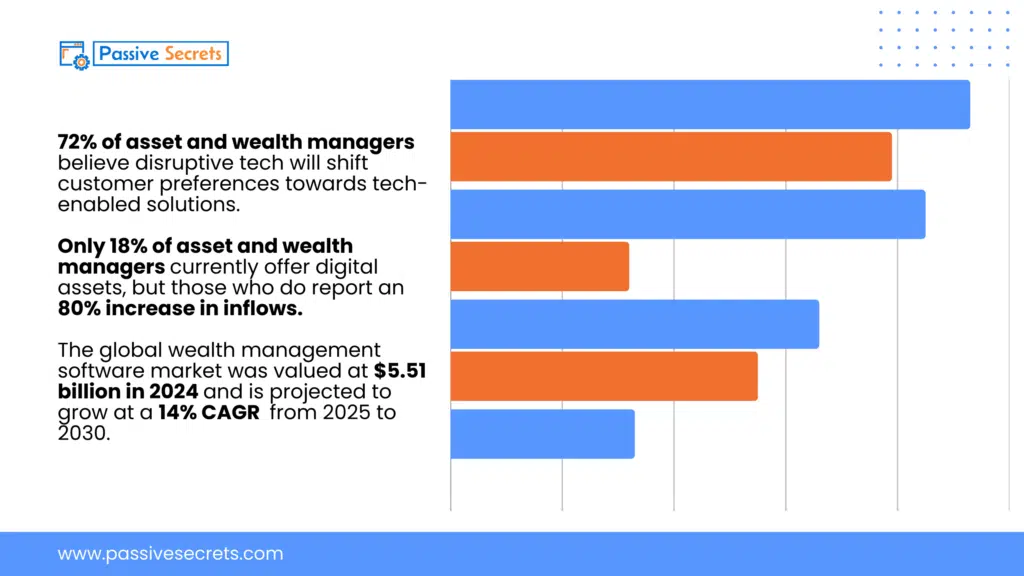

59. 72% of asset and wealth managers believe disruptive tech will shift customer preferences towards tech-enabled solutions. (source)

60. Only 18% of asset and wealth managers currently offer digital assets, but those who do report an 80% increase in inflows. (source)

61. 81% of asset and wealth managers are considering partnerships, consolidations, or M&A to boost their tech capabilities. (source)

62. Only 39% of asset and wealth managers are upskilling staff to leverage new technologies. (source)

63. 54% of asset and wealth managers believe disruptive technologies will significantly impact their cybersecurity measures. (source)

64. Global family offices’ top investment themes in 2023 were digital transformation (75%), followed by health tech (67%), automation/robotics, and green tech. (source)

65. Over 90% of asset managers are utilizing disruptive technologies such as AI, big data, and blockchain. (source)

66. 80% of surveyed asset and wealth managers say disruptive technology drives revenue growth. (source)

67. 68% of asset and wealth managers allocate less than 1/6 of their capital expenditure to innovative technologies. (source)

68. 58% of asset and wealth managers see inadequate technology infrastructure as a barrier to adopting disruptive tech. (source)

69. The global wealth management software market was valued at $5.51 billion in 2024 and is projected to grow at a 14% CAGR from 2025 to 2030. (source)

70. North America’s wealth management software market was $2.0 billion in 2024 and is projected to reach $4.2 billion by 2030, growing at a 13.4% CAGR. (source)

71. Europe’s wealth management software market was $1.4 billion in 2024 and is projected to reach $3.0 billion by 2030, growing at a 13.1% CAGR. (source)

72. 90% of Hong Kong’s wealthy people have increased their use of digital channels for wealth management services over the past two years. (source)

73. Hong Kong’s wealthy individuals primarily manage their wealth through self-service channels, with 53% using the internet, 52% using mobile apps, and 46% utilizing online chats with wealth managers. (source)

74. When accessing investment or wealth management services remotely, 39% of Hong Kong’s wealthy people prefer a hybrid approach combining digital self-service and human interaction, outnumbering those who prefer fully digital (33%) or fully human-led (27%) services. (source)

75. 68% of investors expect wealth management firms’ digital experiences to match leading tech companies, driving demand for seamless omnichannel delivery. (source)

Regional Wealth Management Statistics

76. Japanese investment firms’ discretionary accounts held ¥592.6 trillion, accounting for over 90% of total assets under management, which grew 17.2% from the previous year. (source)

77. Wealth management firms in Europe expect CRM and KYC/AML tech to primarily shape the industry’s future by 2025, while advanced robo-advisory tools were ranked as the least expected to have an impact. (source)

78. Nigeria’s wealth management market is expected to reach $30.5 billion in 2024, led by financial advisory services at $21.37 billion. The market is projected to grow 3.96% annually from 2024-2029, reaching $37.04 billion by 2029. (source)

79. In 2023, nearly 50% of Australasia’s ultra-high-net-worth individuals (UHNWIs) expected a marginal wealth increase (<10%), while around 20% anticipated a significant increase (>10%). (source)

80. South Korea had around 468 asset management companies as of September 2023, up from 437 the previous year and 84 in 2013. (source)

81. India’s wealth management industry AUM is projected to reach $1.8 trillion within the next 4-5 years. (source)

82. India’s wealth management market is projected to grow from $154.25 billion in FY2024 to $331.13 billion in FY2032, at a 10.02% CAGR. (source)

83. Among Hong Kong’s wealthy individuals, 45% prefer face-to-face meetings with wealth managers, a preference that remains strong even among younger respondents (41% of those aged 19-34). (source)

84. In Hong Kong, 75% of wealthy people manage part of their wealth themselves, with 55% using wealth managers, and 52% using robo-advisors. In contrast, mainland China’s wealthy people are more likely to self-manage (66%) and less likely to use robo-advisors (41%). (source)

85. China’s Investment and Asset Management industry reached $16.4 billion in revenue in 2024. (source)

86. China’s Investment and Asset Management industry has experienced an average annual decline of 0.6% from 2019 to 2024. (source)

87. African Wealth Management assets are expected to reach $833.4 billion in 2024, with Financial Advisory making up $795.5 billion. The market will grow 0.78% annually from 2024 to 2029, reaching $866.5 billion. (source)

88. South Africa’s wealth management market is expected to reach $601.9 billion in 2024, led by financial advisory services at $594.3 billion. The market will grow 0.48% annually from 2024 to 2029, reaching $616.4 billion. (source)

89. According to Cowrywise, the top wealth management firms in Nigeria are:

90. Africa is home to 138,000 millionaires, 328 centi-millionaires, and 23 billionaires. (source)

91. The top five countries – South Africa, Egypt, Nigeria, Kenya, and Morocco – account for 56% of Africa’s millionaires and over 90% of its billionaires. South Africa leads with 37,800 millionaires. (source)

92. South Africa is the hub of Africa’s wealth management industry, with assets under management totaling over $85 billion as of December 2022. (source)

93. Australia’s wealth management market reached $4.6 trillion in 2023 and is expected to grow to $9.6 trillion by 2032, at a CAGR of 8.00%. (source)

94. Australia’s wealth management market is expected to reach $1,932 billion in 2024, led by financial advisory services at $1,917 billion, and grow 0.09% annually from 2024 to 2029, reaching $1,941 billion. (source)

95. Africa’s wealth totals $2.5 trillion in liquid investable assets, with 135,200 millionaires, 342 centi-millionaires, and 21 billionaires on the continent. (source)

AI in Wealth Management Statistics

96. 80% of asset and wealth managers believe AI will drive revenue growth, with “tech-as-a-service” potentially boosting revenues by 12% by 2028. (source)

97. 73% of assets and wealth management (AWM) organizations believe AI will be the most transformative technology in the next 2-3 years. (source)

98. 71% of asset and wealth managers believe cloud technology will shape the industry’s future over the next 2-3 years. (source)

99. 65% of wealth managers believe gen AI can improve productivity, 63% see its value in risk management and fraud detection, and 54% acknowledge its role in personalizing client offerings. (source)

100. Nearly three-quarters (74%) of wealthy individuals in Hong Kong are comfortable with AI-driven wealth management decisions. (source)

101. 84% of executives predict artificial intelligence (AI) will transform the wealth management industry within the next five years. (source)

102. 28% of asset managers already use AI, 17% are developing AI applications, 46% are considering AI investment, and 9% haven’t considered AI. (source)

103. Nearly 4 out of 5 asset managers view AI as crucial for future success. (source)

104. The global AI in asset management market was $3.71 billion in 2023, growing to $4.62 billion in 2024, and is projected to reach $33.25 billion by 2033, expanding at a 24.52% CAGR from 2024 to 2033. (source)

105. 98% of financial advisors believe AI is currently transforming financial advice, and 99% think AI will play a role in the future of financial advice, enhancing client-advisor relationships. (source)

106. 21% of advisors think AI can best help by segmenting clients to better understand their acquisition, growth, and retention goals. (source)

107. 55% of financial advisors find AI-generated insights too complicated, while 41% believe AI-driven client insights lack impact. (source)

108. 62% of wealth management firms believe AI will significantly transform their operations, driven by investor expectations, as 68% want digital experiences comparable to leading tech companies. (source)

Wealth Management Investment Trends

109. Most art professionals (91%), wealth managers (88%), and art collectors (87%) agree that art and collectibles should be part of wealth management services. (source)

110. 45% of wealth managers prioritized private markets as a top investment focus for the year. (source)

111. 36% of wealth managers see sustainable investing as a top opportunity for the next two years. (source)

112. Over 50% of UK and European wealth managers plan to increase their emerging market equity exposure in the coming years. (source)

113. 84% of wealth management clients plan to buy ESG products within a year, with 59% seeking ESG advice, including 80% of Gen Z. (source)

114. 90% of art collectors consider art market research/information the most important wealth management service, followed by art valuation services (72%). (source)

Statistics on Wealth Management Challenges or Concerns

115. In 2023, only 26% of people in the US used a professional financial advisor to manage their wealth. (source)

116. In 2024, US financial advisors reported that 74% of clients were concerned about inflation’s impact on investments, while 75% were concerned about interest rates’ effects on financial decisions. (source)

117. 81% of wealth managers who avoid illiquid assets cited lengthy lock-in periods as the primary reason. (source)

118. Wealth managers’ main concerns are volatile markets (40%), higher inflation (28%), and low investment returns (28%). (source)

119. Wealth managers’ top crypto concerns are inadequate transparency/education (43%), insufficient regulation (43%), and security/custody risks (43%). (source)

120. One in six asset and wealth management firms is expected to merge or go out of business within the next five years. (source)

121. 55% of clients feel their wealth management advice is too generic, and another 55% believe they could achieve better returns on their own, net of fees. (source)

122. 89% of mid-to-high net worth investors (HNWI) with $10M+ in personal wealth feel their wealth management advice is too generic. (source)

Asset Management Statistics

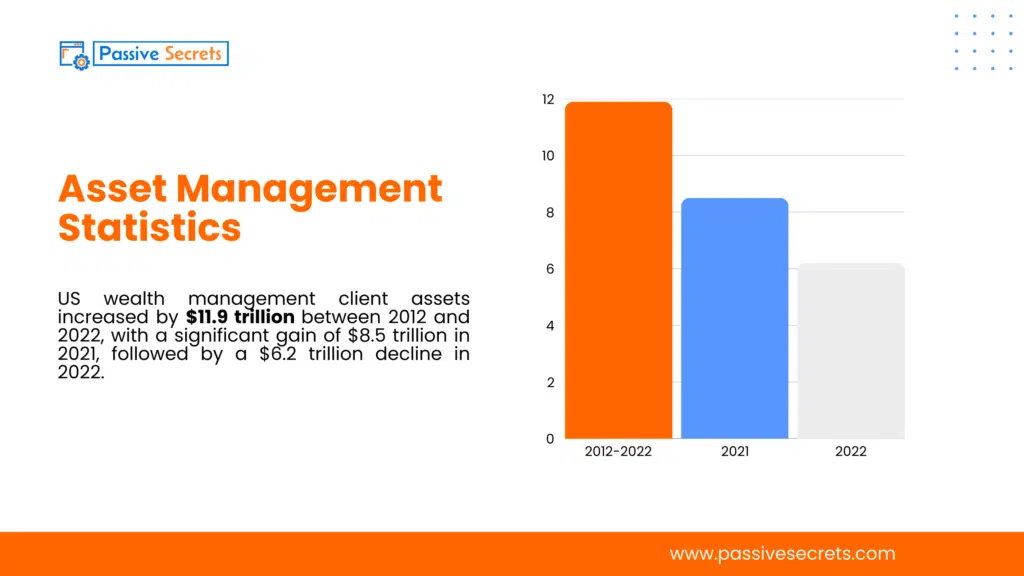

123. US wealth management client assets increased by $11.9 trillion between 2012 and 2022, with a significant gain of $8.5 trillion in 2021, followed by a $6.2 trillion decline in 2022. (source)

124. In 2023, the US had 7,222 mutual funds, marking a reasonable decline from the previous year. (source)

125. 59% of asset and wealth managers are adopting or considering big data analytics for investment operations. (source)

126. As of 2024, the top 10 global asset managers each had over $1 trillion in assets under management, led by BlackRock, with Vanguard as the second-largest, roughly $2 trillion behind BlackRock. (source)

127. Between 2016 and 2023, Assets Under Management (AUM) grew from $24.18 billion to $175.25 billion, with a brief decline in 2022. (source)

128. Goldman Sachs’ asset management segment generated $13.9 billion in net revenue in 2023, with $9.5 billion coming from management and other fees. (source)

129. 73% of asset managers are considering a strategic merger with another asset manager. (source)

130. The global asset management market was valued at $458.02 billion in 2023 and is projected to grow at a 36.4% CAGR from 2024 to 2030. (source)

Wealth Management Statistics FAQs

Other Related Statistics You Should Know:

- 80+ Employee Benefit Statistics: Insights and Trends

- Enterprise Data Management: Essential Statistics and Emerging Trends

- 93 Talent Management Statistics to Help You

- Top Reputation Management Statistics and Trends to Improve Your Brand

- 36 Helpful Social Worker Burnout Statistics To Know

- 100 Business Process Outsourcing Statistics & Facts

- Top HR Outsourcing Statistics and Trends Every Business Must Know

- The Top Outsourcing Statistics You Shouldn’t Ignore

- 47+ Shocking 4-day Work Week Statistics To Know

- 105+ Supply Chain Statistics & Facts You Can’t Ignore

- 50+ Interesting Employer Branding Statistics And Trends

- Job Seekers Statistics: Unemployment Rates, Preferences, Challenges

- 95 Interesting Job Interview Statistics and Huge Trends To Know

- 60+ Helpful Change Management Statistics & Facts

- 65+ Employee Performance Management Statistics & Trends

- Workforce Management Statistics: Trends, Insights, & Opportunities

- 73 Revealing Workplace Distraction Statistics

- Workplace Romance Statistics: How Common Is Workplace Romance?

- 40+ Top Workplace Conflict Statistics You Should Know

- The State of Workplace Communication: Key Statistics and Trends

- 55 Workplace Collaboration & Teamwork Statistics