Business process outsourcing (BPO) has become a go-to strategy for companies looking to streamline operations, cut costs, and boost efficiency.

As the global economy continues to evolve, the BPO market has seen impressive growth, and the forecasts suggest this trend will continue.

Let’s dive into the latest BPO statistics to better understand what’s happening in this dynamic industry.

Key BPO Statistics

- The Business Process Outsourcing market revenue is forecasted to hit US$0.39 trillion by 2024.

- 52% of executives outsource business functions.

- The Insurance BPO Services Market size is estimated to be USD 7.08 billion in 2024, growing to USD 8.94 billion by 2029.

- 76% of surveyed executives receive IT services through third-party delivery models.

- About 44% of businesses outsource their financial tasks to external providers.

- Cost is cited as a primary reason for outsourcing by 70% of surveyed executives.

- Small businesses sought new outsourcing partners primarily in marketing (27%), IT services (22%), and design (21%).

- Approximately 300,000 jobs are outsourced from the United States annually.

- The average spend per Employee in Europe’s BPO market is expected to be US$283.70 in 2024.

- From 2022 to 2032, the IT and telecom segment will account for over 32.7% of revenue in the Asia Pacific BPO market.

- Revenue in the Asia BPO market will reach USD 84.08 billion by 2024.

- The market for customer care BPO in the Middle East and Africa is anticipated to increase from $1,986.49 million in 2023 to $2,618.71 million by 2028.

- The UAE has become a pivotal center for global business, attracting numerous multinational corporations that require BPO services to support their international operations.

BPO Market Size and Growth

1. The Business Process Outsourcing market revenue is forecasted to hit US$0.39 trillion by 2024. (source)

2. The BPO market is anticipated to grow annually by 4.67% from 2024 to 2029, reaching US$0.49 trillion. (source)

3. Average spending per employee in the BPO market is expected to reach US$110.50 in 2024. (source)

4. The Business Process as a Service (BPaaS) market is expected to be valued at approximately USD 71 billion in 2024. (source)

5. The Danish outsourcing company ISS World generated approximately U.S. $11.52 billion in revenue in 2023. This was an increase of roughly U.S. $570 million compared to the previous year. (source)

6. The Business Process as a Service market was valued at USD 56.80 billion in 2022 and is expected to reach USD 145.30 billion by 2031, growing at a CAGR of 11%. (source)

7. The Healthcare payer BPO market was valued at USD 13.20 billion in 2021 and is projected to reach USD 21.30 billion by 2030, growing at a CAGR of 9.5%. (source)

8. The global customer experience business process outsourcing market size was estimated at USD 92.49 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.9% from 2024 to 2030. (source)

9. The administrative outsourcing sector is expected to reach revenue of $21 billion in 2023. (source)

10. Before the pandemic, the global outsourcing market was valued at $92.5 billion. (source)

11. Favorable macroeconomic conditions, including political stability, robust infrastructure, and a sizable consumer base, contribute to the growth of the BPO market in the United States. (source)

12. Increased demand for personalized and efficient services is expected to drive growth in the US BPO market. (source)

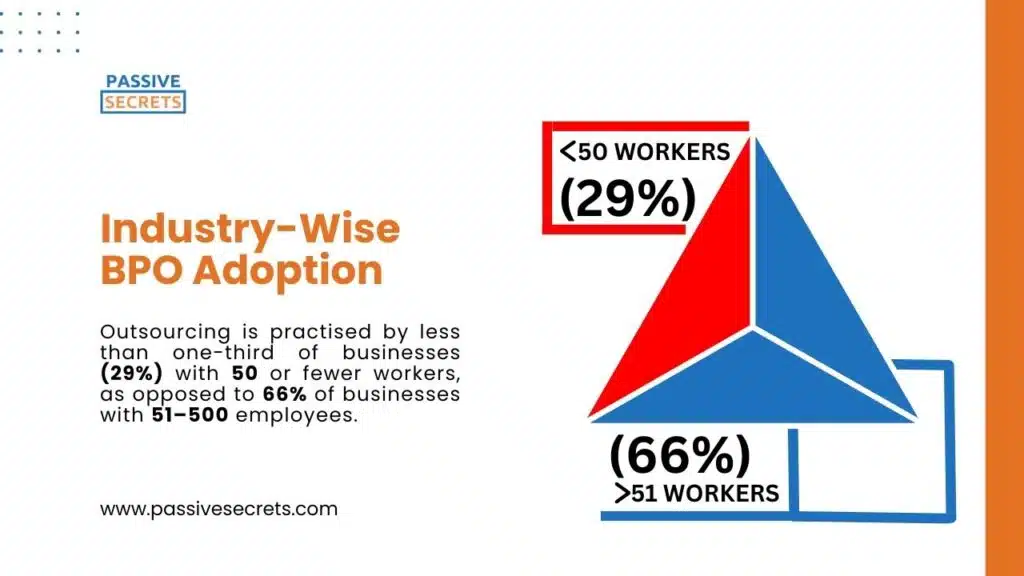

Industry-Wise BPO Adoption

13. 52% of executives outsource business functions. (source)

14. BPO accounted for about 29% of global IT Services revenue in 2022. (source)

15. Sales of IT-related BPO services in Japan are projected to surpass 3.2 trillion yen by the fiscal year 2027 due to labour shortages and increased public sector outsourcing demand. (source)

16. The Insurance BPO Services Market size is estimated to be USD 7.08 billion in 2024, growing to USD 8.94 billion by 2029 with a 4.76% CAGR. (source)

17. Key players in the insurance BPO market include specialized firms and major IT service providers offering insurance-specific BPO services. (source)

18. The insurance BPO market continues to expand as insurance companies increasingly outsource non-core functions. (source)

19. Outsourcing is practised by less than one-third of businesses (29%) with 50 or fewer workers, as opposed to 66% of businesses with 51–500 employees. (source)

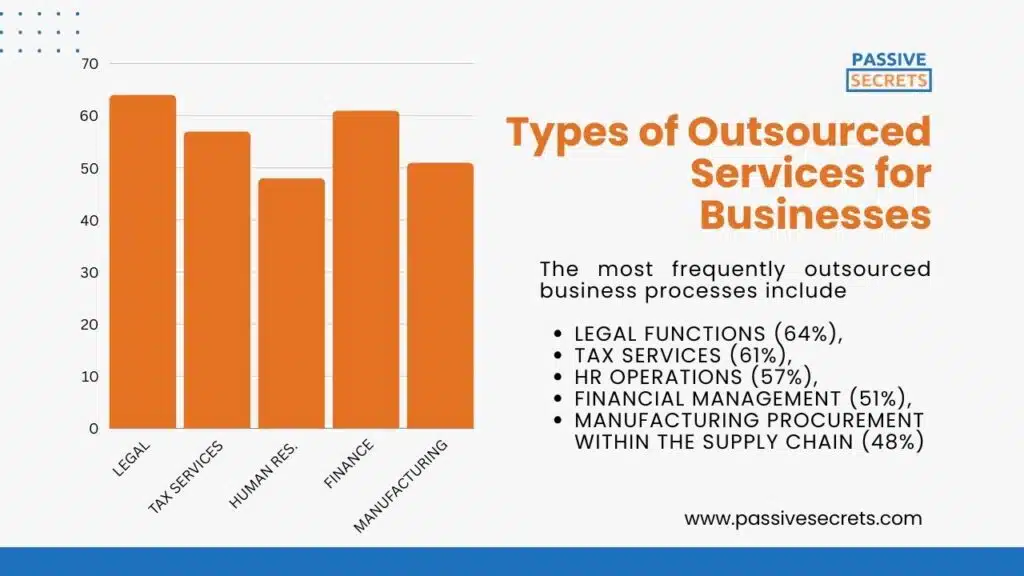

Types of Outsourced Services for Businesses

20. 81% of executives rely on third-party vendors for all or part of their cybersecurity capabilities. (source)

21. Over 40% of larger companies utilize outsourcing for various HR and operational tasks, though none outsource all functions completely. (source)

22. 76% of surveyed executives receive IT services through third-party delivery models. (source)

23. Third-party delivery models are projected to reach adoption levels similar to IT outsourcing, up to 80%. (source)

24. ISS World and Accenture are prominent global leaders in outsourcing, specializing in facility services and IT, help desk, HR outsourcing, and consulting, respectively. (source)

25. Approximately 44% of businesses outsource their financial tasks to external providers. (source)

26. Content marketing tasks are outsourced by 30% of marketing professionals. (source)

27. Lead generation and cold calling are commonly outsourced operational tasks. (source)

28. The most frequently outsourced business processes include legal functions (64%), tax services (61%), HR operations (57%), financial management (51%), and manufacturing and procurement within the supply chain (48%). (source)

Benefits of BPO

29. Cost is cited as a primary reason for outsourcing by 70% of surveyed executives. (source)

30. In a survey of business leaders worldwide, 59% identified cost-cutting as a major driver for outsourcing processes. Other factors included focusing on core business and addressing capacity issues. (source)

31. Outsourced lead-generation departments can generate up to 43% more leads than in-house teams. (source)

32. For cost savings, 28% of businesses outsource company development. (source)

33. Companies outsource to cut costs (57%), access new capabilities (51%), and adapt to strategic shifts (49%). (source)

34. According to the Bureau of Labor Statistics, benefits, including health-related ones, constitute 29.4% of employers’ expenditures, prompting many firms to opt for BPO services. (source)

BPO Trends and Future Outlook

35. In 2023, small businesses sought new outsourcing partners primarily in marketing (27%), IT services (22%), and design (21%). (source)

36. The growing adoption of technology is another factor contributing to the expansion of the BPO market in the United States. (source)

37. A notable trend in South Africa’s BPO market is the rising demand for specialized services such as legal process outsourcing and healthcare outsourcing. (source)

38. The finance & accounting segment of South Africa’s Business Process Outsourcing market is anticipated to expand at a robust CAGR of 13% throughout 2021-2028. (source)

39. One notable trend in Nigeria’s BPO market is the increasing demand for voice-related services like customer support and telemarketing. (source)

40. Specialized BPO services such as Customer Experience Management (CXM) and Knowledge Process Outsourcing (KPO) are gaining popularity within the UAE market. (source)

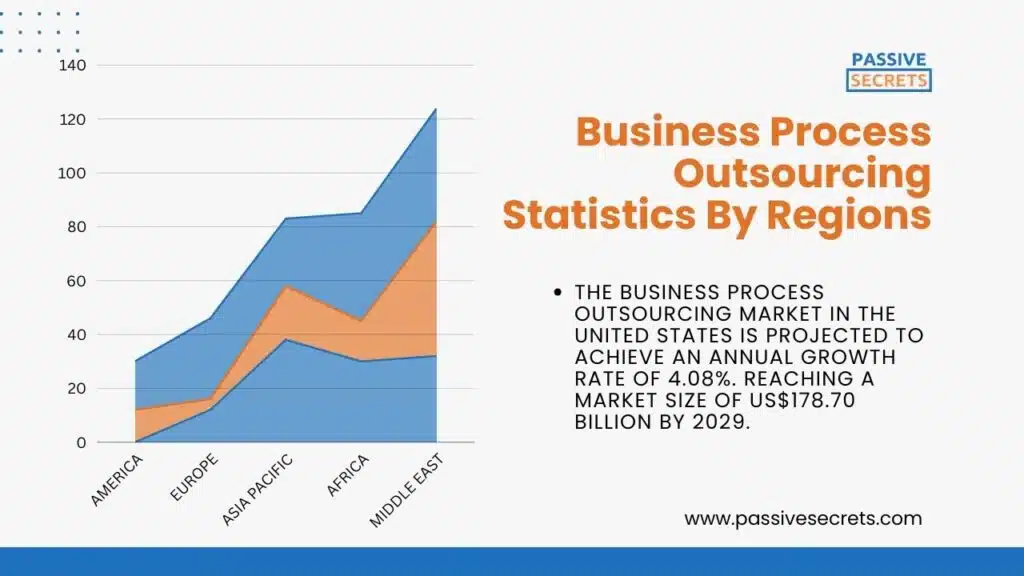

Business Process Outsourcing Statistics By Regions

United States

41. The Business Process Outsourcing market in the United States is projected to achieve an annual growth rate of 4.08%. Reaching a market size of US$178.70 billion by 2029. (source)

42. The United States is expected to generate the most revenue in the BPO market, totalling US$146.30 billion in 2024. (source)

43. Changing customer preferences is a key driver behind the increasing demand for BPO services in the United States. (source)

44. Approximately 300,000 jobs are outsourced from the United States annually. (source)

45. The average spending per employee in the US BPO market will reach US$0.84k in 2024. (source)

46. Market concentration in the US BPO Services industry is low, with the top four companies generating less than 40% of industry revenue. (source)

47. Market concentration in the Professional, Scientific, and Technical Services sector in the United States is 22%. (source)

48. During the pandemic, demand for BPO services in the US declined due to a drop in new business formations and corporate profits. (source)

Europe

49. The Europe Business Process Outsourcing (BPO) market is projected to grow from USD 72.45 billion in 2023 to USD 132.57 billion by 2031, with a CAGR of 7.9% from 2024 to 2031. (source)

50. The U.K. is expected to lead the European BPO market due to its strong business infrastructure, skilled workforce, and strategic location. (source)

51. Revenue in Europe’s BPO market is forecasted to reach US$118.60 billion in 2024. The market is anticipated to grow at a CAGR of 4.32% from 2024 to 2029, reaching US$146.50 billion by 2029. (source)

52. Average spend per Employee in Europe’s BPO market is expected to be US$283.70 in 2024. (source)

53. Revenue in Eastern Europe’s BPO market is projected to hit US$4.29 billion in 2024. The market is poised to grow at a CAGR of 3.32% from 2024 to 2029, reaching US$5.05 billion by 2029. (source)

54. Average spend per Employee in Eastern Europe’s BPO market is projected to reach US$36.25 in 2024. (source)

55. Poland leads the Eastern European BPO market, followed closely by Romania and the Czech Republic. (source)

56. Multilingual professionals are a distinctive feature of the BPO market in Eastern Europe. (source)

57. Southern Europe has the highest proportion of businesses currently or planning to engage in BPO. (source)

58. By 2024, revenue in the UK’s Business Process Outsourcing market is expected to reach US$29.31 billion. The market is anticipated to grow at an annual rate of 5.67% from 2024 to 2029, reaching US$38.61 billion by the end of the period. (source)

59. The projected average expenditure per employee in the UK Business Process Outsourcing market will be US$0.84 thousand in 2024. (source)

60. In 2022, the total revenue of the UK’s BPO services market was $13.5 billion, showing a compound annual growth rate of 5.1% from 2017 to 2022. (source)

61. The HR outsourcing sector constituted the largest share of the UK BPO market in 2022, generating $3.5 billion, which was 26.3% of the market’s total value. (source)

62. Due to historical connections with developing nations and the absence of language barriers since English is widely spoken, the UK is considered a prime location for outsourcing business operations. (source)

![100 Interesting Business Process Outsourcing Statistics & Facts 100 Interesting Business Process Outsourcing Statistics & Facts [2025] ᐈ Passive Secrets](https://passivesecrets.com/wp-content/uploads/2024/07/BPO-Market-Size-and-Growth-1024x576.jpg.webp)

Asia Pacific and Asia

63. The Asia Pacific Business Process Outsourcing (BPO) market is expected to grow at a CAGR of 9.8% from 2023 to 2030. The market size of the Asia Pacific BPO industry was USD 72.7 billion in 2022. (source)

64. China led the Asia Pacific BPO market in 2022 and is projected to maintain its dominance, reaching USD 35,054 million by 2030. (source)

65. In fiscal year 2022, Japan’s IT-related BPO market was valued at 2.78 trillion Japanese yen. (source)

66. The BPO market in Asia Pacific is growing at a CAGR of 9.8% from 2022 to 2032, reaching USD 185.1 billion by 2032. (source)

67. Customer services are expected to dominate the Asia Pacific BPO market from 2022 to 2032. (source)

68. The IT & telecom segment will account for over 32.7% of revenue in the Asia Pacific BPO market from 2022 to 2032. (source)

69. Revenue in the Asia BPO market will reach USD 84.08 billion by 2024. (source)

70. The Asian BPO market is expected to grow at an annual rate of 5.50% from 2024 to 2029, reaching USD 109.90 billion. (source)

71. The average spend per employee in the Asia BPO market will be USD 40.02 by 2024. (source)

72. The Business Process Outsourcing market in India is expected to achieve a revenue of US$7.19 billion by 2024. (source)

73. The revenue of India’s Business Process Outsourcing market is forecasted to grow at an annual rate of 8.76% from 2024 to 2029. Reaching a market size of US$10.94 billion by 2029. (source)

74. The projected average Spend per Employee in India’s Business Process Outsourcing market is US$13.19 for the year 2024. (source)

75. According to the National Investment Promotion Agency, India’s overall retail sector is expected to grow annually at a rate of 25%, reaching $1.1 trillion by 2027 and $2 trillion by 2032. (source)

76. Data Bridge Market Research forecasts that India’s Business Process Outsourcing market, valued at USD 6,077.36 million in 2022, will expand to USD 12,378.73 million by 2030. (source)

77. Countries such as India, the Philippines, and China dominate the BPO landscape in their respective regions. (source)

78. India and the Philippines have established expertise in IT, customer service, and back-office services. (source)

Africa

79. South Africa’s BPO industry is predicted to achieve a value of USD 3.6 billion by 2027, growing annually at 13.2% during this period. (source)

80. As of 2020, the BPO industry in South Africa employed more than 270,000 individuals. The targets set by the DTIC are to increase this figure to 500,000 by 2030. (source)

81. South Africa ranked 12th in the 2021 EF English Proficiency Index, surpassing other key outsourcing destinations such as Poland (16th). (source)

82. Revenue in South Africa’s Business Process Outsourcing market is expected to reach USD 1.89 billion in 2024. The market is forecasted to grow annually at 3.64% from 2024 to 2029, resulting in a market volume of USD 2.26 billion by 2029. (source)

83. The projected average spend per employee in South Africa’s Business Process Outsourcing market is USD 75.21 in 2024. (source)

84. South Africa’s advantageous time zone significantly benefits its BPO market. (source)

85. The size of South Africa’s business process outsourcing market was valued at USD 2.16 billion in 2022 and is expected to grow to USD 6.49 billion by 2031. (source)

86. Outsourcing service providers believe South Africa offers superior opportunities to other African countries for business outsourcing services. Cape Town has emerged as a favoured destination for BPO operations. (source)

87. Customer service is the leading segment in South Africa’s Business Process Outsourcing market. With over 31% market share in 2019, it is expected to grow at a significant CAGR from 2021 to 2028. (source)

88. Nigeria’s Business Process Outsourcing market is forecasted to achieve a revenue of US$0.70 billion by 2024. The market is anticipated to experience an annual growth rate (CAGR 2024-2029) of 11.93%, leading to a market size of US$1.23 billion by 2029. (source)

89. By 2024, the projected average expenditure per employee in the Nigerian Business Process Outsourcing market is US$9.02. (source)

90. Nigeria’s significant pool of skilled and educated workforce enhances its appeal as a favoured location for BPO service providers. (source)

Middle East

91. Data Bridge Market Research forecasts that the Business Process Outsourcing market in the Middle East and Africa will achieve a CAGR of 7.1% from 2023 to 2030. (source)

92. The U.A.E. is projected to lead the Middle East and Africa Business Process Outsourcing market, driven by the increasing number of new enterprises. (source)

93. The market for customer care BPO in the Middle East and Africa is anticipated to increase from $1,986.49 million in 2023 to $2,618.71 million by 2028. The growth rate from 2023 to 2028 is estimated to be 5.7%. (source)

94. The Business Process Outsourcing (BPO) market in the United Arab Emirates is expected to achieve a revenue of approximately US$0.98 billion by 2024. (source)

95. The market is projected to experience an annual growth rate (CAGR 2024-2029) of 4.82%. Leading to a market size of around US$1.24 billion by 2029. By 2024, the anticipated average Spend per Employee in the BPO sector is US$141.00. (source)

96. The UAE has become a pivotal centre for global business, attracting numerous multinational corporations that require BPO services to support their international operations. (source)

97. Data Bridge Market Research forecasts that the UAE’s BPO market, valued at USD 1.8 billion in 2023, is expected to reach USD 3.3 billion by 2031. (source)

98. The rising demand from Small and Medium Enterprises (SMEs) is a key factor driving the growth of the BPO market in the UAE. (source)

Technology and Innovation in BPO

99. In April 2020, Wipro, a business process outsourcing company, collaborated with Nutanix to provide digital database services. (source)

100. Automation and AI adoption is a notable trend in the European BPO market, aimed at enhancing efficiency and cutting costs. (source)

Conclusion

Understanding the latest business process outsourcing statistics is crucial for companies seeking to stay ahead of the curve.

With the knowledge of these BPO statistics, you can uncover opportunities to streamline operations, reduce costs, and boost efficiency.

The data reveals the vast potential of outsourcing to drive business growth, from lead generation to talent acquisition. As the global BPO market evolves, staying informed about the latest trends and insights is essential for making informed decisions.

Stay ahead of the competition by monitoring the latest BPO statistics and unlock your business’s full potential.

Frequently Asked Questions

What percentage of businesses outsource?

Around 37% of small businesses outsource IT services and accounting. Other commonly outsourced processes include digital marketing (34%), Human resources (another common choice, 24%), and customer service (24%).

What is the growth rate of business process outsourcing?

The global business process outsourcing market is expected to expand at a compound annual growth rate of 9.6% from 2024 to 2030, reaching USD 525.23 billion by 2030.

Which industry outsources the most?

The IT sector outsources the most, followed by Health care, Finance, Retail, and Insurance.

What is the top 1 outsourcing country?

India is a premier outsourcing destination, offering a vast pool of highly skilled professionals, courtesy of its vast higher education system, the largest in the world.

Other Related Statistics Report You Should Know:

- 80+ Employee Benefit Statistics: Insights and Trends

- The Most Important Wealth Management Statistics You Can’t Afford to Ignore

- Enterprise Data Management: Essential Statistics and Emerging Trends

- 93 Talent Management Statistics to Help You

- Top Reputation Management Statistics and Trends to Improve Your Brand

- 36 Helpful Social Worker Burnout Statistics To Know

- Top HR Outsourcing Statistics and Trends Every Business Must Know

- The Top Outsourcing Statistics You Shouldn’t Ignore

- 47+ Shocking 4-day Work Week Statistics To Know

- 105+ Supply Chain Statistics & Facts You Can’t Ignore

- 50+ Interesting Employer Branding Statistics And Trends

- Job Seekers Statistics: Unemployment Rates, Preferences, Challenges

- 95 Interesting Job Interview Statistics and Huge Trends To Know

- 60+ Helpful Change Management Statistics & Facts

- 65+ Employee Performance Management Statistics & Trends

- Workforce Management Statistics: Trends, Insights, & Opportunities

- 73 Revealing Workplace Distraction Statistics

- Workplace Romance Statistics: How Common Is Workplace Romance?

- 40+ Top Workplace Conflict Statistics You Should Know

- The State of Workplace Communication: Key Statistics and Trends

- 55 Workplace Collaboration & Teamwork Statistics